Get the free 2013-2014 INCOME TAX EXTENSION FORM Office of Financial Aid ... - sunydutchess

Show details

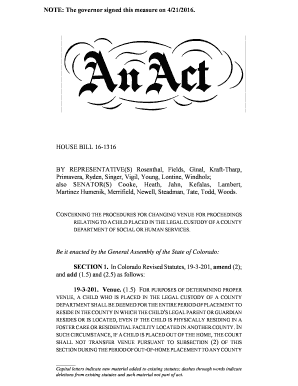

Office of Financial Aid Duchess Community College Occult Student Services Center/ Room 104 (845) 431-8030/Fax (845) 431-8603 Email: financial-aid sunydutchess.edu 2013-2014 INCOME TAX EXTENSION FORM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2013-2014 income tax extension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013-2014 income tax extension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013-2014 income tax extension online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2013-2014 income tax extension. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out 2013-2014 income tax extension

How to fill out 2013-2014 income tax extension:

01

Obtain the IRS Form 4868: To apply for an income tax extension for the 2013-2014 tax year, you will need to locate and download Form 4868 from the official IRS website. This form is specifically designed for individuals who require extra time to file their tax returns.

02

Fill in your personal information: On Form 4868, provide accurate details about your name, address, and Social Security number. Make sure to double-check the information to avoid any errors or delays in processing.

03

Estimate your tax liability: In the appropriate section of Form 4868, you must provide an estimate of the total tax liability for the 2013-2014 tax year. This estimation will serve as the basis for granting your extension. If you are unsure about the exact amount, consider consulting a tax professional or using tax software.

04

Determine the amount of payment: If you anticipate owing any taxes for the 2013-2014 tax year, you should make a payment using one of the accepted methods (e.g., check, money order, electronic payment). The payment should be for the estimated amount of taxes owed. Failure to submit any payment may result in penalties or interest charges.

05

Submit the form: Once you have properly completed Form 4868 and made the necessary payment, send the form to the appropriate IRS address. Check the IRS website or consult the form's instructions for the correct mailing address based on your location.

Who needs a 2013-2014 income tax extension:

01

Individuals facing unavoidable circumstances: The 2013-2014 income tax extension is helpful for individuals who have experienced certain situations that made it difficult or impossible to file their tax returns by the original due date. These may include severe illnesses, natural disasters, or other unforeseen events.

02

Taxpayers with complex financial situations: Some taxpayers may require additional time to gather all the necessary documents or organize complex financial information, such as multiple income sources, investments, or business activities. Filing for an extension allows these individuals to ensure accuracy and completeness in their tax returns.

03

Individuals living abroad: U.S. citizens or resident aliens who are living outside the United States during the tax filing period also qualify for an income tax extension. This extension accommodates the unique circumstances and challenges faced by expatriates in gathering the required information and completing their tax returns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is income tax extension form?

Income tax extension form is a form that allows taxpayers to request additional time to file their tax return beyond the original filing deadline.

Who is required to file income tax extension form?

Taxpayers who are unable to file their tax return by the original deadline are required to file an income tax extension form.

How to fill out income tax extension form?

To fill out an income tax extension form, taxpayers need to provide their personal information, estimated tax liability, and the reason for requesting an extension.

What is the purpose of income tax extension form?

The purpose of income tax extension form is to give taxpayers more time to gather necessary documents, information, and accurately complete their tax return.

What information must be reported on income tax extension form?

Income tax extension form typically requires taxpayers to provide their name, address, social security number, estimated tax liability, and reason for extension request.

When is the deadline to file income tax extension form in 2023?

The deadline to file income tax extension form in 2023 is usually October 15th.

What is the penalty for the late filing of income tax extension form?

The penalty for late filing of income tax extension form is usually a percentage of unpaid taxes owed, with a maximum penalty of 25% of the tax owed.

How do I make edits in 2013-2014 income tax extension without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2013-2014 income tax extension and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I fill out 2013-2014 income tax extension on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your 2013-2014 income tax extension. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out 2013-2014 income tax extension on an Android device?

On an Android device, use the pdfFiller mobile app to finish your 2013-2014 income tax extension. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your 2013-2014 income tax extension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.