Get the free Internal Revenue Service - IRS

Show details

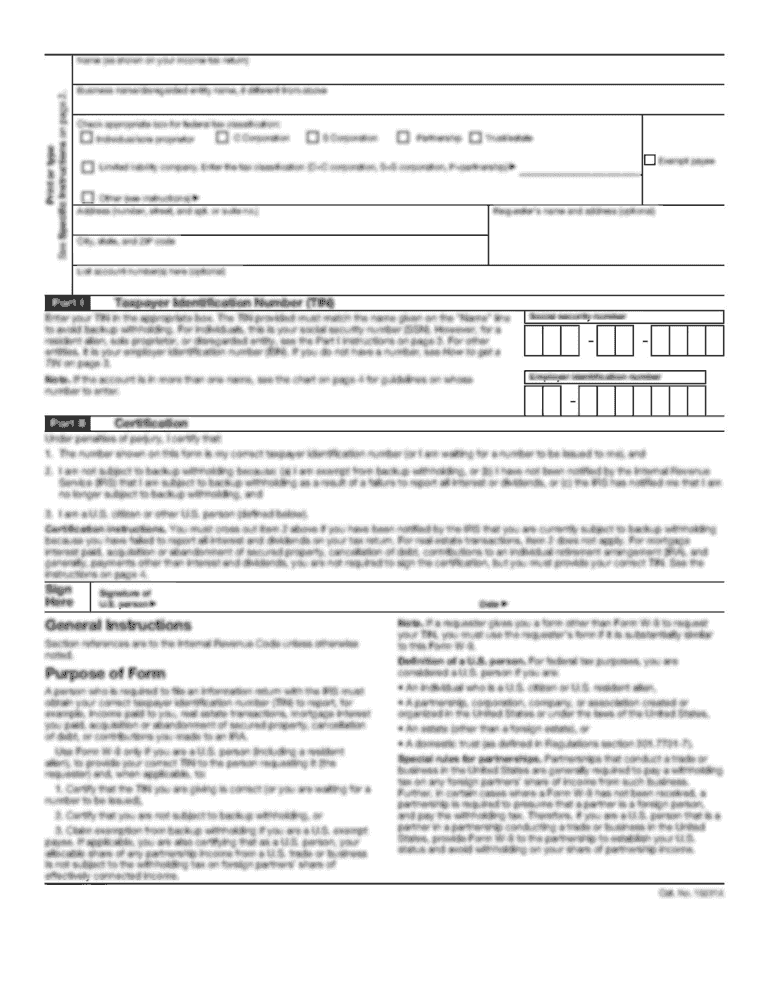

Internal Revenue ServiceDepartment of the TreasuryNumber: 200147034 Release Date: 11/23/2001 Index Number: 1362.0203; 1375.0000Washington, DC 20224Person to Contact: Telephone Number: Refer Reply

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your internal revenue service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit internal revenue service online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit internal revenue service. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

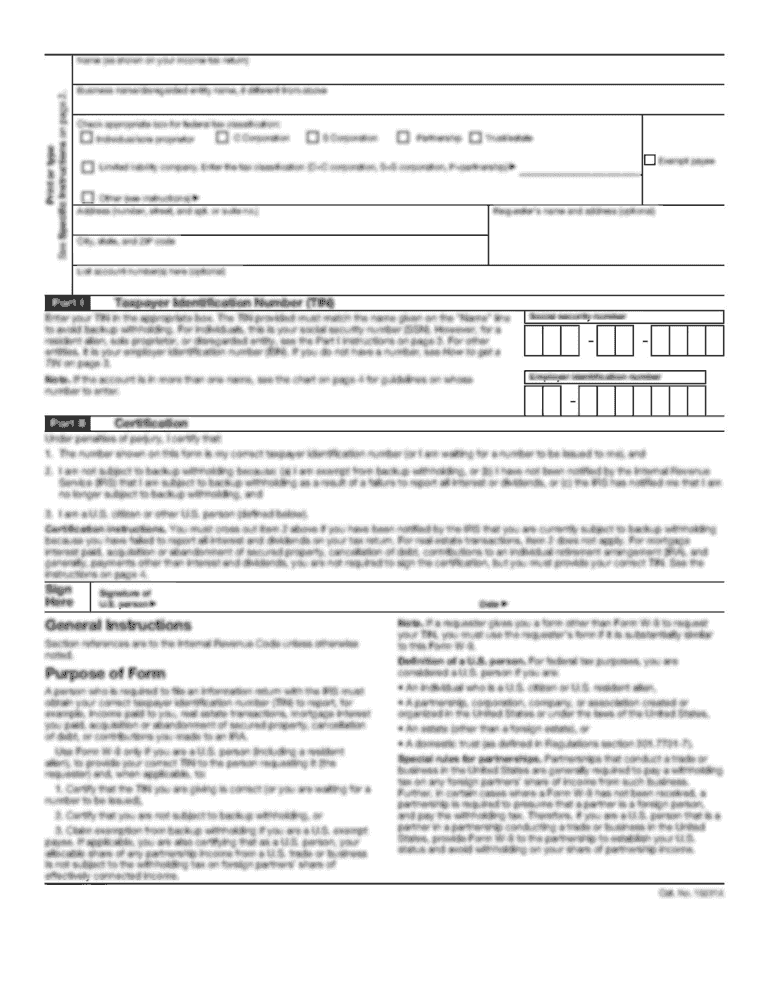

How to fill out internal revenue service

How to fill out the Internal Revenue Service (IRS):

01

Gather relevant documents: Before starting the process, make sure you have all the necessary documents such as W-2 forms, 1099 forms, receipts, and any other supporting documents for your income and deductions.

02

Understand the forms: Familiarize yourself with the different IRS forms such as Form 1040, Form 1040A, or Form 1040EZ. Determine which form is applicable to your situation based on your income, deductions, and eligibility.

03

Provide personal information: Fill in your personal information such as name, address, Social Security Number (SSN), and any applicable information for your spouse and dependents.

04

Report income: Enter the details of your income, including wages, dividends, interest, self-employment income, etc. Make sure to report all sources of income accurately.

05

Claim deductions and credits: Determine if you are eligible for any deductions or credits such as education expenses, mortgage interest, medical expenses, or child tax credits. Fill out the appropriate sections or forms to claim these benefits.

06

Calculate taxes: Based on your income and deductions, calculate the amount of tax you owe or any refund you may be eligible for. This may involve using tax tables or tax software to ensure accurate calculations.

07

Sign and file: Once you have completed the necessary sections, sign the form and consider whether you want to file electronically or by mail. Electronic filing generally offers faster processing and reduces the chance of errors.

Who needs the Internal Revenue Service (IRS)?

01

Individuals: Any individual who earns income in the United States, above a certain threshold, is required to file a federal tax return with the IRS. This includes both U.S. citizens and resident aliens.

02

Businesses: Various types of businesses, such as sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), may need to file tax returns with the IRS, depending on their structure and earnings.

03

Non-profit organizations: Non-profit organizations, including charities and religious institutions, may also need to file tax returns with the IRS to maintain their tax-exempt status and report financial activities.

Overall, anyone who has a tax filing requirement, whether an individual or an entity, will need to interact with the Internal Revenue Service to fulfill their tax obligations and ensure compliance with the tax laws of the United States.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send internal revenue service for eSignature?

Once your internal revenue service is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the internal revenue service in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your internal revenue service in minutes.

Can I create an eSignature for the internal revenue service in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your internal revenue service and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your internal revenue service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.