Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

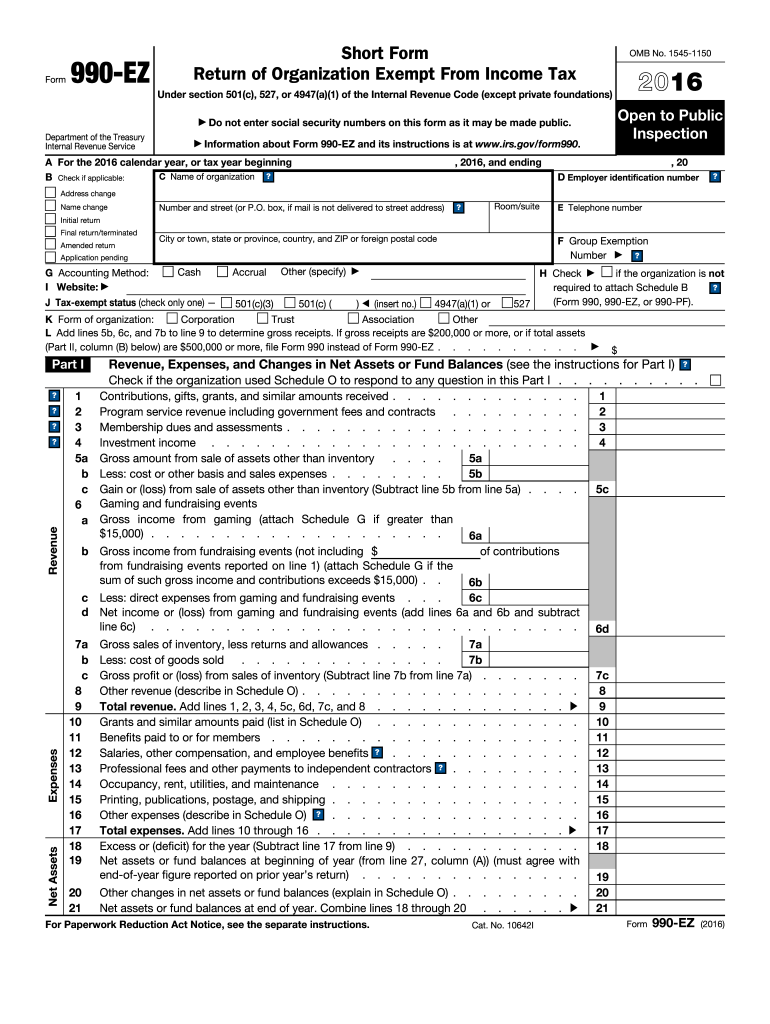

IRS Form 990-EZ is a shortened version of Form 990, which is a tax form used by tax-exempt organizations to provide information to the Internal Revenue Service (IRS) about their finances and activities. Form 990-EZ is designed for organizations with annual gross receipts less than $200,000 and total assets less than $500,000. It requires less detailed reporting compared to the full Form 990 but still provides important information about an organization's income, expenses, assets, and activities. The form helps the IRS and the public evaluate a tax-exempt organization's compliance with tax laws and ensure transparency.

Who is required to file irs form 990 ez?

The IRS Form 990-EZ is required to be filed by tax-exempt organizations with gross receipts less than $200,000 and total assets less than $500,000. These organizations include certain types of charitable, religious, educational, and other tax-exempt organizations under section 501(c). It is important to note that some organizations may still be required to file the full Form 990 depending on their size and other factors.

How to fill out irs form 990 ez?

Filling out IRS Form 990-EZ involves providing detailed information about an organization's activities, finances, and governance. Here is a step-by-step guide to help you fill out the form:

1. Obtain the latest version of Form 990-EZ: You can download the form from the IRS website (www.irs.gov) or request a copy by mail.

2. Gather necessary information: Before starting the form, collect all the required information such as organization's name, address, EIN (Employer Identification Number), fiscal year details, and records of income and expenses.

3. Provide basic information: Begin by entering the organization's name, EIN, address, and the fiscal year for which you are filing the form.

4. Complete Part I: This section requires you to answer a series of yes/no questions regarding the organization's gross receipts, assets, activities, and compliance. Answer each question based on your organization's situation.

5. Complete Part II: Here, you will report various financial information, including revenue, expenses, and assets. Provide details of income from different sources such as contributions, fundraising events, program service revenue, and investments. Deduct relevant expenses, such as salaries, programs, administrative costs, and other expenses.

6. Complete Part III: This section deals with the organization's specific activities and provides space to describe its mission, achievements, program expenses, and details about high-level employees' compensation.

7. Complete Part IV: In this part, you need to provide information about the organization's voting members or governing body, including their names and addresses. Note that for smaller organizations, you may need to include only the highest-compensated individuals.

8. Complete Part V: This section requires details about the organization's highest-compensated employees and independent contractors. Include their names, addresses, titles, compensation, and a brief description of their responsibilities.

9. Review and sign: Once you've completed all the sections, ensure that all the information is accurate and double-check for any errors or missing data. Sign and date the form.

10. Submit the form: Make a copy of the completed Form 990-EZ for your records and submit the original to the IRS. Note that you may also need to attach certain schedules, additional documents, or make payments if required.

It is highly recommended to consult with a tax professional or utilize tax software specifically designed for nonprofit organizations to ensure accuracy and compliance with IRS regulations.

What is the purpose of irs form 990 ez?

The purpose of IRS Form 990-EZ is to gather financial and operational information about tax-exempt organizations in the United States. It is specifically designed for small to medium-sized organizations with gross receipts less than $200,000 and total assets less than $500,000. Form 990-EZ serves as a simplified version of the full Form 990 and provides the Internal Revenue Service (IRS) with an overview of an organization's activities, governance structure, and financial details. It helps the IRS monitor compliance with tax laws and regulations and ensures transparency for donors, stakeholders, and the public.

What information must be reported on irs form 990 ez?

The IRS Form 990-EZ is used by tax-exempt organizations to provide information about their financial activities and to comply with the reporting requirements of the Internal Revenue Service (IRS). Some of the main information that must be reported on Form 990-EZ includes:

1. Basic organizational information: This includes the name, address, and Employer Identification Number (EIN) of the organization.

2. Overview of the organization's activities: This section requires information about the organization's mission, programs, and accomplishments during the tax year.

3. Revenue and expenses: The Form 990-EZ requests details about the organization's revenue sources, such as contributions, grants, program service revenue, investment income, and other sources. It also asks for details about various types of expenses, including program services, management and general expenses, and fundraising costs.

4. Balance sheet information: This section requires the organization to disclose its assets, liabilities, and net assets at the beginning and end of the tax year.

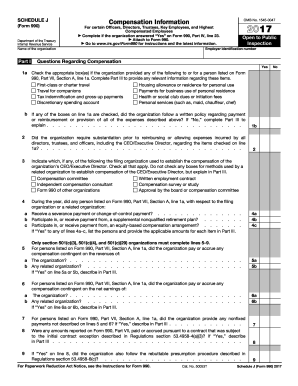

5. Compensation of officers, directors, trustees, and key employees: Nonprofit organizations must report the compensation and other benefits provided to their key individuals, including top officers and highest-paid employees.

6. Other required information: The Form 990-EZ asks for additional details like foreign financial accounts, compliance with certain tax laws, public support and activities, and certain transactions with interested persons, among others.

It is important to note that the information required on Form 990-EZ may vary based on the specific circumstances and activities of each organization. Nonprofits are advised to consult the official IRS instructions for the most accurate and up-to-date guidance.

When is the deadline to file irs form 990 ez in 2023?

The deadline to file IRS Form 990-EZ (Short Form Return of Organization Exempt from Income Tax) for the tax year 2022 (not 2023) is May 15, 2023. However, please note that the deadline may vary if this date falls on a weekend or a federal holiday, in which case it would be moved to the next business day.

What is the penalty for the late filing of irs form 990 ez?

The penalty for late filing of IRS Form 990-EZ (Short Form Return of Organization Exempt From Income Tax) is calculated based on the organization's gross receipts. For organizations with gross receipts less than $1,070,000, the penalty is $20 per day, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less. For organizations with gross receipts over $1,070,000, the penalty is $105 per day, up to a maximum of $53,000.

It's important to note that the penalty can be reduced or waived if the organization can show reasonable cause for the late filing.

How can I manage my irs form 2016 990 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your irs form 2016 990 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send irs form 2016 990 to be eSigned by others?

When you're ready to share your irs form 2016 990, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete irs form 2016 990 on an Android device?

Use the pdfFiller Android app to finish your irs form 2016 990 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.