Get the free Loan application checklist and forms - Mission Federal Credit Union

Show details

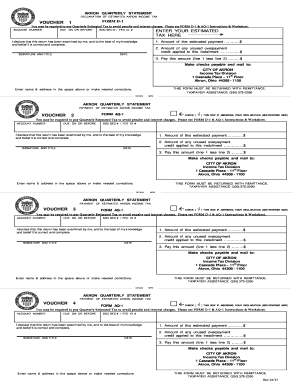

LOAN APPLICATION CHECKLIST AND FORMS

Thank you for applying to Mission Federal Credit Union (Mission Fed) for your commercial real estate financing. We look forward to forming a solid relationship

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan application checklist and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan application checklist and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan application checklist and online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loan application checklist and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out loan application checklist and

How to fill out a loan application checklist:

01

Gather all necessary documents: Begin by collecting all the required documents for the loan application checklist. These typically include identification proof, income verification, bank statements, tax returns, and any other relevant financial information.

02

Review the checklist: Carefully go through the loan application checklist to ensure that you understand all the items listed. Take note of any additional documents or information that may be required for the specific loan application.

03

Complete the personal information section: Fill in all personal details accurately, including your full name, contact information, social security number, and current address. Double-check the information for any errors or missing information.

04

Provide employment and income details: Include your employment history, current job position, and the duration of employment. Provide accurate information regarding your income, including salary, bonuses, commissions, or any other sources of income.

05

List your assets and liabilities: Disclose all your assets, such as real estate, vehicles, investments, and savings accounts. Additionally, provide information on any outstanding debts, loans, or credit cards that you have.

06

Fill in the requested loan details: Specify the purpose of the loan, the loan amount requested, and the desired loan term. Additionally, provide information on any collateral or guarantees if applicable.

07

Review and submit: Before submitting your loan application checklist, review all the information you have provided. Make sure there are no mistakes or omissions. Once you are satisfied, submit the completed checklist along with all the required documents to the lender or financial institution.

Who needs a loan application checklist:

01

Individuals seeking personal loans: Whether you require funds for a major purchase, debt consolidation, or unexpected expenses, having a loan application checklist ensures that you have all the necessary documentation and information ready to present to the lender.

02

Small business owners: Entrepreneurs looking for business loans need to prepare a loan application checklist to provide comprehensive financial information regarding their business, including financial statements, tax returns, and business plans.

03

Homebuyers: Individuals or families planning to purchase a home typically require a mortgage loan. A loan application checklist enables them to gather the necessary documents, such as income verification, bank statements, and credit reports, to apply for the loan.

04

Students applying for educational loans: Students looking to finance their education with a student loan often need to go through a loan application process. A loan application checklist helps them compile documents like identification, school enrollment details, academic transcripts, and financial aid information.

Using a loan application checklist ensures that the application process goes smoothly and saves valuable time by having all the required information readily available.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan application checklist and?

Loan application checklist is a list of required documents and information that need to be submitted when applying for a loan.

Who is required to file loan application checklist and?

Anyone applying for a loan is required to file a loan application checklist.

How to fill out loan application checklist and?

To fill out a loan application checklist, gather all required documents and information, then follow the checklist provided by the lender.

What is the purpose of loan application checklist and?

The purpose of a loan application checklist is to ensure that the lender has all the necessary information to process the loan application.

What information must be reported on loan application checklist and?

The information required on a loan application checklist typically includes income verification, employment history, credit score, and personal identification.

When is the deadline to file loan application checklist and in 2023?

The deadline to file a loan application checklist in 2023 will depend on the specific lender and loan program.

What is the penalty for the late filing of loan application checklist and?

The penalty for late filing of a loan application checklist can vary depending on the lender, but may include additional fees or a delay in loan processing.

How can I get loan application checklist and?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific loan application checklist and and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute loan application checklist and online?

Filling out and eSigning loan application checklist and is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit loan application checklist and on an iOS device?

Create, modify, and share loan application checklist and using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your loan application checklist and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.