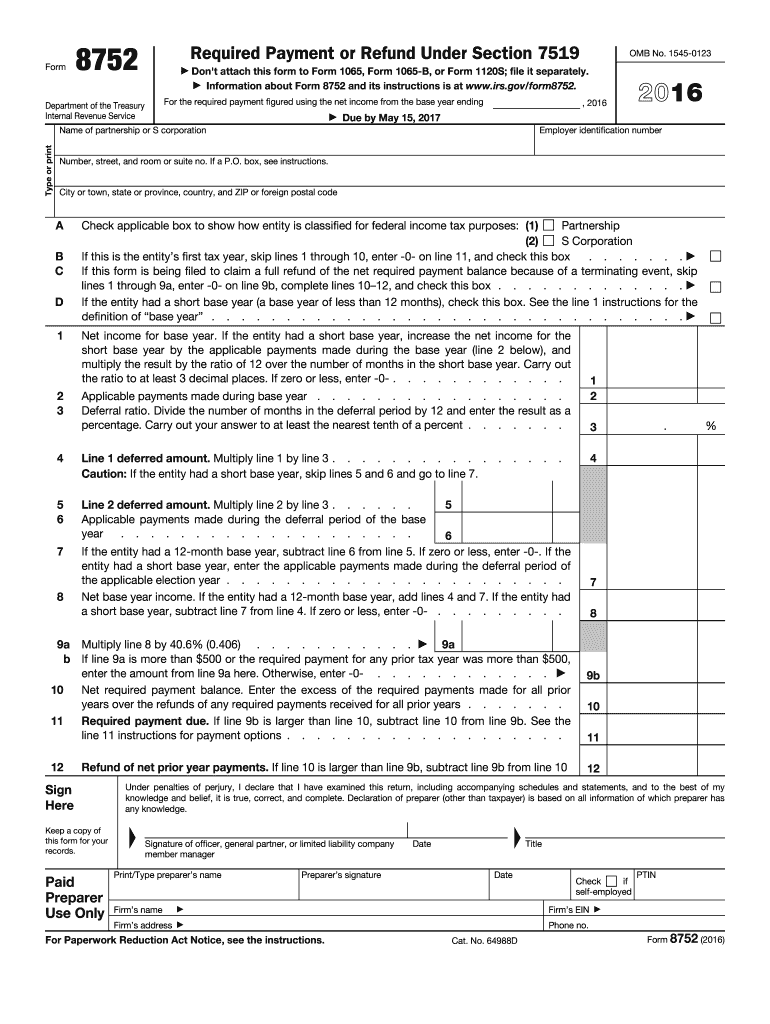

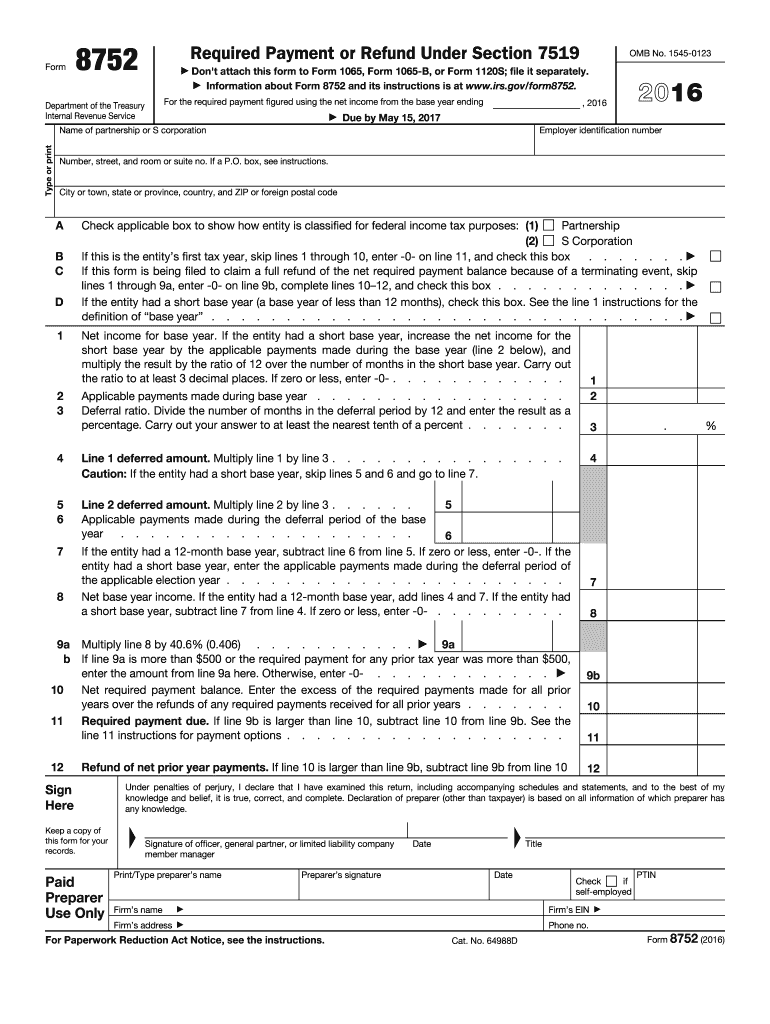

IRS 8752 2016 free printable template

Get, Create, Make and Sign

Editing 2016 form 8752 online

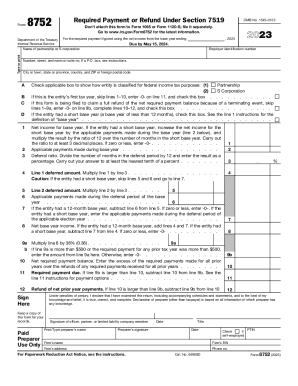

IRS 8752 Form Versions

How to fill out 2016 form 8752

How to fill out 2016 form 8752:

Who needs 2016 form 8752?

Instructions and Help about 2016 form 8752

Okay for this video I wanted to cover IRS form 8863 this is how to claim the education tax credit for the American opportunity tax credit, so the form is used to claim either one of these two so American opportunity or lifetime learning in this example I'm going to cover the ATC rather than the lifetime learning because the American opportunity credit is generally more favorable it provides greater amounts, and you can claim it on a per-student basis rather than just one per taxpayer okay, so I've got the form in front of us here we'll go through this, but I've also got a slide here where I want to cover some background on these credits and wonder what are some differences between the two, and then we'll look at the fact pattern so broadly speaking there's a number of different types of tax credits or incentives that the IRS offers you if you're a US student right, so the first one is the American opportunity tax credit that's what we'll cover in this video and then there's a lifetime learning tax credit the third one here the tuition and fees tax deduction...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 2016 form 8752 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.