Get the free Texas Hotel Occupancy Tax Exemption Certi cate

Show details

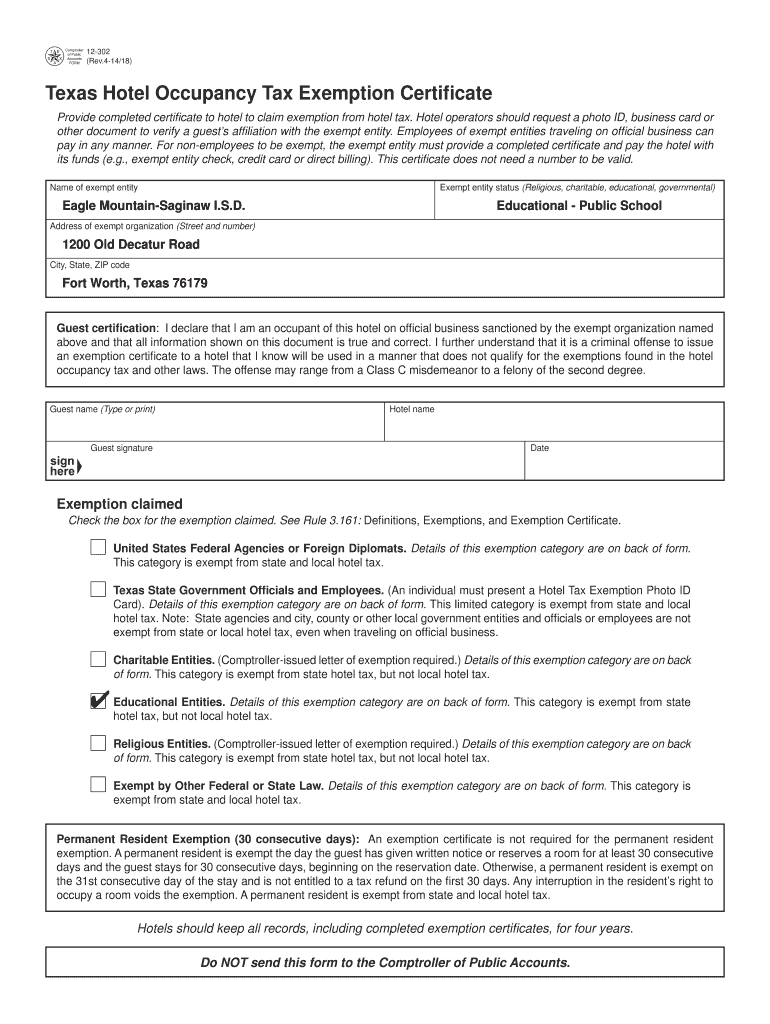

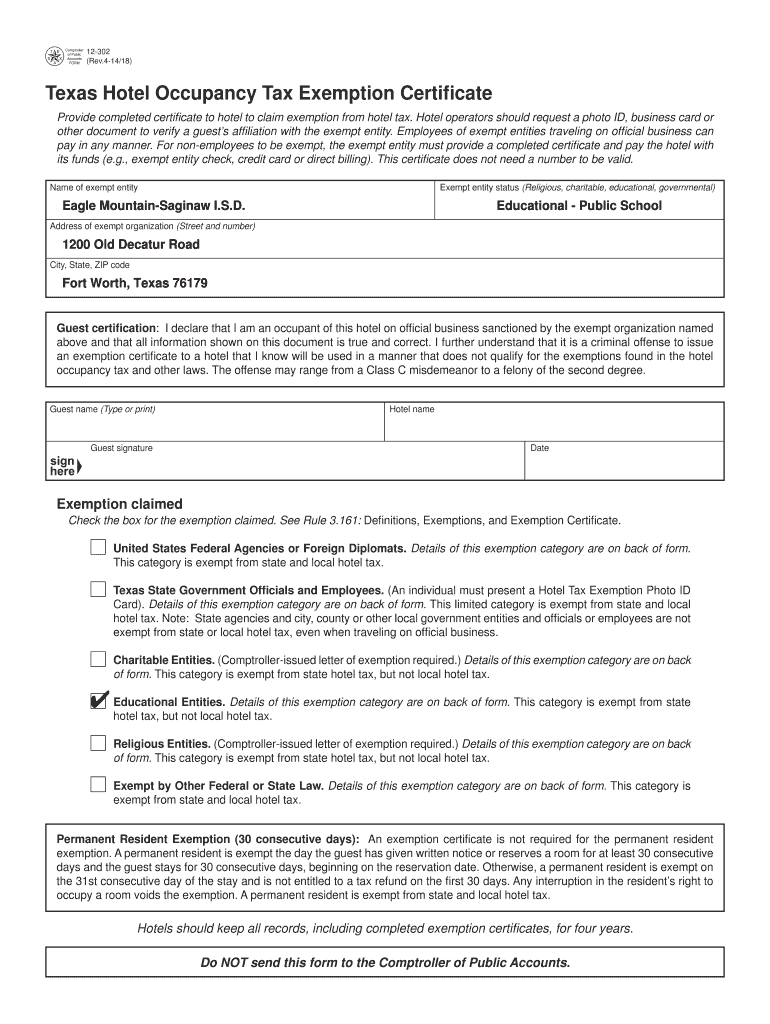

12-302 (Rev.4-14/18) Texas Hotel Occupancy Tax Exemption Cert?came. Provide completed cert ?came to hotel to claim exemption from hotel tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas hotel occupancy tax

Edit your texas hotel occupancy tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas hotel occupancy tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas hotel occupancy tax online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas hotel occupancy tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas hotel occupancy tax

How to fill out Texas hotel occupancy tax:

01

Determine if you are required to pay the Texas hotel occupancy tax. In general, any person or company that provides accommodations for a fee in Texas is required to collect and remit this tax.

02

Obtain the necessary forms for reporting the tax. The Texas Comptroller's website provides the required forms and instructions for filing the hotel occupancy tax.

03

Fill out the necessary information on the tax forms. This typically includes providing your business information, such as your name and address, as well as details about the accommodations you are offering.

04

Calculate the amount of tax you owe. The hotel occupancy tax rate in Texas is generally 6% of the cost of the room, plus an additional local tax that varies by city or county. You may need to consult the local tax authority to determine the specific tax rate applicable to your location.

05

Keep thorough records of your sales and tax collection. It is important to accurately track the number of rooms rented, the amount charged, and the tax collected. This will help ensure compliance and provide documentation in case of an audit.

06

Submit the completed tax forms and payment to the appropriate tax authority. Typically, you will need to remit the tax monthly or quarterly, depending on your business volume. Be sure to adhere to the designated deadlines to avoid penalties or interest charges.

Who needs Texas hotel occupancy tax:

01

Hotels and motels: Any establishment that offers rooms or accommodations for a fee in Texas is required to collect and remit the hotel occupancy tax.

02

Vacation rentals: Individuals or companies that operate vacation rental properties, such as Airbnb hosts or property management companies, are also subject to the hotel occupancy tax.

03

Bed and breakfasts and inns: These types of accommodations that provide lodging for guests in exchange for a fee are required to collect and report the hotel occupancy tax.

04

Short-term rentals: If you rent out a residential property for less than 30 consecutive days, you may be required to collect and remit the hotel occupancy tax.

05

Other lodging establishments: Any business that provides accommodations, including campgrounds, resort properties, or extended-stay hotels, may be subject to the Texas hotel occupancy tax.

Overall, anyone who operates or provides accommodations for a fee in Texas should familiarize themselves with the requirements and obligations related to the hotel occupancy tax. It is important to comply with the tax laws to avoid penalties and ensure the proper funding of state and local programs and services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send texas hotel occupancy tax for eSignature?

texas hotel occupancy tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find texas hotel occupancy tax?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the texas hotel occupancy tax. Open it immediately and start altering it with sophisticated capabilities.

How do I edit texas hotel occupancy tax on an iOS device?

You certainly can. You can quickly edit, distribute, and sign texas hotel occupancy tax on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is texas hotel occupancy tax?

Texas hotel occupancy tax is a tax imposed on the rental of a room or space in a hotel.

Who is required to file texas hotel occupancy tax?

Any hotel or lodging establishment in Texas that rents out rooms or spaces to guests is required to file Texas hotel occupancy tax.

How to fill out texas hotel occupancy tax?

To fill out Texas hotel occupancy tax, you must report the total occupancy revenue and calculate the tax owed based on the applicable rate.

What is the purpose of texas hotel occupancy tax?

The purpose of Texas hotel occupancy tax is to generate revenue for local governments and promote tourism and convention activities.

What information must be reported on texas hotel occupancy tax?

You must report the total occupancy revenue, the applicable tax rate, and calculate the tax owed.

Fill out your texas hotel occupancy tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Hotel Occupancy Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.