Get the free STOCK PURCHASE AGREEMENT BETWEEN Ron Evans, SELLER ... - sec

Show details

STOCK PURCHASE AGREEMENT BETWEEN Ron Evans, SELLER, AND HEARTLAND, INC., BUYER TABLE OF CONTENTS Section 1. Section 2. Section 3. Section 4. Section 5. Section 6. Section 7. Section 8. Section 9.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your stock purchase agreement between form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stock purchase agreement between form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stock purchase agreement between online

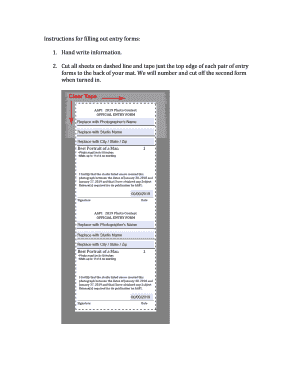

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit stock purchase agreement between. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

How to fill out stock purchase agreement between

How to Fill Out Stock Purchase Agreement Between:

01

Start by including the names and contact information of both the buyer and the seller. This ensures that both parties are clearly identified and can be reached if needed throughout the process.

02

Specify the total number of shares being purchased and the purchase price per share. It's important to include precise details about the transaction to avoid any misunderstandings or conflicts in the future.

03

Outline the payment terms, including the initial deposit amount, any installment payments, or a lump-sum payment. Be sure to specify any deadlines or conditions for payment to ensure a smooth transaction.

04

Include provisions for due diligence, allowing the buyer to thoroughly examine the company's financial records, legal documents, and any other relevant information. This helps the buyer make an informed decision before finalizing the purchase.

05

Address any warranties or representations made by the seller regarding the shares being sold. This includes disclosing any potential liabilities, pending legal actions, or ownership disputes. It helps protect the buyer from unforeseen issues that may arise after the purchase.

06

Specify the closing date, which is when the ownership of shares is officially transferred from the seller to the buyer. This date should be agreed upon by both parties and should allow enough time for necessary paperwork and procedures to be completed.

07

Outline any additional conditions or agreements that both parties must abide by during and after the transaction. This may include non-compete clauses, confidentiality agreements, or any other specific requirements deemed necessary for the benefit of both parties.

Who Needs a Stock Purchase Agreement Between:

01

Individuals or entities looking to buy or sell company shares. This agreement helps formalize the transaction and protects the rights and interests of both the buyer and the seller.

02

Companies undergoing mergers or acquisitions. Stock purchase agreements are crucial in these situations to ensure transparency and clarity in the transfer of ownership.

03

Investors or venture capitalists investing in startups or small businesses. A stock purchase agreement helps establish the terms and conditions of the investment, ensuring proper documentation of the purchased shares and protecting the parties involved.

In summary, filling out a stock purchase agreement requires careful consideration of key details such as party information, share details, payment terms, due diligence, warranties, closing dates, and additional conditions. It is essential for individuals, companies, and investors involved in buying or selling shares to have this legally binding agreement in place to protect their interests and ensure a smooth transaction.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get stock purchase agreement between?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the stock purchase agreement between. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in stock purchase agreement between?

The editing procedure is simple with pdfFiller. Open your stock purchase agreement between in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit stock purchase agreement between on an Android device?

You can edit, sign, and distribute stock purchase agreement between on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your stock purchase agreement between online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.