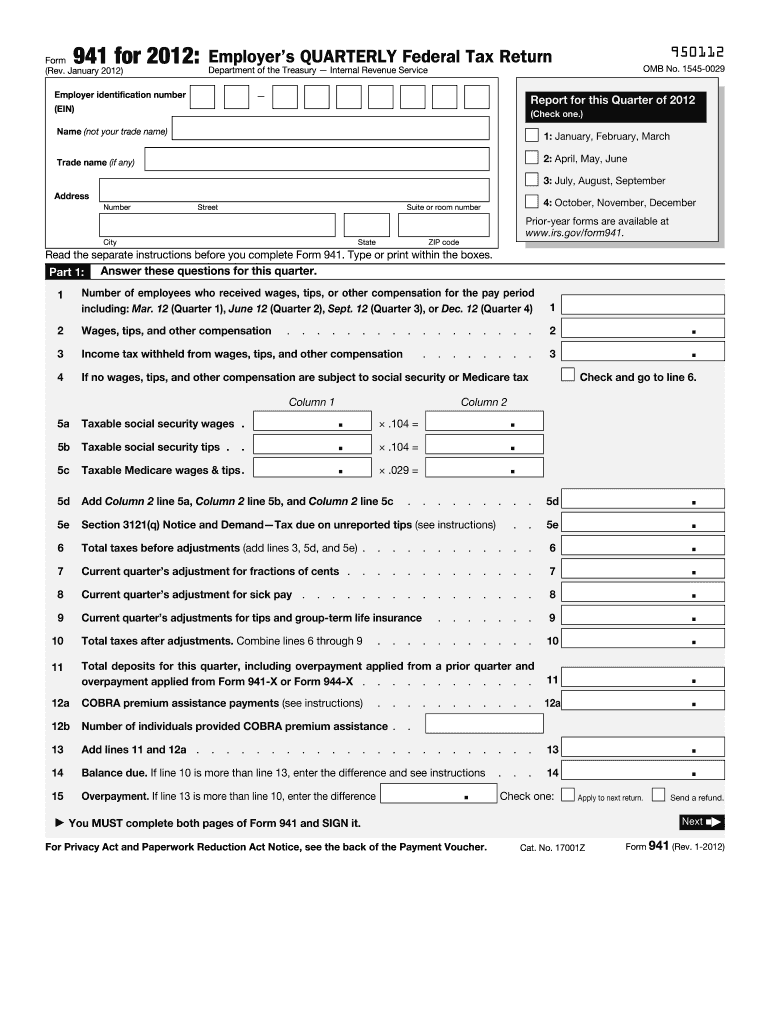

IRS 941 2012 free printable template

Instructions and Help about IRS 941

How to edit IRS 941

How to fill out IRS 941

About IRS 941 previous version

What is IRS 941?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

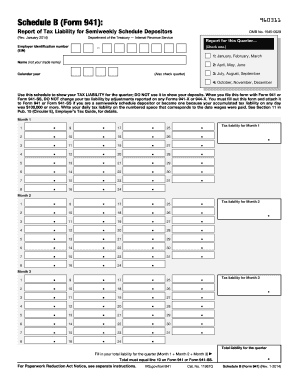

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 941

What should I do if I made a mistake on my IRS 941 after filing?

If you discover an error on your filed IRS 941, you should file an amended return using Form 941-X. This form allows you to correct mistakes related to wages, tax computations, and more. Remember to clearly explain the changes on the 941-X and retain documentation supporting these modifications.

How can I track the status of my IRS 941 submission?

To verify the receipt and processing of your IRS 941, you can contact the IRS directly or check their online resources. In cases of e-filing, be aware of common rejection codes that may occur, and ensure you address any issues promptly to avoid delays in processing.

What if I'm filing an IRS 941 on behalf of someone else?

When filing the IRS 941 for another individual or business, ensure that you have the appropriate Power of Attorney (POA) documentation. Additionally, be aware of the differing requirements that may apply to nonresidents or special payee situations, as these can affect the filing process.

How long do I need to keep records related to my IRS 941 filings?

The IRS recommends retaining records related to your IRS 941 submissions for at least four years. This is to ensure compliance and assist in case of an audit or any inquiries regarding your tax filings. Securely store these documents to protect sensitive information.

What are some common errors to avoid when filing IRS 941?

Common errors often include incorrect employee information, miscalculations of taxes due, and failure to sign the form if required. To prevent these mistakes, double-check all data before submission and consider using reliable tax software that can guide you through the filing process.

See what our users say