Get the free credit union individual retirement account periodic payments before ... - acuonline

Show details

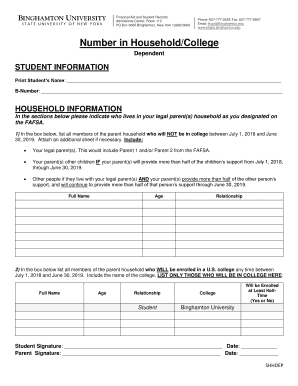

CREDIT UNION INDIVIDUAL RETIREMENT ACCOUNT PERIODIC PAYMENTS BEFORE AGE 70 (FORM 2316) Please Print or Type QUID (Credit Union will Complete) Credit Union Name Social Security Number IRA Owners Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit union individual retirement

Edit your credit union individual retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit union individual retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit union individual retirement online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit union individual retirement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit union individual retirement

How to fill out credit union individual retirement?

01

Gather necessary documents: Before filling out the credit union individual retirement form, make sure you have all the required documents handy, such as your social security number, identification proof, and any other relevant financial information.

02

Understand your investment options: Familiarize yourself with the investment options offered by the credit union for individual retirement accounts (IRAs). Different credit unions may provide a variety of investment choices, including stocks, bonds, mutual funds, or certificates of deposit. Review the options and decide which best suits your retirement goals.

03

Determine your contribution amount: Decide how much you want to contribute to your credit union individual retirement account. Keep in mind that there may be annual contribution limits set by the IRS, and exceeding these limits could have tax implications.

04

Complete the application form: Fill out the credit union individual retirement form accurately and provide all the required information. Make sure to double-check your entries for any errors or omissions.

05

Select beneficiary designation: Designate a beneficiary for your credit union individual retirement account. This individual will receive the funds in your account in the event of your death. This step ensures that your hard-earned savings are transferred to the intended recipient.

06

Review and sign the form: Carefully review all the information you have provided on the form to ensure its accuracy. Once satisfied, sign and date the form as required.

07

Submit the form: Submit your completed credit union individual retirement form to the designated office or department of the credit union. Ensure that you follow any specific submission instructions provided, such as sending it via mail or submitting it in person.

Who needs credit union individual retirement?

01

Individuals planning for retirement: Credit union individual retirement accounts are designed to help individuals save and invest for their retirement years. If you are looking to secure your financial future and build a nest egg for retirement, a credit union individual retirement account can be beneficial.

02

Members of credit unions: Credit unions are financial institutions owned by the members who use their services. If you are a member of a credit union, you may have the option to open an individual retirement account with them. This allows you to take advantage of any special benefits or rates offered exclusively to credit union members.

03

Individuals seeking tax advantages: Contributing to a credit union individual retirement account can provide certain tax advantages. Traditional IRAs may offer tax deductions for contributions, while Roth IRAs can provide tax-free growth and withdrawals during retirement. Consult with a tax professional to understand the specific tax benefits that you may be eligible for.

Overall, credit union individual retirement accounts cater to individuals who want to save for retirement, are members of credit unions, and wish to maximize their tax advantages while securing their financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit union individual retirement to be eSigned by others?

When your credit union individual retirement is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in credit union individual retirement?

The editing procedure is simple with pdfFiller. Open your credit union individual retirement in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete credit union individual retirement on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your credit union individual retirement from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is credit union individual retirement?

Credit union individual retirement is a retirement account specifically tailored for members of a credit union, allowing them to save for retirement with competitive rates and personalized service.

Who is required to file credit union individual retirement?

Individuals who are members of a credit union and wish to save for retirement using this particular type of account are required to file credit union individual retirement.

How to fill out credit union individual retirement?

To fill out credit union individual retirement, individuals must contact their credit union to open the account, choose their investments, and make regular contributions towards their retirement savings.

What is the purpose of credit union individual retirement?

The purpose of credit union individual retirement is to provide credit union members with a convenient and efficient way to save for retirement while receiving personalized service and competitive rates.

What information must be reported on credit union individual retirement?

Information such as contributions made, investments chosen, and account balances must be reported on credit union individual retirement.

Fill out your credit union individual retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Union Individual Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.