Get the free IRA 50 & Over Catch-up Contribution

Show details

2009 CostofLiving Limits IRA Contribution Limit $5,000 IRA 50 & Over Catch up Contribution $1,000 401(k) deferral limit $16,500 401(k) 50 & Over Catch up ContributionJENNIFER A. JONES, CPA, LTD. Volume

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ira 50 amp over form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira 50 amp over form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira 50 amp over online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira 50 amp over. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

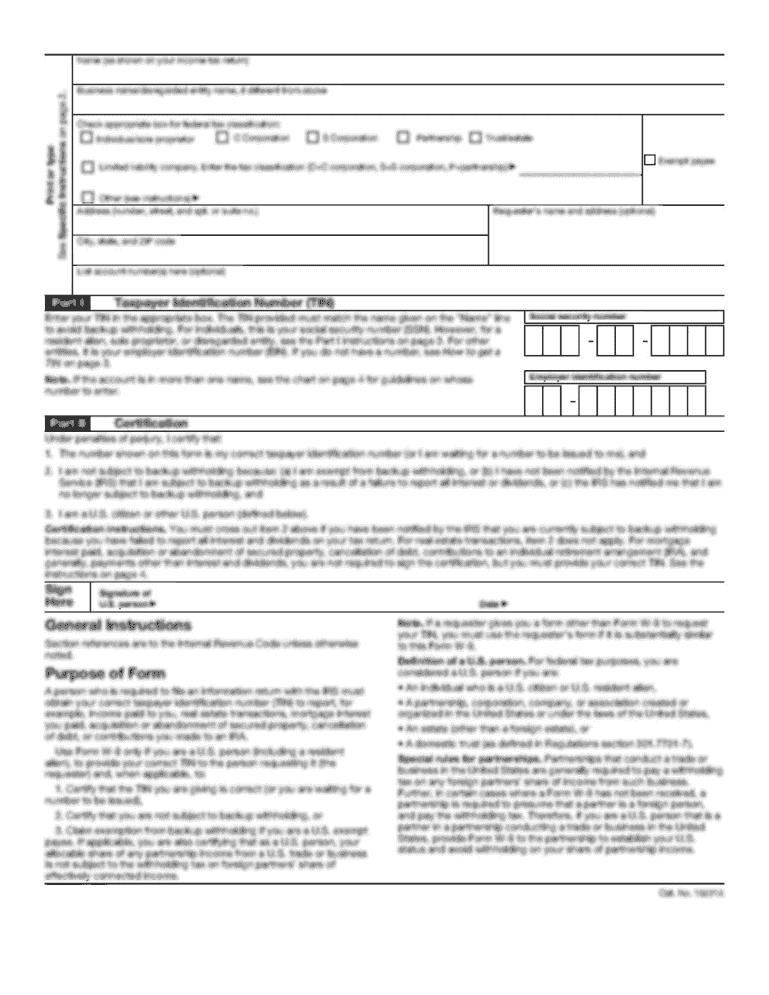

How to fill out ira 50 amp over

How to fill out ira 50 amp over:

01

Gather all the necessary documents, such as your identification, social security number, and financial information.

02

Start by providing your personal information, including your name, address, and contact details.

03

Fill in the required information about your employment status, including your employer's name and address.

04

Provide details about your annual income and any other sources of income or assets that you may have.

05

Indicate the amount you would like to contribute to your IRA 50 amp over account.

06

Choose the investment options that best match your financial goals and risk tolerance.

07

Review the information you have provided, making sure that everything is accurate and complete.

08

Sign and date the form, indicating your agreement to the terms and conditions of the IRA 50 amp over account.

Who needs ira 50 amp over:

01

Individuals who are planning for retirement and want to maximize their savings.

02

Those who are looking for tax advantages and the potential for long-term growth in their investments.

03

Individuals who are eligible for an IRA and are interested in contributing larger amounts, up to the maximum limit allowed.

Remember to consult with a financial advisor or tax professional to ensure that an IRA 50 amp over is the right choice for your financial situation and retirement goals.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

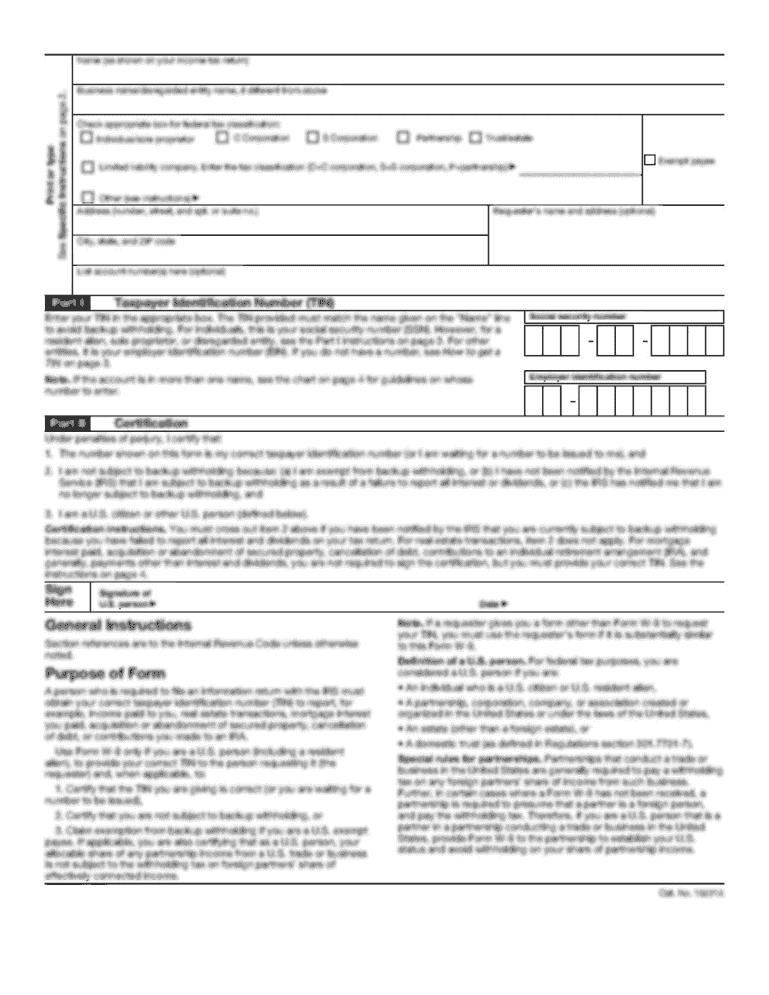

What is ira 50 amp over?

IRA 50 amp over refers to the Internal Revenue Service form used to report excessive contributions to an Individual Retirement Account.

Who is required to file ira 50 amp over?

Individuals who have made contributions to their IRA in excess of the annual limit set by the IRS are required to file IRA 50 amp over.

How to fill out ira 50 amp over?

To fill out form IRA 50 amp over, individuals must provide information about their excess contributions, calculate any applicable penalties, and submit the form to the IRS.

What is the purpose of ira 50 amp over?

The purpose of IRA 50 amp over is to report and address excessive contributions to Individual Retirement Accounts to ensure compliance with IRS regulations.

What information must be reported on ira 50 amp over?

Information such as the amount of excess contributions, the tax year in which they were made, and any associated penalties must be reported on IRA 50 amp over.

When is the deadline to file ira 50 amp over in 2023?

The deadline to file IRA 50 amp over for the tax year 2023 is usually April 15, 2024.

What is the penalty for the late filing of ira 50 amp over?

The penalty for late filing of IRA 50 amp over is $100 per month per IRA account, up to a maximum of $1,000 per year.

How can I modify ira 50 amp over without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your ira 50 amp over into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find ira 50 amp over?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific ira 50 amp over and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete ira 50 amp over on an Android device?

Use the pdfFiller mobile app to complete your ira 50 amp over on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your ira 50 amp over online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.