CO DoR DR 1093 2016 free printable template

Show details

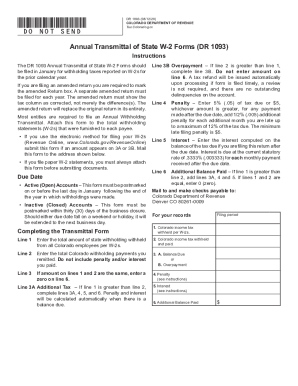

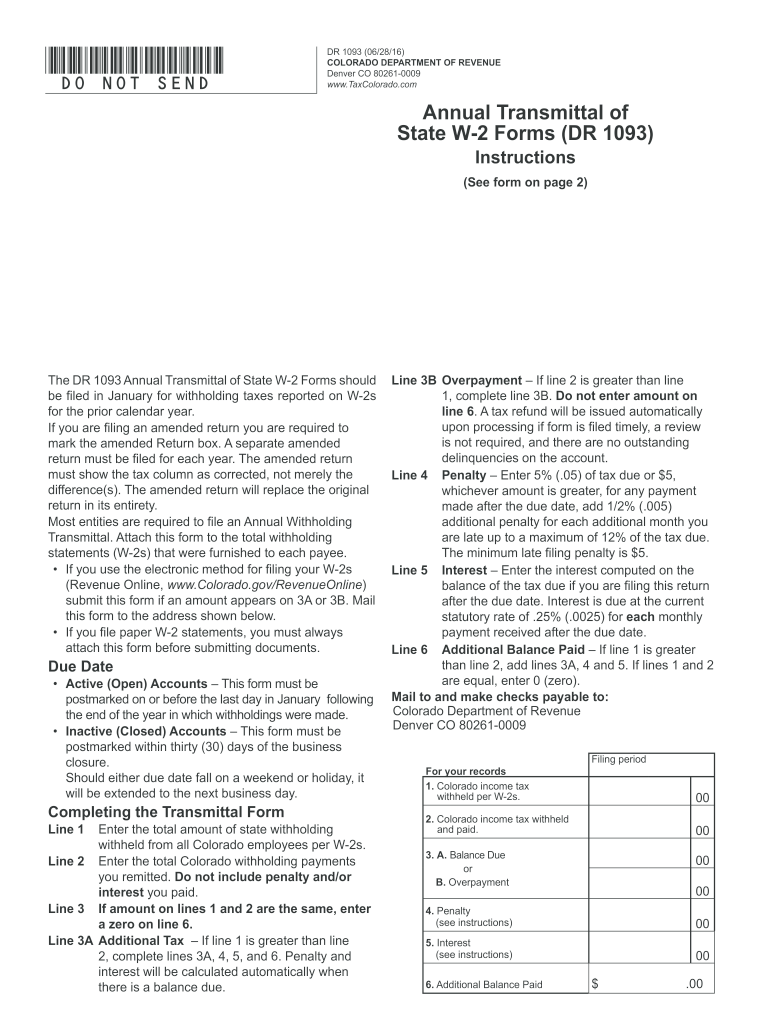

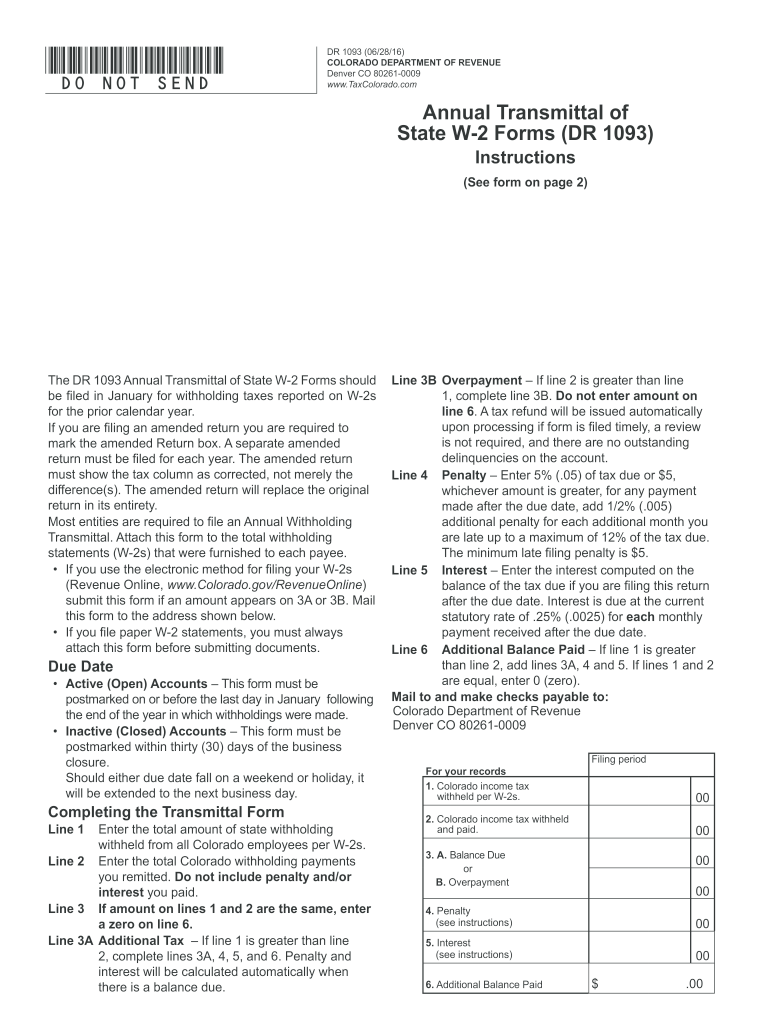

DO NOT SEND DR 1093 06/28/16 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0009 www. TaxColorado. com Annual Transmittal of State W-2 Forms DR 1093 Instructions See form on page 2 The DR 1093 Annual Transmittal of State W-2 Forms should be filed in January for withholding taxes reported on W-2s for the prior calendar year. If you are filing an amended return you are required to mark the amended Return box. A separate amended return must be filed for each year. The amended return must show...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your dr 1093 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 1093 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dr 1093 2016 form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dr 1093 2016 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

CO DoR DR 1093 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dr 1093 2016 form

How to fill out dr 1093 2016 form

01

Step 1: Start by gathering all the necessary information and documents required to fill out the DR 1093 2016 form. This may include your personal identification details, income information, and any other relevant supporting documents.

02

Step 2: Carefully read through the instructions provided with the form to understand the requirements and any specific guidelines for filling it out.

03

Step 3: Begin filling out the form by entering your personal details such as your name, address, and contact information in the designated fields.

04

Step 4: Provide accurate and complete information regarding your income, assets, and any deductions or credits you may be eligible for.

05

Step 5: Double-check all the information you have entered to ensure its accuracy and completeness.

06

Step 6: If required, attach any supporting documents or evidence requested by the form instructions.

07

Step 7: Review the completed form one final time to ensure all the information provided is accurate and legible.

08

Step 8: Sign and date the form in the designated spaces.

09

Step 9: Make a copy of the filled-out form for your own records.

10

Step 10: Submit the completed DR 1093 2016 form to the relevant authority as specified in the instructions.

Who needs dr 1093 2016 form?

01

Any individual or entity who is required to report their income, assets, and tax obligations to the relevant tax authority.

02

People who have earned income from various sources and need to file their tax returns in compliance with the regulations.

03

Those who have made deductions, credits, or any other adjustments to their income that are eligible for tax benefits or exemptions.

04

Individuals or businesses who are subject to tax audits or require documentation to support their financial and tax positions.

05

Anyone who wants to ensure compliance with tax laws and avoid penalties or legal issues related to inaccurate or incomplete reporting.

Instructions and Help about dr 1093 2016 form

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dr 1093 2016 form for eSignature?

dr 1093 2016 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute dr 1093 2016 form online?

pdfFiller has made it simple to fill out and eSign dr 1093 2016 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit dr 1093 2016 form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing dr 1093 2016 form right away.

Fill out your dr 1093 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.