Get the free Credit Repair & Debt Settlement

Show details

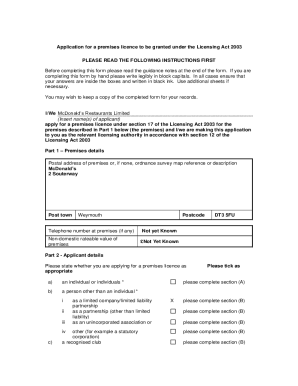

SCC AOR University Credit Repair & Debt Settlement Instructor: Ruth Van Kerosene When is the best time to settle a debt? Learn how to increase your FICO score quickly How to deal with collection companies

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit repair amp debt

Edit your credit repair amp debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit repair amp debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit repair amp debt online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit repair amp debt. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit repair amp debt

How to Fill Out Credit Repair & Debt:

01

First, gather all your financial information including credit card statements, loan documents, and credit reports.

02

Review your credit reports thoroughly to identify any inaccuracies or errors. These may include incorrect personal information, unauthorized accounts, or outdated negative information.

03

Dispute any errors you find on your credit reports by contacting the credit bureaus in writing. Provide evidence to support your dispute and request that the errors be corrected or removed.

04

Develop a budget and create a plan to pay off your debts. Prioritize high-interest debts and consider negotiating with creditors for lower interest rates or payment plans.

05

Make all payments on time and in full to improve your credit score. Set up automatic payments or reminders to help you stay organized.

06

Reduce your credit utilization ratio by paying down balances on your credit cards. Aim to keep your credit utilization below 30% to demonstrate responsible credit management.

07

Consider seeking professional help from a credit counseling agency or a credit repair company if you're struggling to manage your debts or improve your credit score.

08

Monitor your credit regularly to track your progress and identify any other issues that need attention.

09

Stay patient and committed to the process, as repairing credit and reducing debt takes time and effort.

Who Needs Credit Repair & Debt?

01

Individuals who have a poor credit score and want to improve their creditworthiness.

02

People who have made significant financial mistakes in the past, such as missed payments, defaults, or bankruptcy.

03

Those who have excessive debt and are struggling to make payments or manage their finances effectively.

04

Individuals who have identity theft or fraud issues on their credit reports.

05

People who have recently experienced major life events, such as divorce or job loss, which have negatively affected their finances.

06

Those who want to qualify for better interest rates and loan terms in the future, such as when buying a house or car.

07

People aiming to improve their overall financial health and reduce stress related to debt and credit issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit repair amp debt?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the credit repair amp debt in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in credit repair amp debt?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your credit repair amp debt to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit credit repair amp debt straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing credit repair amp debt.

What is credit repair amp debt?

Credit repair and debt refers to the process of improving an individual's credit score and managing debts.

Who is required to file credit repair amp debt?

Individuals with a need to improve their credit score or manage their debts are required to file credit repair and debt.

How to fill out credit repair amp debt?

To fill out credit repair and debt, individuals need to assess their credit report, create a plan to reduce debt, and negotiate with creditors if needed.

What is the purpose of credit repair amp debt?

The purpose of credit repair and debt is to improve an individual's credit score, reduce debt burden, and achieve financial stability.

What information must be reported on credit repair amp debt?

Information such as payment history, outstanding debts, credit utilization, and derogatory marks must be reported on credit repair and debt.

Fill out your credit repair amp debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Repair Amp Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.