Get the free Low Incomes Tax Reform Group of the ... - Revenue Benefits - revenuebenefits org

Show details

The following table sets out the commencement dates of each Section of the Welfare Reform Act 2012. This table is correct as of 7 March 2013. Section Number 1 2 3 4 Section title Commencement date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your low incomes tax reform form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low incomes tax reform form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low incomes tax reform online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit low incomes tax reform. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

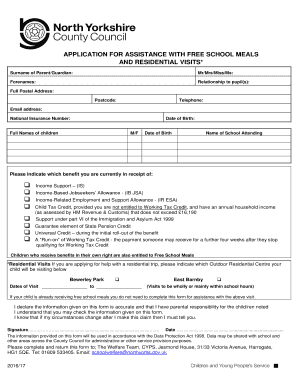

How to fill out low incomes tax reform

How to fill out low incomes tax reform:

01

Gather all necessary documents such as your income statements, receipts, and any other relevant financial records.

02

Determine your filing status - whether you are single, married filing jointly or separately, or head of household.

03

Calculate your total income by adding up all your sources of income, such as wages, self-employment earnings, dividends, and interest.

04

Deduct any eligible deductions, such as student loan interest, contributions to a retirement account, or mortgage interest.

05

Determine if you qualify for any tax credits, such as the earned income tax credit or child tax credit, and apply them to reduce your tax liability.

06

Fill out the appropriate tax forms, such as Form 1040 or 1040A, and include all necessary information accurately and thoroughly.

07

Double-check your calculations and ensure that all information provided is correct before submitting your tax return.

08

Submit your tax return to the appropriate tax authority, either electronically or through mail, by the deadline.

Who needs low incomes tax reform:

01

Individuals or families with low incomes who are struggling to meet their tax obligations.

02

Those who may be eligible for tax credits such as the earned income tax credit, which can provide substantial refunds to low-income individuals and families.

03

Individuals who want to ensure that they are taking advantage of all available tax deductions and credits to reduce their tax liability.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is low incomes tax reform?

Low incomes tax reform is a policy aimed at reducing the tax burden on individuals with low income.

Who is required to file low incomes tax reform?

Individuals with low income who meet the income threshold set by the government are required to file low incomes tax reform.

How to fill out low incomes tax reform?

Low incomes tax reform can be filled out online through the government's official website or submitted in person at a tax office.

What is the purpose of low incomes tax reform?

The purpose of low incomes tax reform is to provide tax relief to individuals with low income and help alleviate financial burden.

What information must be reported on low incomes tax reform?

Information such as income sources, deductions, and credits must be reported on low incomes tax reform.

When is the deadline to file low incomes tax reform in 2023?

The deadline to file low incomes tax reform in 2023 is April 15th.

What is the penalty for the late filing of low incomes tax reform?

The penalty for late filing of low incomes tax reform is a fine of $50 per month, up to a maximum of $300.

How do I fill out low incomes tax reform using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign low incomes tax reform and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit low incomes tax reform on an Android device?

You can edit, sign, and distribute low incomes tax reform on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete low incomes tax reform on an Android device?

Complete low incomes tax reform and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your low incomes tax reform online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.