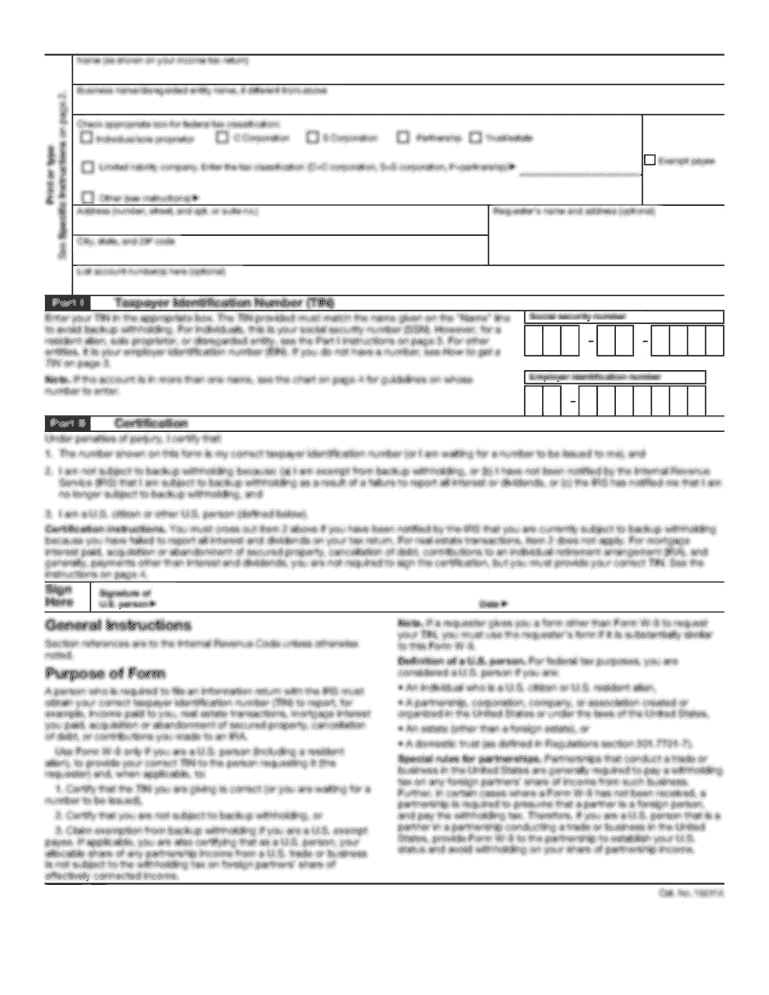

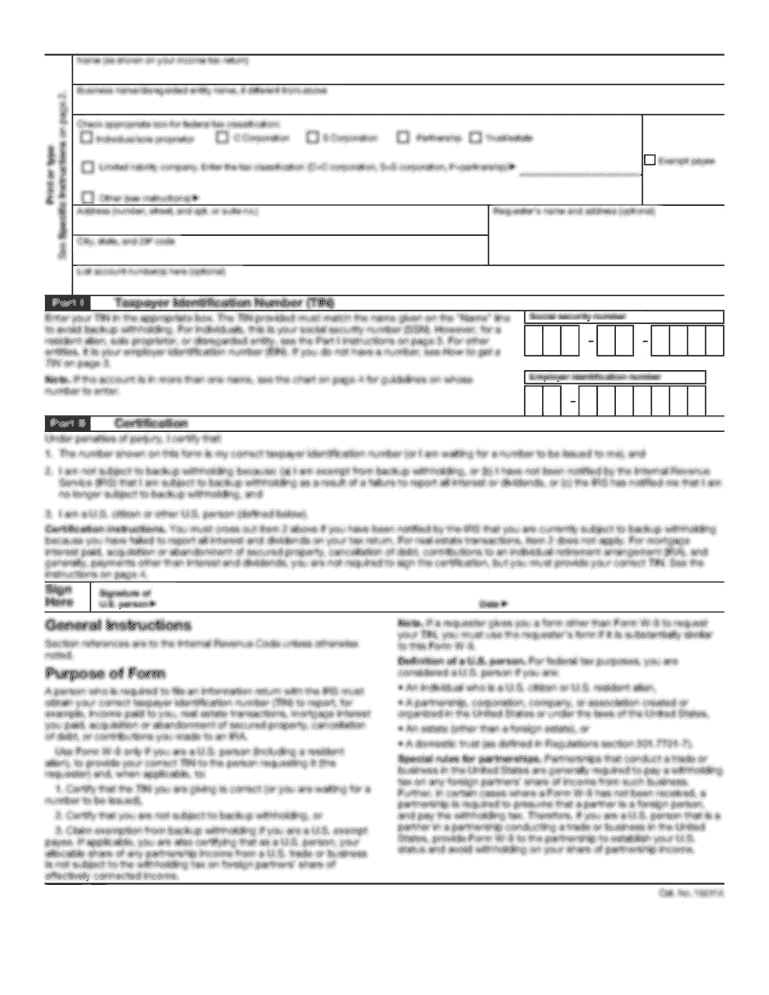

IRS 1099-CAP 2016 free printable template

Show details

Form 1099-CAP 2016. Cat. No. 35115M. Changes in Corporate Control and Capital Structure. Copy A. For Internal Revenue Service Center. Department of the.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your 2016 form 1099-cap form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2016 form 1099-cap form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2016 form 1099-cap online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2016 form 1099-cap. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

IRS 1099-CAP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2016 form 1099-cap

How to Fill out 2016 Form 1099-CAP:

01

Gather the necessary information: Before filling out the form, make sure you have all the required information handy. This includes the name, address, and taxpayer identification number (TIN) of the issuer and the recipient, as well as the date of the acquisition or issuance of the securities, and the total consideration paid or received.

02

Obtain the correct form: Make sure you have the correct version of Form 1099-CAP for the tax year 2016. You can either download the form from the official IRS website or obtain a physical copy from an IRS office or certain authorized providers.

03

Enter the issuer and recipient information: Fill out the top section of Form 1099-CAP with the name, address, and TIN of the issuer and the recipient. Double-check the information to ensure its accuracy.

04

Provide the transaction details: In Part I of the form, you need to provide the details of the acquisition or issuance of the securities. This includes the date of the transaction, a description of the securities, the CUSIP number (if applicable), and the quantity of securities acquired or issued.

05

Complete Part II if applicable: Part II of Form 1099-CAP is used for additional reporting requirements related to contingent payments, acquisitions in conversion transactions, and acquisitions in the bankruptcy or insolvency of an issuer. If any of these situations apply to your transaction, make sure to fill out the necessary information.

06

Calculate the total consideration: In Part III of the form, you need to calculate the total consideration paid or received for the securities. This may include the cash paid, the fair market value of property transferred, any liabilities assumed, and other amounts.

07

Submit the form: Once you have completed all the necessary sections of Form 1099-CAP, make a copy for your records and submit the original to the IRS. Keep in mind the deadlines for filing, which usually falls in late February or early March.

Who Needs 2016 Form 1099-CAP:

01

Issuers of securities: Any entity that issues securities to shareholders or investors during the tax year 2016 may need to file Form 1099-CAP. This includes corporations, mutual funds, partnerships, and other organizations.

02

Recipients of securities: If you received securities from an issuer during the tax year 2016, you may need to report the transaction by using Form 1099-CAP. This is especially important if you sold, exchanged, or disposed of the securities during the same tax year.

03

Taxpayers involved in specific transaction types: Certain transaction types, such as contingent payments, conversions, and acquisitions in bankruptcy or insolvency, may require the filing of Form 1099-CAP. If you were involved in any of these transaction types during the tax year 2016, you may need to use this form for reporting purposes.

It is important to consult the official IRS guidelines or seek professional tax advice to determine if you specifically need to file Form 1099-CAP for the tax year 2016, as individual circumstances may vary.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2016 form 1099-cap for eSignature?

Once your 2016 form 1099-cap is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete 2016 form 1099-cap on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 2016 form 1099-cap. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete 2016 form 1099-cap on an Android device?

Use the pdfFiller app for Android to finish your 2016 form 1099-cap. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your 2016 form 1099-cap online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.