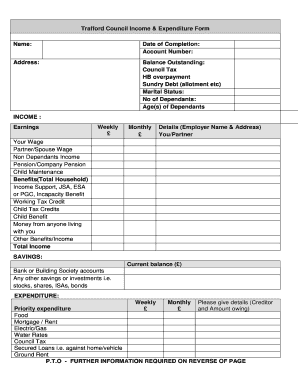

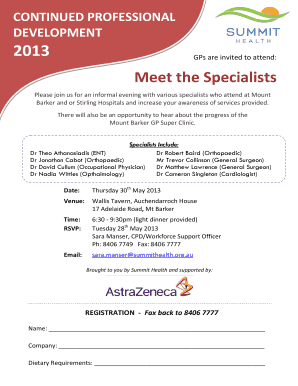

UK Trafford Council Income & Expenditure Form 2013 free printable template

Show details

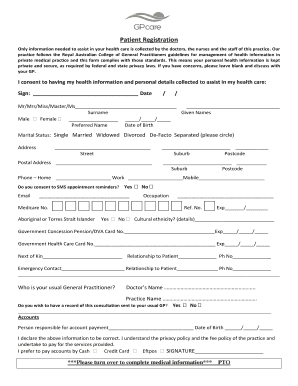

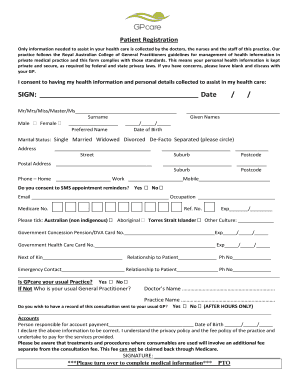

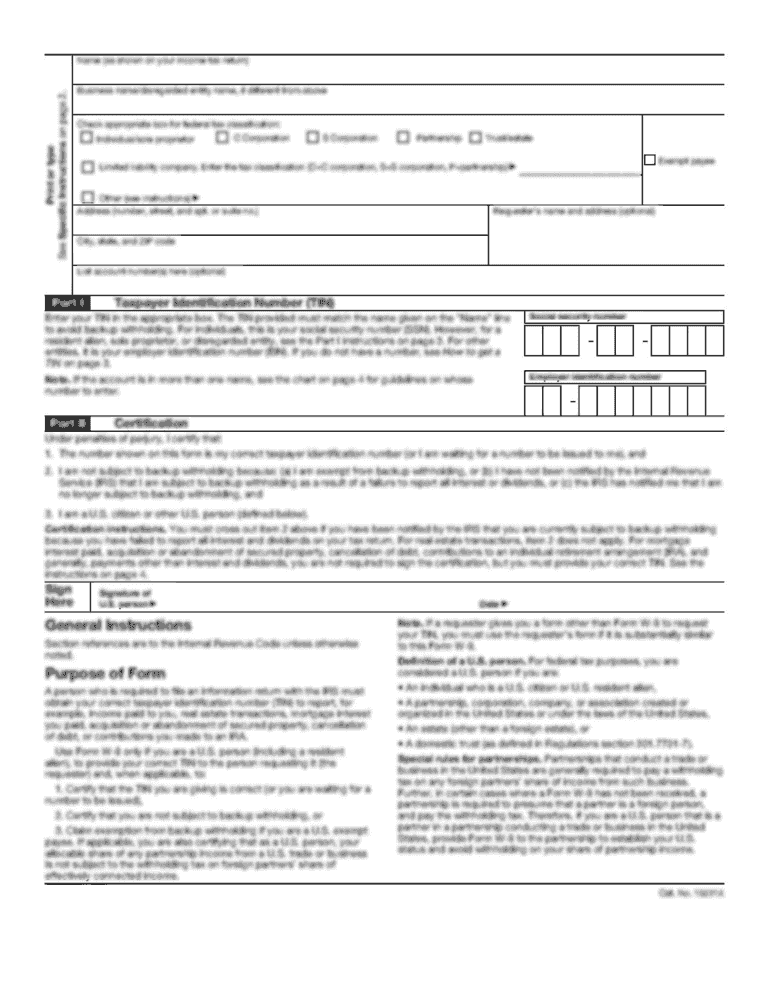

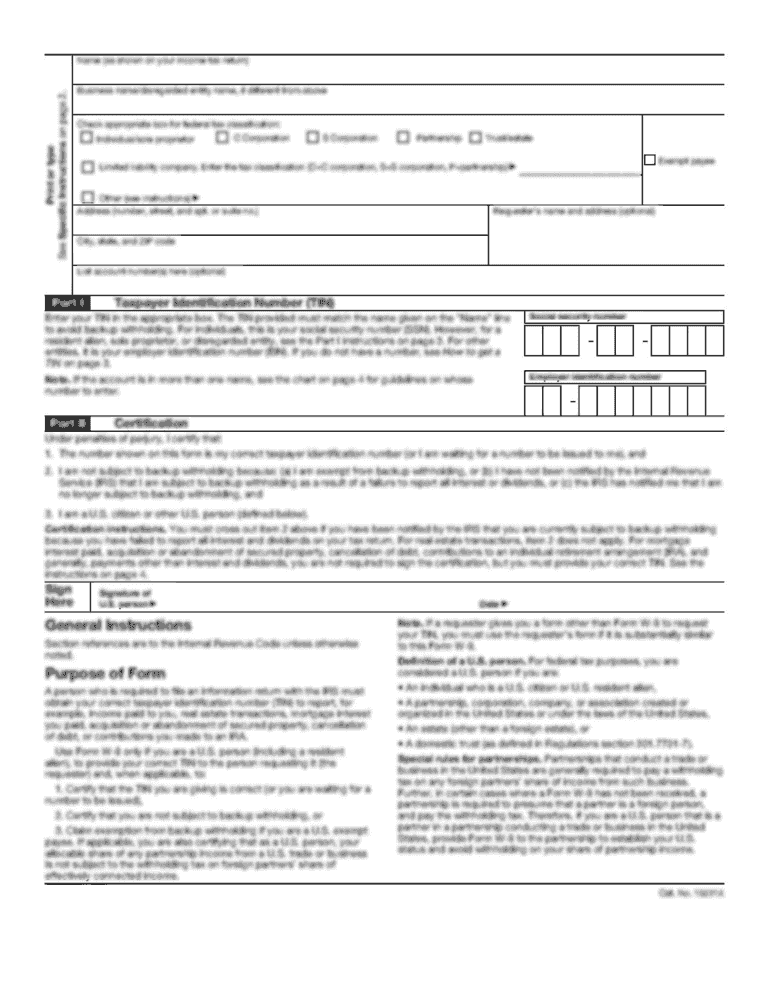

Income and expenditure form Date Sent: Name: Address: Reference number: Personal budget Weekly Monthly Total income You're spending (We need to see proof of all regular spending.) Weekly Monthly Mortgage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your printable income and expenditure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable income and expenditure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing printable income and expenditure form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit income and expenditure form template. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

UK Trafford Council Income & Expenditure Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out printable income and expenditure

How to fill out printable income and expenditure:

01

Start by gathering all your financial documents, such as bank statements, pay stubs, and receipts.

02

Review your income sources and record them accurately in the designated section of the printable form. Include any regular income from employment, investments, or side businesses.

03

Next, categorize your expenses into different sections such as housing, transportation, groceries, entertainment, etc. Go through your bank statements and receipts to ensure you account for all expenses accurately.

04

Write down each expense in the corresponding category on the printable form. Be consistent and thorough to ensure an accurate representation of your spending.

05

For each expense, record the amount spent and the date of the transaction.

06

Calculate the total income and total expenditure, and then subtract the expenditure from the income to determine the net income or loss.

07

Evaluate your spending patterns and assess areas where you can cut back or save more. This analysis will help you make informed financial decisions.

08

Finally, keep the completed printable income and expenditure form in a safe place for reference or future evaluation.

Who needs printable income and expenditure:

01

Individuals who want to track their personal finances and gain a better understanding of their income and spending habits.

02

Business owners, especially those who are self-employed or have small businesses, to monitor their revenues and expenses accurately.

03

Individuals preparing for tax filing, as having a record of income and expenditure helps in filling out tax forms correctly, maximizing deductions, and minimizing errors.

Fill expenditure form : Try Risk Free

People Also Ask about printable income and expenditure form

How do I create an income and expenditure account?

What is the purpose of expenditure statement?

What can I put on expenditure form?

What are examples of income and expenditure?

Do I have to fill out an income and expenditure form?

What is an income and expenditure form?

How do you present income and expenditure?

Do I have to fill out an income and expenditure form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is printable income and expenditure?

Printable income and expenditure refers to a record or document that tracks the money coming in (income) and going out (expenditure) of an individual, company, or organization. It typically includes details such as the source of income, such as salaries, wages, business profits, or investments, as well as the various expenses incurred, such as rent, utilities, taxes, food, transportation, and other discretionary expenses. The printable format allows for easy documentation and organization of financial transactions to track and analyze income and spending patterns.

Who is required to file printable income and expenditure?

Individuals and businesses are required to file printable income and expenditure statements or reports for tax purposes. This includes individuals who earn income through various sources, such as employment, self-employment, rental income, investments, and any other form of income. Additionally, businesses, including corporations, partnerships, and sole proprietorships, are also required to file income and expenditure statements to report their financial activities and calculate their taxes.

How to fill out printable income and expenditure?

To fill out a printable income and expenditure form, follow these steps:

1. Gather all necessary financial information: Collect your bank statements, paycheck stubs, receipts, bills, and any other relevant documents that provide details of your income and expenses.

2. Begin with income: Write down the sources of your income for the given period, such as salary, wages, rental income, or any other sources of money coming in. Include their respective amounts and frequencies.

3. Calculate your total income: Add up all the income sources to determine your total income for the specified timeframe. Write this amount at the designated space provided.

4. Move on to expenses: Start listing your expenditures under various categories. Common expense categories include housing, utilities, transportation, groceries, entertainment, insurance, healthcare, debt payments, and savings.

5. Record each expense: Write down each expense you incurred in the corresponding category, along with the amount spent. Be detailed and precise to get an accurate representation of your spending habits.

6. Categorize your expenses: Group similar expenses together to organize your spending. For example, combine all grocery expenses into one total under the "Groceries" category.

7. Calculate your total expenses: Add up all the expenses in each category and calculate the total amount spent. Write this total at the designated space provided on the form.

8. Determine the difference: Subtract your total expenses from your total income to find out whether you have a surplus or a deficit. If your income surpasses your expenses, you have a surplus. If your expenses exceed your income, you have a deficit.

9. Analyze and make adjustments: Review the completed income and expenditure form to identify any areas where you can reduce expenses or increase income. This will help you identify potential adjustments to your budget to achieve financial goals.

10. Keep track monthly: Consider filling out a new income and expenditure form each month to monitor and compare your financial situation over time. This regular tracking helps you make necessary adjustments and maintain financial stability.

Remember, completing an income and expenditure form accurately requires attention to detail. Always update the form promptly whenever there are changes in your income or expenses to ensure the information remains up-to-date.

What is the purpose of printable income and expenditure?

The purpose of a printable income and expenditure statement is to provide a clear, organized, and detailed overview of an individual or organization's financial activities over a specific period of time. It helps to track and analyze incoming funds (income) and outgoing expenses (expenditure), allowing for better financial planning, budgeting, and decision-making. It enables individuals or organizations to understand their financial situation, identify areas of overspending or areas where they can potentially save, and monitor their overall financial health. Additionally, a printable income and expenditure statement may be required for financial reporting, tax purposes, or when applying for loans or grants.

What information must be reported on printable income and expenditure?

When preparing a printable income and expenditure statement, the following information should typically be reported:

1. Income:

- Sources of income: This includes salaries, wages, self-employment earnings, rental income, investment income, pension, social security benefits, etc.

- Amount: Report the total amount received from each income source during the specified period.

2. Expenses:

- Housing expenses: Rent or mortgage payments, property taxes, utilities, repairs and maintenance, insurance, etc.

- Transportation expenses: Vehicle loan payments, fuel costs, insurance, maintenance and repairs, public transportation fares, etc.

- Food and groceries: Expense for purchasing food items and regular groceries.

- Healthcare expenses: Health insurance premiums, co-pays, prescriptions, medical bills, etc.

- Education expenses: Tuition fees, textbooks, supplies, student loans, etc.

- Debt payments: Credit card payments, loan installments, etc.

- Personal and household expenses: Clothing, personal care items, home supplies, entertainment, subscriptions, memberships, etc.

- Charitable contributions: Donations made to charitable organizations.

- Other expenses: Any other discretionary or miscellaneous expenses incurred.

3. Total income: Sum up the total amount received from all income sources.

4. Total expenses: Sum up the total of all expenses.

5. Net income (or surplus/deficit): Calculate by subtracting the total expenses from the total income. A positive value indicates a surplus, while a negative value indicates a deficit.

6. Additional information:

- Date range: Specify the period covered by the income and expenditure statement.

- Currency: Mention the currency in which the amounts are reported.

- Contact information: Include your name, address, and any relevant contact information.

It is important to note that the specific details required may vary depending on the purpose and format of the income and expenditure statement.

What is the penalty for the late filing of printable income and expenditure?

The penalties for late filing of printable income and expenditure reports vary depending on the jurisdiction and the specific circumstances. In general, late filing penalties can include:

1. Late filing fees: A fixed amount or a percentage of tax owed may be imposed as a late filing fee. This fee is typically calculated on a daily, weekly, or monthly basis for each day the report is filed late.

2. Interest charges: Interest may be assessed on the amount of tax owed starting from the original due date until the date the payment is made. The interest rate can be fixed or variable and may be compounded daily, weekly, or monthly.

3. Administrative penalties: Additional penalties may be imposed for repeated late filing offenses. These penalties can be more severe than the initial late filing fees.

It is important to consult the specific tax regulations and guidelines in your jurisdiction to determine the accurate penalties for late filing of printable income and expenditure reports.

How can I edit printable income and expenditure form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your income and expenditure form template into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send income and expenditure form pdf to be eSigned by others?

To distribute your expenditure form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete expenditure form on an Android device?

On Android, use the pdfFiller mobile app to finish your income and expenditure form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your printable income and expenditure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income And Expenditure Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to income and expenditure form pdf

Related to income and expenditure form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.