Get the free loan application for stated income verified asset ... - LenderLine.com

Show details

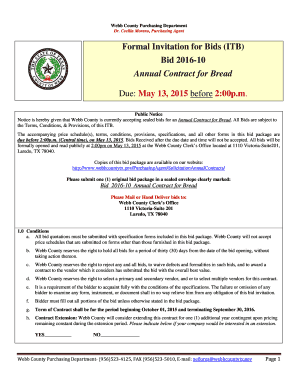

Rev. 06172016 LOAN APPLICATION FOR STATED INCOME VERIFIED ASSET MORTGAGES Dear Prospective Borrower, Thank you for choosing UNDERLINE for your mortgage needs. We are currently offering stated income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan application for stated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan application for stated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan application for stated online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan application for stated. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out loan application for stated

How to fill out loan application for stated:

01

Start by gathering all the necessary documents and information, including your personal identification, employment details, financial statements, and any additional documentation required by the lender.

02

Carefully review the application form and make sure you understand all the questions and requirements. Take your time to fill in all the information accurately and honestly.

03

Provide detailed information about your employment history, including your current employer, job title, and salary. Be prepared to provide documentation such as pay stubs or tax returns to support your income.

04

Disclose any other sources of income you may have, such as investments, rental properties, or business income.

05

Provide information about your assets and liabilities, including bank accounts, investments, real estate, and any outstanding debts or obligations.

06

If you have a co-borrower or guarantor, provide their information along with any necessary supporting documentation.

07

Review the completed application form to ensure all the information provided is accurate and complete. Double-check for any errors or missing information before submitting.

08

Sign and date the application form as required.

09

Submit the loan application along with any supporting documents to the lender, either electronically or in person, as per their instructions.

Who needs loan application for stated:

01

Individuals or small business owners who have difficulty providing traditional income documentation, such as tax returns or W-2 forms, may need a loan application for stated. This type of application allows applicants to state their income without necessarily providing extensive proof.

02

Self-employed individuals who have fluctuating or non-traditional income sources may also require a loan application for stated. It allows them to declare their income based on their average earnings or projected income.

03

Borrowers with non-traditional employment arrangements, such as freelancers or contractors, may benefit from a loan application for stated, as it considers their specific financial situation and income sources.

04

Individuals who have a limited credit history or less-than-ideal credit scores may find that a loan application for stated offers more flexibility and higher chances of approval.

Note: It is important to consult with a financial advisor or lender to determine if a loan application for stated is the right option for your specific circumstances, as requirements and eligibility criteria may vary.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loan application for stated directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your loan application for stated and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit loan application for stated in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your loan application for stated, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit loan application for stated on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as loan application for stated. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your loan application for stated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.