Get the free Declaration Receipt of minimum wage in accordance with the ...

Show details

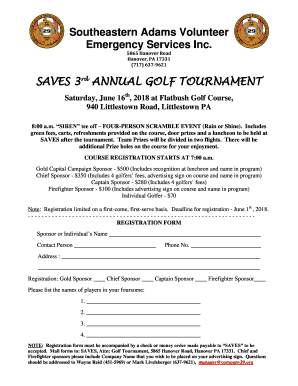

Declaration Receipt of minimum wage in accordance with the Employee Deployment Law (Arbeitnehmerentsendegesetz) Construction project: Client: Employer: My employer has notified me that 14 of the Arbeitnehmerentsendegesetz

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your declaration receipt of minimum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration receipt of minimum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declaration receipt of minimum online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit declaration receipt of minimum. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

How to fill out declaration receipt of minimum

How to fill out a declaration receipt of minimum:

01

Obtain the necessary form: Start by obtaining a copy of the declaration receipt of minimum form. This can usually be found on the official website of the relevant government agency or at their office.

02

Provide personal information: The form will typically require you to provide personal information such as your full name, address, contact details, and any other relevant identification details. Make sure to fill out this information accurately and completely.

03

Declare minimum income: The declaration receipt of minimum is usually related to declaring your minimum income for a specific time period. Fill out the form by accurately stating your minimum income during the designated period.

04

Attach supporting documents: Depending on the requirements of the declaration receipt of minimum, you may be required to attach supporting documents such as pay stubs, bank statements, or any other evidence of your minimum income. Ensure that you have these documents ready and attach them securely to the form.

05

Double-check and submit: Before submitting the form, double-check all the information provided to ensure its accuracy. Any mistakes or incomplete sections may result in delays or rejection of the declaration receipt of minimum. Once you are satisfied, submit the completed form along with the necessary supporting documents to the designated authority or office.

Who needs a declaration receipt of minimum?

01

Individuals applying for social welfare benefits: People who are applying for social welfare benefits that require proof of their minimum income may need to obtain a declaration receipt of minimum. This receipt serves as evidence to support their eligibility for specific benefits.

02

Job applicants: In some cases, employers may request a declaration receipt of minimum as part of the application process. This requirement helps employers verify the income information provided by job applicants and ensures that they meet the minimum income criteria for the position.

03

Self-employed individuals: Self-employed individuals, such as freelancers or independent contractors, may need a declaration receipt of minimum to demonstrate their minimum income when applying for loans, mortgages, or other financial transactions.

04

Students applying for financial aid: Students who are applying for financial aid, scholarships, or student loans may be required to provide a declaration receipt of minimum to prove their financial need and eligibility for assistance.

In summary, the declaration receipt of minimum is a document that requires individuals to declare and provide evidence of their minimum income for various purposes. It is important to accurately fill out the form and attach any necessary supporting documents to ensure its validity and effectiveness.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the declaration receipt of minimum in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your declaration receipt of minimum in minutes.

How do I fill out the declaration receipt of minimum form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign declaration receipt of minimum and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit declaration receipt of minimum on an iOS device?

Create, modify, and share declaration receipt of minimum using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your declaration receipt of minimum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.