Get the free W-16073

Show details

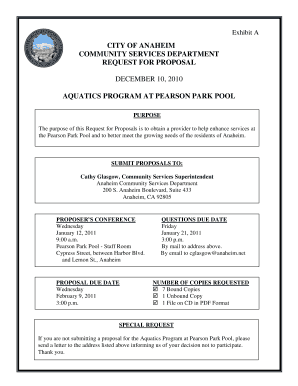

U.S. Department of Homeland Security Washington, D.C. 20472 W16073 October 10, 2016, MEMORANDUM FOR: Write Your Own (WYO) Company Principal Coordinators, WYO Vendors, National Flood Insurance Program

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w-16073 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-16073 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w-16073 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit w-16073. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out w-16073

How to fill out w-16073:

01

Start by carefully reading the instructions provided on the form. Make sure you understand all the information required to fill it out accurately.

02

Provide your full name, address, and social security number in the designated spaces on the form. This information is necessary for identification purposes.

03

Indicate the tax year for which you are filing the form. This helps the IRS process your information correctly.

04

Specify your filing status by checking the appropriate box. Options typically include single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

05

If applicable, provide the names and social security numbers of any dependents you are claiming. Dependents can include children or other individuals who rely on you for financial support.

06

Complete the income section of the form according to your specific circumstances. This may include reporting wages, salaries, tips, self-employment income, or income from investments.

07

Deduct any applicable expenses or adjustments to income, such as business expenses or contributions to retirement accounts. Follow the instructions provided to accurately calculate these amounts.

08

If you owe any taxes, indicate the payment method you will be using. This can include a check, money order, or electronic payment.

09

Sign and date the form at the bottom to certify the information provided is accurate to the best of your knowledge.

10

Keep a copy of the completed form for your records.

Who needs w-16073:

The w-16073 form is typically required by individuals who have received income from any source that is subject to backup withholding. This can occur when there is missing or incorrect taxpayer identification information on previous tax forms. The IRS may request the completion of the w-16073 form to update or verify the required information before processing any future payments or returns.

It is important to consult with a tax advisor or the IRS website to determine if you specifically require the w-16073 form based on your unique circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-16073 to be eSigned by others?

w-16073 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit w-16073 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your w-16073, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit w-16073 on an Android device?

You can make any changes to PDF files, like w-16073, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your w-16073 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.