Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the penalty for the late filing of irs form?

The penalty for the late filing of IRS forms is 5% of the unpaid taxes for each month or part of a month that a tax return is late, up to a maximum of 25%. In addition, if a return is more than 60 days late, the minimum penalty is the smaller of $210 or 100% of the unpaid tax.

IRS Form is a document provided by the Internal Revenue Service (IRS), which is the tax collection agency of the United States government. These forms are used by individuals and businesses to report their financial information and calculate the amount of taxes they owe or the refund they may be entitled to. The IRS offers various types of forms for different purposes, including income tax returns, payroll taxes, estate taxes, and other tax-related matters.

Who is required to file irs form?

There are several different IRS forms that are applicable to different individuals or entities. The specific forms that need to be filed depend on various factors such as income level, filing status, and type of income or transactions. Some common forms include:

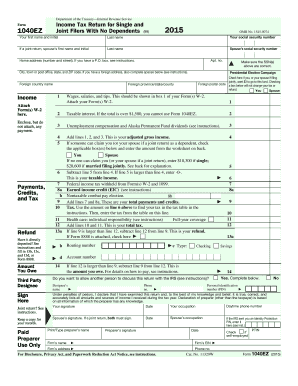

1. Form 1040: Individual Income Tax Return - This form is typically filed by most individuals who are U.S. citizens or resident aliens, and have income to report or certain deductions to claim.

2. Form 1040-NR: U.S. Nonresident Alien Income Tax Return - This form is for nonresident aliens who have income in the United States, but are not eligible to use Form 1040.

3. Form 1065: U.S. Return of Partnership Income - This form is usually filed by partnerships to report their income, deductions, and credits.

4. Form 1120: U.S. Corporation Income Tax Return - This form is used by domestic corporations (including S corporations) to report their income, deductions, and credits.

5. Form 990: Return of Organization Exempt from Income Tax - This form is filed by tax-exempt organizations, such as non-profit organizations, to report their financial activities.

These are just a few examples, and there are numerous other forms and schedules that may apply to specific situations. It is advisable to consult the official IRS website or seek professional tax advice to determine the specific forms that need to be filed.

How to fill out irs form?

Filling out an IRS form involves a series of steps to accurately report your information. Here is a general guide on how to fill out an IRS form:

1. Gather all necessary documents: Before you start filling out the form, gather all relevant documentation, such as W-2 forms, 1099 forms, receipts, and any other supporting documentation required for the specific form you are filling out.

2. Review the instructions: IRS forms usually come with detailed instructions, so familiarize yourself with them before you begin. The instructions will guide you through each section of the form and provide explanations for specific entries.

3. Provide personal information: Begin by filling out your personal information, including your name, address, social security number, and other identifying details. Ensure accuracy and legibility when providing this information.

4. Report income: If the form requires you to report income, follow the instructions provided and report your income from various sources like wages, self-employment, dividends, or any other applicable income sources. Attach necessary statements or schedules if requested.

5. Claim deductions or credits: If eligible, claim any deductions or credits you are entitled to. You may need to provide supporting information or complete additional forms to document your eligibility for specific deductions or credits.

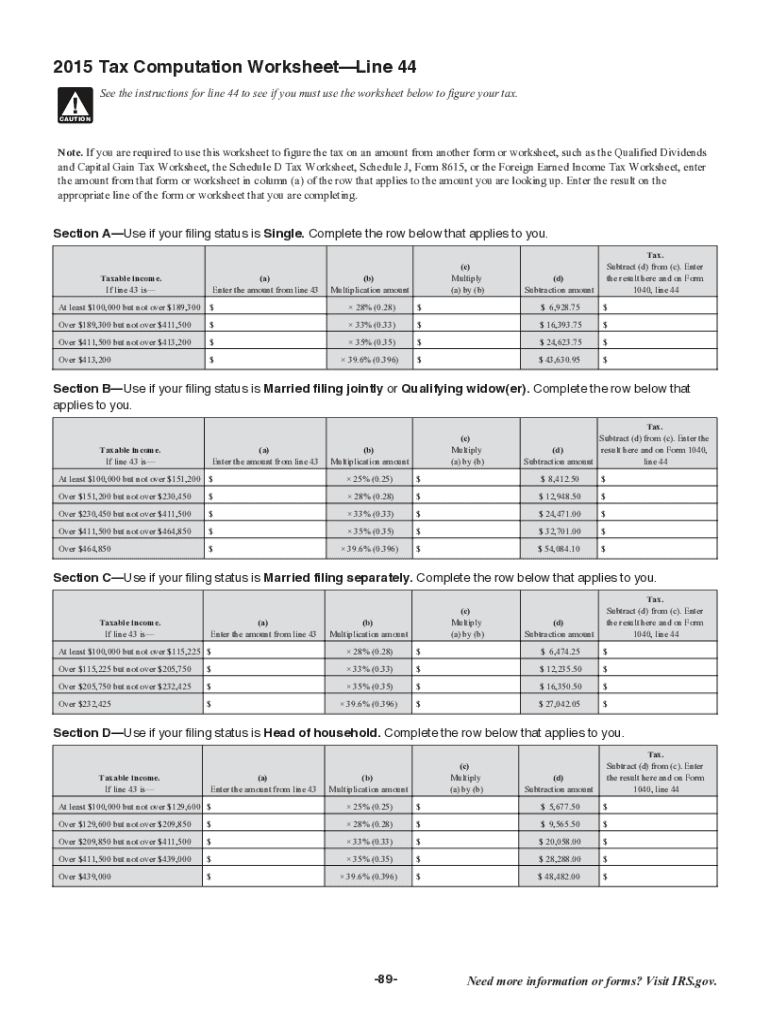

6. Calculate and report taxes: Calculate your tax liability based on the information you have provided. This may involve referring to tax tables, using provided worksheets, or completing additional schedules. Depending on the form, you may also need to report estimated tax payments or withholding.

7. Sign, date, and submit: Once you have completed filling out the form, sign and date it as required. Keep a copy of the form for your records and submit it to the IRS through the appropriate channels (mail, e-file, or drop-off locations) based on the instructions provided.

It's important to note that specific IRS forms may have unique requirements and may require additional steps or attachments. Always read the instructions provided with the form and consider seeking professional tax advice if you have complex tax situations.

What is the purpose of irs form?

The Internal Revenue Service (IRS) form is used for various purposes related to reporting and paying taxes in the United States. The main purpose of IRS forms is to collect information from taxpayers, calculate their tax liability, and ensure compliance with the tax laws. IRS forms are used to report income, deductions, credits, and other financial transactions relevant to the determination of a taxpayer's tax liability. Additionally, IRS forms are used for requesting tax refunds, making tax payments, and claiming tax benefits or exemptions. The specific purpose of each form varies depending on the type of tax return or transaction being reported.

When is the deadline to file irs form in 2023?

The deadline to file IRS Form in 2023 is typically April 17th, 2023. However, it's important to note that the IRS may change the deadline occasionally, so it is advisable to double-check with official IRS announcements or consult a tax professional for the most accurate and up-to-date information.

How do I modify my 2015 irs form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 2015 irs form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send 2015 irs form for eSignature?

To distribute your 2015 irs form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit 2015 irs form online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 2015 irs form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.