Get the free Concepts in Customer Due Diligence:

Show details

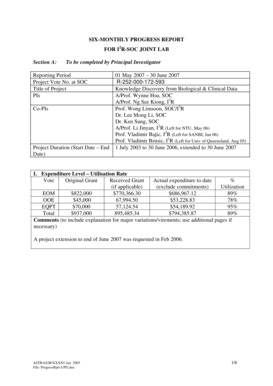

White PaperConcepts in Customer Due Diligence: Meeting the Challenge of Regulatory ExpectationsKnowledge is power and protection. Design a due diligence program that supports business growth. February

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign concepts in customer due

Edit your concepts in customer due form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your concepts in customer due form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit concepts in customer due online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit concepts in customer due. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out concepts in customer due

How to fill out concepts in customer due:

01

Understand the purpose of concepts in customer due: Before filling out concepts in customer due, it is essential to have a clear understanding of why they are required. Customer due diligence refers to the process of assessing the potential risks associated with a customer or client before establishing a business relationship. Concepts in customer due help gather crucial information about the customer, their background, financial status, and potential risks.

02

Collect relevant information: Begin by collecting all the necessary information about the customer. This includes their name, contact details, identification documents, and any relevant business documentation. The aim is to gather accurate and up-to-date information to ensure compliance with regulatory requirements and to mitigate risks related to money laundering, fraud, or other illegal activities.

03

Review customer identification documents: Examine the identification documents provided by the customer, such as passports or driver's licenses. Ensure that the documents are authentic, valid, and match the information provided by the customer. Keep a record of these documents to establish the customer's identity and comply with any legal and regulatory obligations.

04

Assess the customer's financial status: Gathering information about the customer's financial status is vital in customer due diligence. This includes information on their income, assets, liabilities, and credit history. It helps evaluate the customer's ability to engage in the proposed business relationship and assess any risk associated with their financial stability.

05

Conduct background checks: Research the customer's background to identify any potential red flags or risks. This may involve checking public records, conducting a credit check, or using third-party databases. Look for any criminal records, involvement in suspicious activities, or adverse media coverage that could pose a risk to your business.

06

Evaluate the customer's risk level: After collecting all the necessary information, evaluate the customer's risk level based on the established criteria. This can be done by assigning risk scores or categories depending on various factors such as the nature of the business, jurisdiction, or previous compliance records. This step helps to determine the level of due diligence required for the customer and to implement appropriate risk mitigation measures.

Who needs concepts in customer due:

01

Financial institutions: Banks, credit unions, and other financial institutions are the primary users of concepts in customer due. They are legally obligated to perform customer due diligence to mitigate risks associated with money laundering, terrorist financing, and other financial crimes. Concepts help them gather and assess the necessary information to comply with regulatory requirements.

02

Legal and professional service providers: Lawyers, accountants, and other professionals who provide services to clients are also required to conduct customer due diligence. Concepts assist these professionals in assessing the reputation and integrity of their potential clients and ensuring compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

03

Government agencies: Government agencies responsible for regulating and monitoring financial transactions also require concepts in customer due. These agencies aim to prevent illegal activities such as money laundering, tax evasion, and fraud. Concepts help them gather information about individuals and businesses involved in financial transactions to identify potential risks and take appropriate actions.

In summary, filling out concepts in customer due requires understanding the purpose, gathering relevant information, reviewing identification documents, assessing financial status, conducting background checks, and evaluating the customer's risk level. Financial institutions, legal and professional service providers, and government agencies are among the entities that require concepts in customer due to fulfill their regulatory obligations and mitigate risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send concepts in customer due to be eSigned by others?

When you're ready to share your concepts in customer due, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in concepts in customer due?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your concepts in customer due and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit concepts in customer due on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as concepts in customer due. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is concepts in customer due?

Concepts in customer due refer to the essential information that a company must gather and evaluate about a potential customer before entering into a business relationship with them.

Who is required to file concepts in customer due?

Companies in various industries, such as banking, finance, and real estate, are required to file concepts in customer due in order to comply with regulations and reduce the risk of financial crimes.

How to fill out concepts in customer due?

Concepts in customer due are usually filled out by gathering information about the customer's identity, background, financial activities, and any potential risks associated with doing business with them.

What is the purpose of concepts in customer due?

The purpose of concepts in customer due is to assess the legitimacy of potential customers, prevent money laundering and terrorist financing, and protect companies from being involved in criminal activities.

What information must be reported on concepts in customer due?

Information that must be reported on concepts in customer due includes the customer's identity, address, occupation, source of funds, and any relevant financial transactions.

Fill out your concepts in customer due online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Concepts In Customer Due is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.