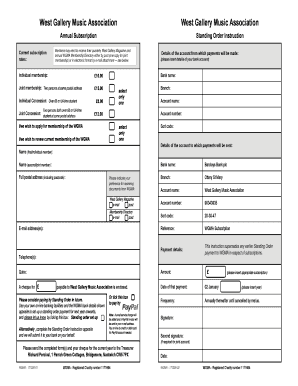

Get the free progressive lienholder verification form

Show details

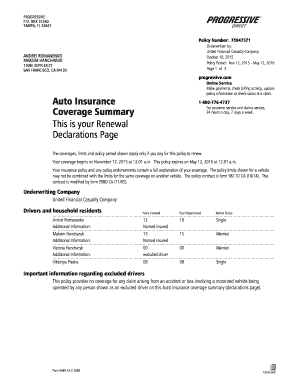

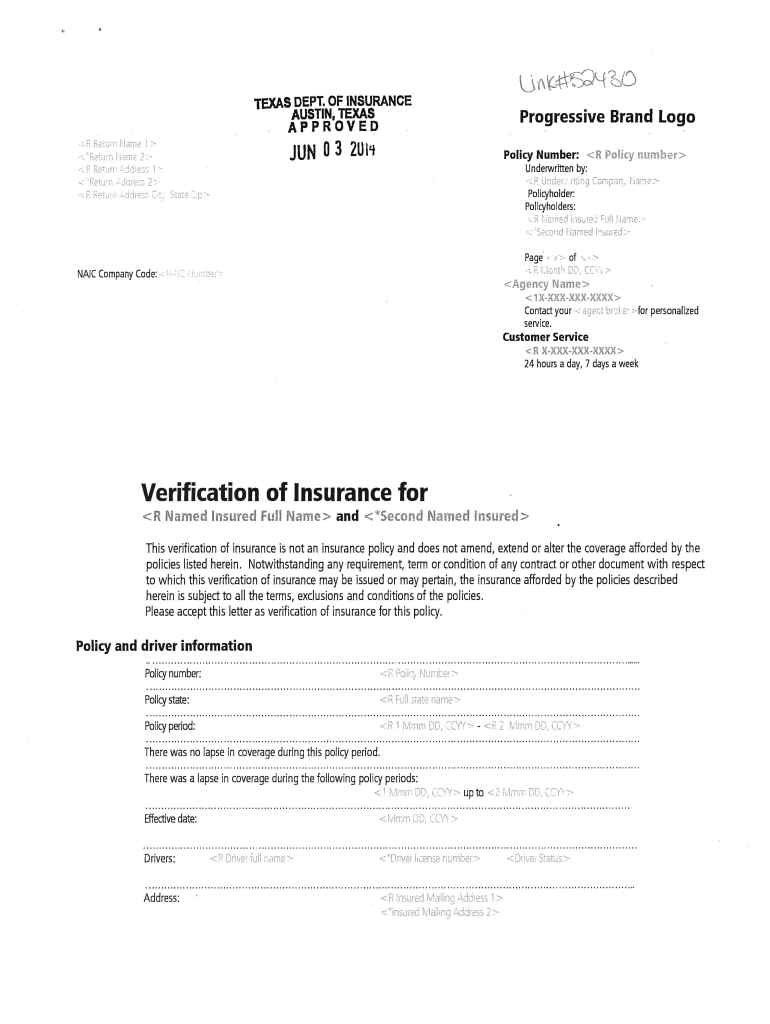

J(bi::J TEXAS DEPT. OF INSURANCE AUSTIN, TEXAS APPROVE!;).::. RTU::, I, Jame 1 'Return hard 2. .:. R Return Progressive Brand Logo JUN 03 2U “l 't Policy Number: R Polity number Underwritten by:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your progressive lienholder verification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your progressive lienholder verification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit progressive lienholder verification online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit progressive auto insurance lienholder verification form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out progressive lienholder verification form

How to fill out progressive lienholder verification:

01

Gather all necessary information: Before starting the verification process, make sure you have all the required documentation such as the lienholder's contact information, vehicle details, and account number.

02

Access the progressive lienholder verification form: Visit the Progressive Insurance website and log into your account. Navigate to the lienholder verification section and locate the form.

03

Provide vehicle information: Fill in the form with accurate details about the vehicle. This includes the make, model, year, and vehicle identification number (VIN). Double-check the information to ensure its correctness.

04

Enter lienholder details: Input the contact information of the lienholder, which may include their name, address, phone number, and any additional details requested by Progressive.

05

Provide proof of lienholder: Progressive may require you to submit supporting documents as proof of the lienholder's involvement. This can include a lien agreement, loan statement, or a letter of authorization from the lienholder.

06

Review and submit: Once you have filled out all the necessary information and attached any required documents, carefully review the entire form to ensure accuracy. Make the necessary corrections if needed and then submit the form.

Who needs progressive lienholder verification:

01

Individuals with financed vehicles: If you have obtained a loan or financing to purchase your vehicle, it is likely that you need to go through the progressive lienholder verification process. This step is necessary to confirm the lienholder's interest in the vehicle and ensure proper insurance coverage.

02

Those seeking insurance claims: In the event of an accident or damage claim, Progressive may require lienholder verification to ensure the appropriate parties are involved and informed. This is particularly important when making comprehensive or collision claims where the vehicle's value is relevant.

03

Progressive customers renewing policies or changing vehicles: Even if you have previously completed the progressive lienholder verification, certain policy changes or vehicle replacements may require you to revisit the process. This ensures that the lienholder's details are up to date and accurately reflected in your insurance policy.

Fill progressive lienholder insurance verification : Try Risk Free

People Also Ask about progressive lienholder verification

How do I upload photos to progressive?

How do I send a fax to progressive?

What is the 3 digit code for Progressive?

What is proof of garaging for Progressive?

How do I add a lienholder to my Progressive Insurance?

How do I submit documents to Progressive?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

When is the deadline to file progressive lienholder verification in 2023?

The deadline to file progressive lienholder verification in 2023 is typically 30 days from the date of the lienholder's notification to the borrower.

What is the penalty for the late filing of progressive lienholder verification?

The penalty for the late filing of progressive lienholder verification is a fine of up to $10,000. Additionally, the lienholder may be subject to other civil or criminal penalties.

What is progressive lienholder verification?

Progressive lienholder verification is a process used by insurance companies, specifically Progressive Insurance, to verify the lienholder information for vehicles with an active loan. When a policyholder insures a vehicle that is financed through a loan, the insurance company needs to ensure that the lienholder information is accurate and up to date.

During the verification process, Progressive may contact the lienholder or use various databases to confirm the accuracy of the lienholder information provided by the policyholder. This helps prevent any potential issues or complications in case of a claim or loss involving the insured vehicle.

The verification process typically involves sending a notice to the policyholder, requesting them to provide the current lienholder information or to confirm the existing details. Failure to provide accurate and updated information may lead to policy cancellations or the policyholder being charged an incorrect premium.

By conducting progressive lienholder verification, insurance companies like Progressive aim to maintain accurate records, ensure proper coverage, and provide necessary information to the lienholder if required.

Who is required to file progressive lienholder verification?

There is no specific entity or individual required to file progressive lienholder verification. The term "progressive lienholder verification" is not commonly used or recognized in a legal or regulatory context. It is possible that you may be referring to a specific requirement or process related to lien verification or notification, but without more information, it is difficult to provide a definitive answer.

How to fill out progressive lienholder verification?

To fill out the Progressive lienholder verification form, you will need the following information:

1. Your personal information: Provide your name, address, phone number, and email address.

2. Policy details: Input your Progressive policy number and the effective date of your policy.

3. Vehicle information: Enter the make, model, year, and vehicle identification number (VIN) of the vehicle insured under the policy.

4. Lienholder details: Fill in the name of your lienholder, the lienholder's address, phone number, and email address.

5. Loan/Lease information: Specify whether your vehicle is financed or leased. If financed, provide the name of the bank, lender, or financing company where you obtained the loan. If leased, provide the name of the leasing company.

6. Signature and date: Sign and date the form to confirm the accuracy of the information provided.

Make sure to review the completed form for any errors or missing details before submitting it to Progressive or your insurance agent. Additionally, you may need to attach any supporting documents requested by Progressive to verify the lienholder details, such as a copy of the finance agreement or lease contract.

What is the purpose of progressive lienholder verification?

The purpose of progressive lienholder verification is to ensure that the lienholder's interest in a property or asset is properly recorded and protected. This process is typically followed in situations involving loans or financing, where a lien is placed on the property or asset as collateral.

Progressive lienholder verification involves confirming the lienholder's information, such as their identity, contact details, and the specifics of the lien, including the amount owed and any other relevant terms. This verification process helps to prevent fraud, identify potential issues or conflicts, and ensure that the lienholder's rights are properly recognized and maintained.

By conducting progressive lienholder verification, lenders or financial institutions can ensure that all relevant information regarding the lienholder is accurate and up-to-date. This helps in maintaining the integrity of legal and financial agreements and provides a reliable record of the lienholder's interest in the property or asset.

What information must be reported on progressive lienholder verification?

The exact information that needs to be reported on progressive lienholder verification may vary depending on the specific requirements and regulations in different regions. However, generally, the following information is typically included:

1. Vehicle information: This includes the complete and accurate details about the vehicle, such as the make, model, year, vehicle identification number (VIN), and license plate number.

2. Owner information: The progressive lienholder verification form usually requires the owner's personal details, such as their full name, address, contact information, and driver's license number.

3. Lienholder information: The form typically asks for the comprehensive details of the lienholder, such as the lienholder's full name, address, contact information, and any additional identifying information.

4. Lienholder authorization: The lienholder verification form often requires the lienholder's signature or any other form of authorization that confirms their consent to release information regarding the vehicle's ownership and lien status.

5. Additional documents: In some cases, the verification process may require additional documents or supporting evidence, such as a copy of the vehicle's title, loan agreement, or any other relevant paperwork.

It's important to note that the specific requirements for progressive lienholder verification may be different depending on the purpose or context of the verification, as well as any specific legal or administrative regulations governing the process.

How can I edit progressive lienholder verification from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including progressive auto insurance lienholder verification form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my progressive insurance verification lienholder in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your progressive lien holder and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit progressive lienholder straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing progressive lienholder proof of insurance form.

Fill out your progressive lienholder verification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Progressive Insurance Verification Lienholder is not the form you're looking for?Search for another form here.

Keywords relevant to progressive insurance lienholder verification form

Related to progressive lien verification

If you believe that this page should be taken down, please follow our DMCA take down process

here

.