Get the free ALTERNATIVE FUELS INCENTIVE ACT ALTERNATIVE FUELS INCENTIVE FUND AND

Show details

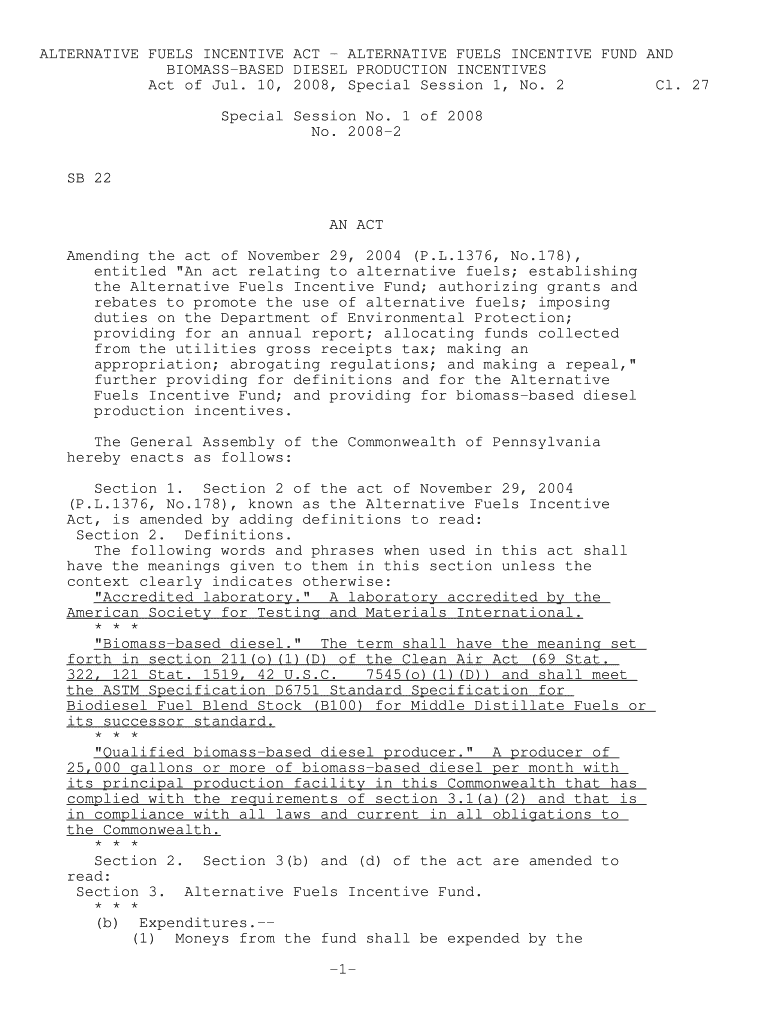

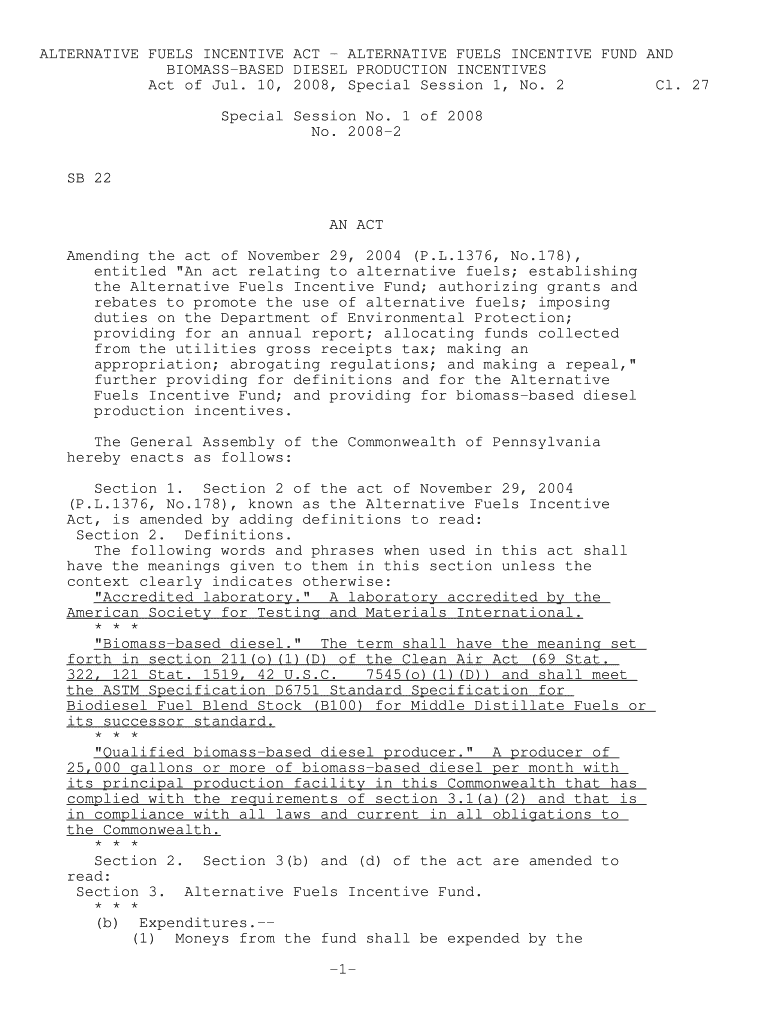

ALTERNATIVE FUELS INCENTIVE ACT ALTERNATIVE FUELS INCENTIVE FUND AND BIOMASSBASED DIESEL PRODUCTION INCENTIVES Act of Jul. 10, 2008, Special Session 1, No. 2 Cl. 27 Special Session No. 1 of 2008 No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alternative fuels incentive act

Edit your alternative fuels incentive act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alternative fuels incentive act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alternative fuels incentive act online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit alternative fuels incentive act. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alternative fuels incentive act

How to fill out alternative fuels incentive act:

01

Research and gather information: Start by understanding the requirements and guidelines of the alternative fuels incentive act. Read through the official documentation, visit relevant websites, or consult with experts to ensure you have a comprehensive understanding of the act.

02

Determine eligibility: Before filling out the alternative fuels incentive act, determine if you or your organization are eligible for the incentives. Check if you meet the criteria for using alternative fuels, such as biodiesel, electricity, natural gas, or hydrogen. Also, confirm if you qualify for any tax credits or grants related to alternative fuels.

03

Collect necessary documentation: Gather all the required documents for filling out the alternative fuels incentive act. This may include proof of fuel purchases or usage, vehicle registration details, receipts, invoices, and other relevant financial records. Make sure to organize and keep these documents in a safe place for future reference.

04

Understand the application process: Familiarize yourself with the specific steps involved in completing the application for the alternative fuels incentive act. Determine whether the process is done online or through paper forms and get acquainted with any deadlines or submission requirements.

05

Complete the application: Fill out the application form accurately and provide all the necessary information requested. Double-check your entries to ensure accuracy and avoid any mistakes that could delay or invalidate your application. If applicable, attach all the supporting documentation as requested.

06

Seek professional assistance if needed: If you find the process complex or have any doubts, consider seeking professional assistance, such as a tax advisor or an expert in alternative fuels incentives. They can guide you through the process, offer advice, and ensure compliance with all relevant regulations.

Who needs the alternative fuels incentive act:

01

Individuals or Businesses using alternative fuels: The alternative fuels incentive act is relevant to individuals or businesses utilizing alternative fuels, such as biodiesel, electricity, natural gas, or hydrogen. It provides incentives, tax credits, or grants to encourage the use of these fuels as an alternative to traditional fossil fuels.

02

Organizations involved in alternative fuels infrastructure: The incentive act may also be relevant to organizations involved in developing or maintaining alternative fuels infrastructure. This includes entities engaged in setting up charging stations for electric vehicles, constructing natural gas refueling stations, or establishing distribution networks for alternative fuels.

03

Energy companies and manufacturers: Energy companies and manufacturers producing or selling alternative fuels can benefit from the alternative fuels incentive act. This act can provide financial incentives for their operations, promote research and development in the alternative fuels sector, and support the growth of clean energy solutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send alternative fuels incentive act for eSignature?

Once your alternative fuels incentive act is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute alternative fuels incentive act online?

pdfFiller has made it simple to fill out and eSign alternative fuels incentive act. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the alternative fuels incentive act in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your alternative fuels incentive act right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is alternative fuels incentive act?

The Alternative Fuels Incentive Act provides incentives for the use of alternative fuels such as biodiesel and ethanol.

Who is required to file alternative fuels incentive act?

Businesses and individuals who use alternative fuels are required to file the Alternative Fuels Incentive Act.

How to fill out alternative fuels incentive act?

To fill out the Alternative Fuels Incentive Act, you must provide information on the amount of alternative fuels used and any incentives claimed.

What is the purpose of alternative fuels incentive act?

The purpose of the Alternative Fuels Incentive Act is to promote the use of alternative fuels and reduce dependence on traditional fossil fuels.

What information must be reported on alternative fuels incentive act?

Information such as the type and amount of alternative fuels used, any incentives claimed, and the total emissions reductions achieved must be reported on the Alternative Fuels Incentive Act.

Fill out your alternative fuels incentive act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alternative Fuels Incentive Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.