Get the free california anti money laundering form

Show details

I.ANTIMONY LAUNDERING POLICY Statement Companies Commitment to AML Compliance Hickman Financial & Insurance Services, Inc. and its associates are committed to ensuring full compliance by the Company

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your california anti money laundering form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california anti money laundering form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california anti money laundering online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit company affiliate form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out california anti money laundering

How to fill out California Anti Money Laundering:

01

Start by familiarizing yourself with the California Anti Money Laundering Act and its requirements. This can be done by reviewing the legislation and any accompanying guidance provided by the relevant authorities.

02

Identify if your business or profession is subject to the California Anti Money Laundering Act. Certain industries, such as financial institutions, money services businesses, and real estate professionals, are typically required to comply with these regulations.

03

Gather all the necessary information and documentation required to complete the California Anti Money Laundering report. This may include details about your business, customer identification information, transaction records, and suspicious activity reporting.

04

Follow the guidelines and instructions provided by the appropriate authority, such as the California Department of Business Oversight or the Financial Crimes Enforcement Network (FinCEN), to accurately complete the report.

05

Ensure the filled-out report is submitted within the specified deadline and according to the designated method. This may involve electronic filing or manual submission, depending on the requirements.

06

Periodically review and update your anti-money laundering policies and procedures to stay compliant with any changes in the California Anti Money Laundering Act. This may include conducting ongoing training for employees and implementing internal controls to prevent money laundering activities.

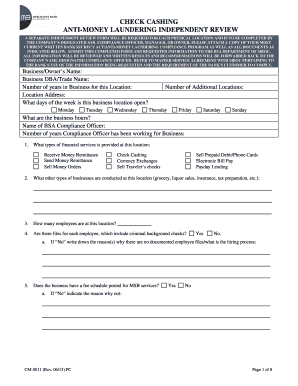

Who needs California Anti Money Laundering:

01

Financial Institutions: Banks, credit unions, and other financial entities that handle monetary transactions or provide financial services are typically required to comply with the California Anti Money Laundering Act.

02

Money Services Businesses: Entities which engage in activities such as money transmission, check cashing, foreign currency exchange, or issuing or redeeming money orders may need to adhere to the regulations.

03

Real Estate Professionals: Individuals or businesses involved in real estate transactions, including real estate agents, brokers, and escrow officers, are often required to comply with anti-money laundering regulations.

04

Casinos and Card Clubs: Establishments that engage in gambling activities and handle significant cash transactions are typically subject to anti-money laundering requirements.

05

Precious Metal Dealers and Jewelers: Businesses involved in buying or selling precious metals, stones, or high-value jewelry may be required to comply with the California Anti Money Laundering Act.

Note: The specific entities subject to the California Anti Money Laundering Act may vary, and it is essential to consult the legislation or relevant authorities for accurate information.

Fill form : Try Risk Free

People Also Ask about california anti money laundering

How do you carry out anti money laundering checks?

How long does it take to do anti money laundering checks?

What is an example of an anti money laundering policy statement?

What documents do I need for anti money laundering?

How do you pass anti money laundering checks?

What is the format of money laundering?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out california anti money laundering?

1. Fill out the California Department of Justice (DOJ) Form #A-44, which is available online.

2. Enter your name and contact information in the appropriate fields.

3. Read the instructions carefully and provide all the requested information.

4. Answer all questions honestly and accurately.

5. Sign and date the form.

6. Submit the form to the California DOJ.

What information must be reported on california anti money laundering?

Under California anti-money laundering laws, financial institutions are required to report any transaction over $10,000, suspicious activity, and any cash transactions over $10,000. Financial institutions are also required to perform rigorous customer due diligence, including collecting and verifying customer identification information. Furthermore, financial institutions must establish an anti-money laundering program that includes risk-based customer due diligence, record-keeping, and reporting requirements.

When is the deadline to file california anti money laundering in 2023?

The deadline to file California's annual anti-money laundering report is June 30th, 2023.

What is california anti money laundering?

The term "California Anti-Money Laundering" refers to the laws, regulations, and measures in place within the state of California to prevent and combat money laundering activities. Money laundering involves the process of making illegally obtained money appear legal by channeling it through legitimate financial systems and transactions.

California has its own set of laws to address money laundering, which align with federal anti-money laundering regulations. The main California legislation targeting money laundering is the California Money Transmitters Act (CMTA) and the California Anti-Money Laundering and Terrorism Financing Act (CAMLTA).

The CMTA regulates money transmitting businesses, ensuring they are licensed and adhering to strict anti-money laundering requirements. It also requires them to maintain records, report suspicious activities, and implement necessary measures to prevent money laundering within their operations.

The CAMLTA complements federal anti-money laundering laws and requires financial institutions and other specified businesses to establish and maintain anti-money laundering programs. It also imposes obligations to report and cooperate with law enforcement agencies, and provides guidelines for compliance and enforcement.

Overall, California's anti-money laundering laws aim to detect, prevent, and deter money laundering activities, ensuring the integrity of the state's financial systems and contributing to efforts in combating organized crime, terrorism financing, and other illicit activities.

Who is required to file california anti money laundering?

As of my knowledge, individuals and entities engaged in certain specified business activities are required to file a California Anti-Money Laundering (AML) Suspicious Activity Report (SAR). These include banks, financial institutions, casinos, money transmitters, virtual currency businesses, insurers, and various licensed professionals such as attorneys, accountants, and real estate agents. However, specific requirements may change over time, so it is advisable to consult the California Department of Business Oversight or a legal professional for the most up-to-date information.

What is the purpose of california anti money laundering?

The purpose of California's anti-money laundering (AML) laws is to prevent and combat the illegal activities related to money laundering within the state. Money laundering involves disguising the proceeds of illegal activities as legitimate funds, making it difficult for law enforcement agencies to trace the origin of the funds.

California's AML laws aim to identify and track suspicious financial transactions to ensure compliance with state regulations, deter criminals from using the financial system for illicit purposes, and protect the integrity of the state's economy. The laws require financial institutions, such as banks and money service businesses, to implement robust compliance programs, report suspicious transactions, and cooperate with law enforcement agencies to detect, prevent, and deter money laundering activities. The goal is to safeguard the financial system against the risks associated with money laundering, terrorist financing, and organized crime.

How can I edit california anti money laundering from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your company affiliate form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send aml policy to be eSigned by others?

Once your aml policy is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out california anti money laundering on an Android device?

Use the pdfFiller Android app to finish your company affiliate form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your california anti money laundering online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aml Policy is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.