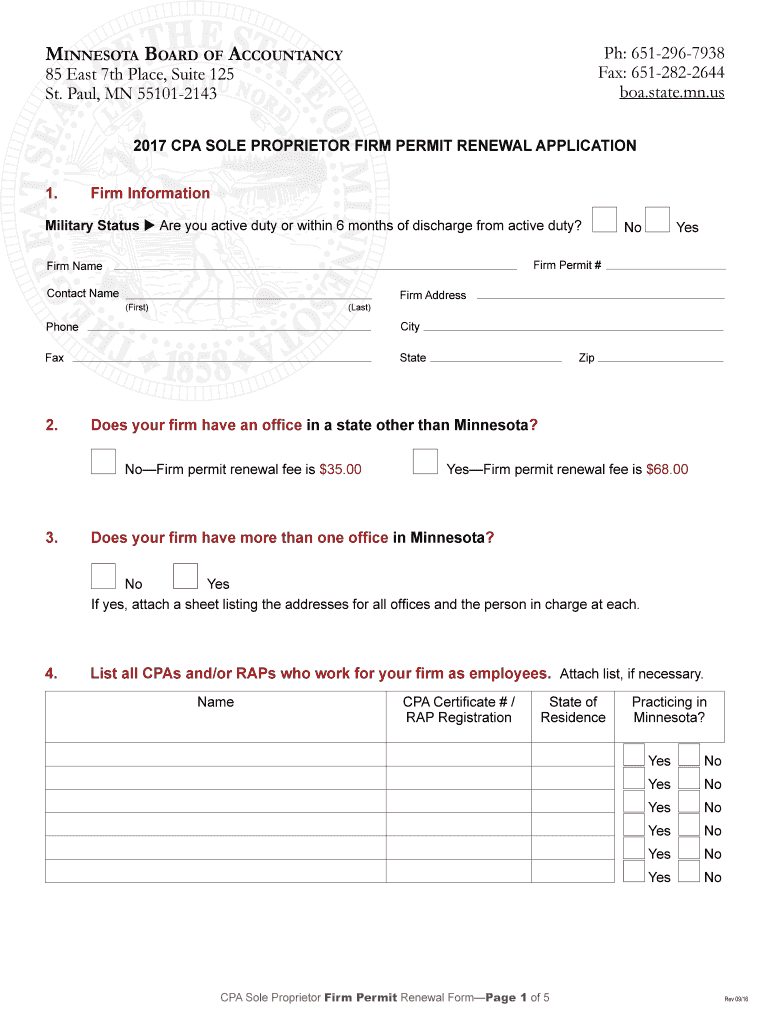

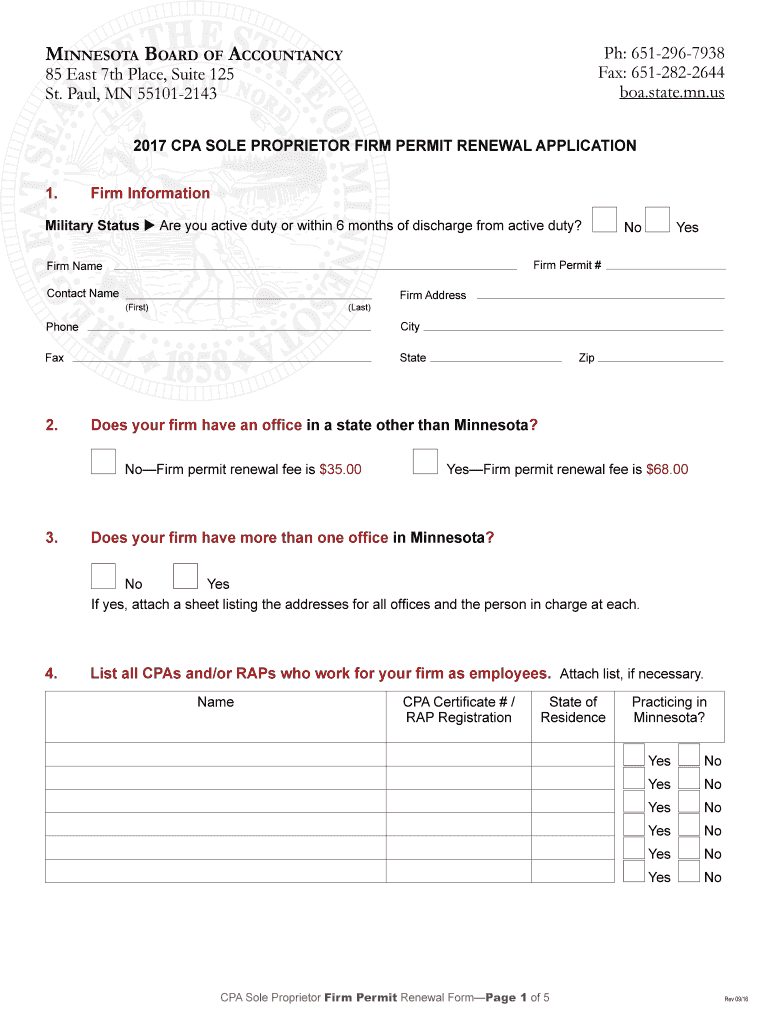

Get the free CPA Sole Proprietor Renewal Form (2017) - boa.state.mn.us

Show details

CPA Sole Proprietor Firm Permit Renewal Form Page 2 of 5 5. A) Provide the names of all owners, managers, directors and officers of the firm who.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cpa sole proprietor renewal

Edit your cpa sole proprietor renewal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpa sole proprietor renewal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cpa sole proprietor renewal online

Follow the steps below to benefit from the PDF editor's expertise:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cpa sole proprietor renewal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cpa sole proprietor renewal

How to fill out CPA sole proprietor renewal:

01

Start by gathering all the necessary documents and information. This may include your personal information, business information, financial records, and any other relevant documents.

02

Make sure you have the latest renewal form provided by your state's board of accountancy or regulatory agency. The form may be available for download on their website or you can request it by mail.

03

Read through the instructions carefully. Familiarize yourself with the requirements and any specific guidelines for filling out the form.

04

Begin filling out the form by providing your personal information such as your name, address, phone number, and email. Make sure to double-check for accuracy.

05

Provide your business information, including the name of your CPA firm, business address, phone number, and any other required details.

06

Fill in any required information about your business structure, such as whether you operate as a sole proprietorship or if you have partners or employees.

07

Indicate whether you have made any changes to your business structure or ownership since your last renewal. If there have been any changes, provide the necessary details.

08

Provide information about your professional liability insurance coverage. This may include the policy number, coverage amount, and expiration date.

09

If applicable, indicate whether you have faced any disciplinary actions or complaints since your last renewal. If yes, provide the necessary details and any supporting documentation.

10

Complete any additional sections or questions that are specific to your state or regulatory agency. These may include disclosing any criminal convictions, attesting to the completion of required continuing education credits, or any specific requirements for your profession.

Who needs CPA sole proprietor renewal:

CPA sole proprietors who operate their own accounting firm or offer accounting services to clients are typically required to renew their licenses or registrations periodically. This renewal ensures that they remain licensed and compliant with the state's accounting regulations. It is important for CPA sole proprietors to renew their licenses to continue practicing legally and maintain their professional standing.

Please note that the specific requirements and renewal periods may vary depending on the state or jurisdiction where the CPA sole proprietor is based. It is advisable to check with the state's board of accountancy or regulatory agency for the exact renewal requirements and deadlines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cpa sole proprietor renewal from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including cpa sole proprietor renewal. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send cpa sole proprietor renewal for eSignature?

cpa sole proprietor renewal is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the cpa sole proprietor renewal in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your cpa sole proprietor renewal in seconds.

What is cpa sole proprietor renewal?

CPA sole proprietor renewal is the process of renewing the license for a Certified Public Accountant who operates as a sole proprietor.

Who is required to file cpa sole proprietor renewal?

CPA sole proprietors who operate their own accounting business are required to file for renewal.

How to fill out cpa sole proprietor renewal?

CPA sole proprietors can fill out the renewal forms online or by mail with the required information and payment.

What is the purpose of cpa sole proprietor renewal?

The purpose of cpa sole proprietor renewal is to ensure that licensed accountants continue to meet the qualifications and standards set by the relevant licensing authority.

What information must be reported on cpa sole proprietor renewal?

CPA sole proprietors must report their contact information, current business activities, professional development activities, and any changes to their license status.

Fill out your cpa sole proprietor renewal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa Sole Proprietor Renewal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.