Who needs Form 1040-V?

Basically the 1040 type Forms are federal income tax Forms applied by each taxpayer. They are used for filing income tax returns for the defined tax year. With no dependency on what kind of basic 1040 Form is used, a taxpayer may turn to account additional 1040-V Form for speeding up the processing of the payment.

What is Form 1040-V Used for?

Form 1040-V is an optional form that is used for making processing of the payment more accurate and efficient.

Is Form 1040-V Accompanied by Other Forms?

The Taxpayer should append Form 1040-V to one of the next Forms:

- Form 1040

- Form 1040-A

- Form 1040-EZ

While filing Form 1040-V taxpayer has to add a check or money order.

When is Form 1040-V due?

As far as Form 1040-V is an optional form that exists for making processing payment more accurate and efficient, it is filed once a tax year on or before the Tax Day (April 18th for tax year 2017) with one of 1040 Forms listed earlier.

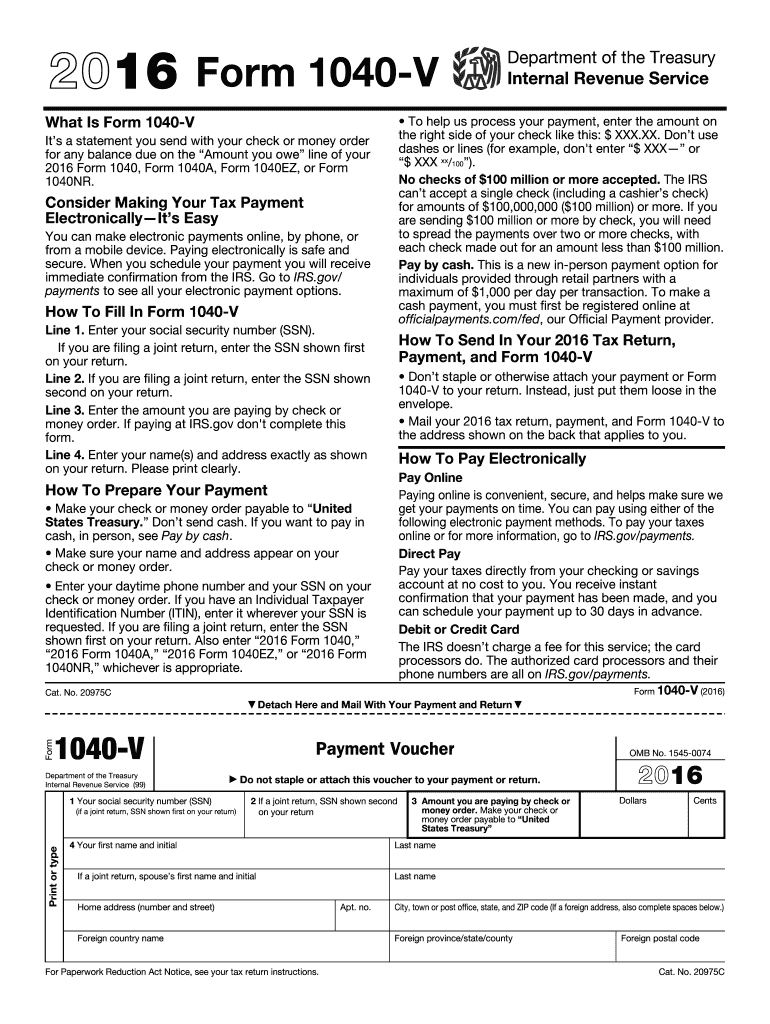

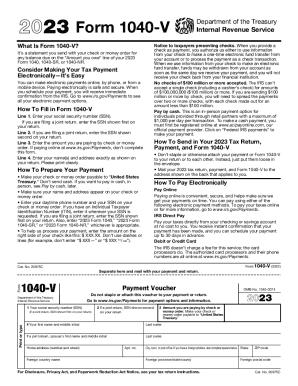

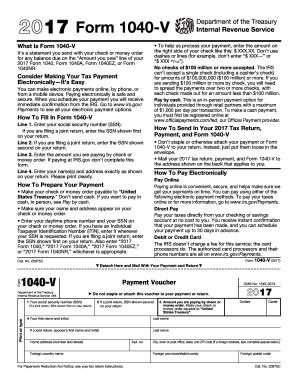

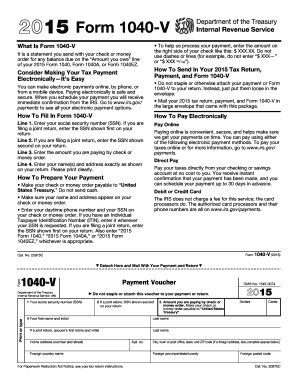

What Information Should I Provide in Form 1040-V ?

While filling in the 1040-V Form you shall input the following data:

- Social Security Number

- The amount paid by check or money order

- Name

- Home address

- Daytime phone Number

- Name and address as it is shown on the 2nd page of the Form 1040-V

Where do I send Form 1040-V?

The address of the recipient depends on the State the taxpayer lives or is registered in. A Dependency scheme is shown on the 2nd page of the Voucher. Attention: there is a special address for foreign countries U.S. possessions or territories.