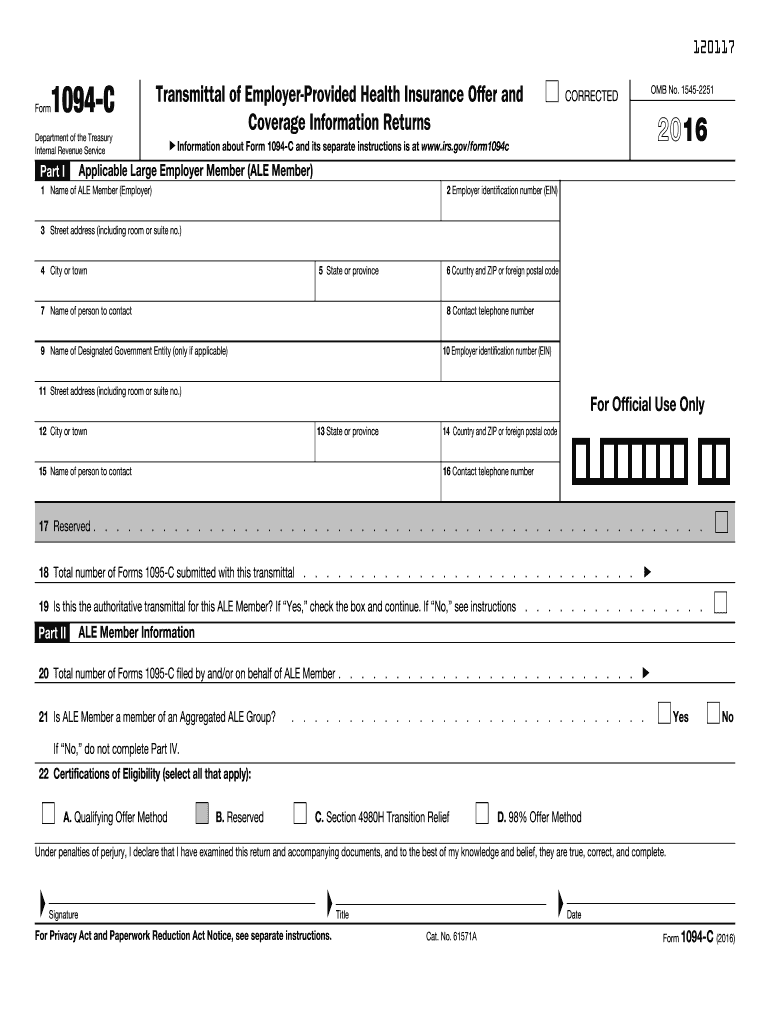

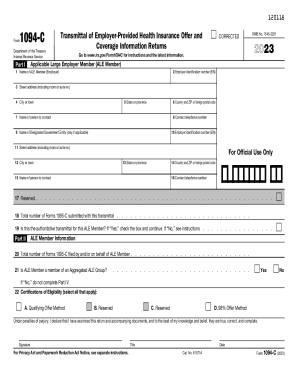

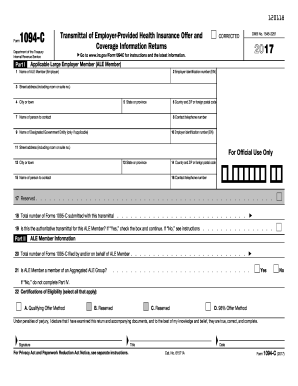

What is 1094 С?

The form's official title is Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns. This document is transmittal and acts as a cover sheet for 1095-C.

Who should file 1094 C 2016?

1094-C is the form for large employers (with 50 and more employees) that must offer healthcare coverage to their employees according to the Affordable Care Act.

What information do you need to file the 1094-C Form?

The template requests information about the Applicable Large Employer Member (name, EIN, address, and a contact person), the number of employees, and how many 1095-Cs are attached to this record.

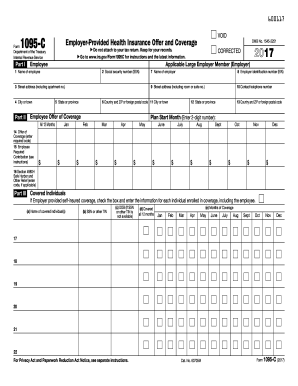

How do I fill out Form 1094 C in 2017?

In 2017, it is easiest to fill out the template online with pdfFiller:

- Click Get Form.

- Select the first fillable field and insert your information.

- Enable the Wizard mode to see tips for filling out the document.

- Navigate between fields using Tab or Enter.

- Place your signature at the bottom of the second page using the Sign tool.

- Add a date using the appropriate tool from the top toolbar.

- Select Done to save the document.

- Export your filled-out record in your preferred way.

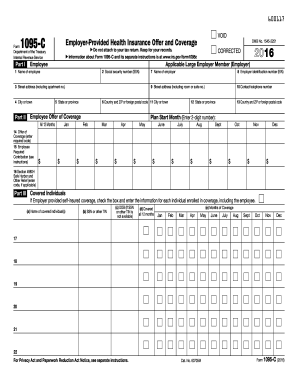

Is the 1094-C Form accompanied by other forms?

1094-C must be submitted to the Internal Revenue Service with 1095-C forms.

When is the 1094-C due?

Federal law requires large employers to file 1095Cs by January 31. Since they have 1094 C as a cover sheet, the deadline for filing this document is the same.

Where do I send 1094 C?

Employers are not required to send this form to employees (as is necessary with form 1095 C). Form 1094 C is sent only to the Internal Revenue Service.