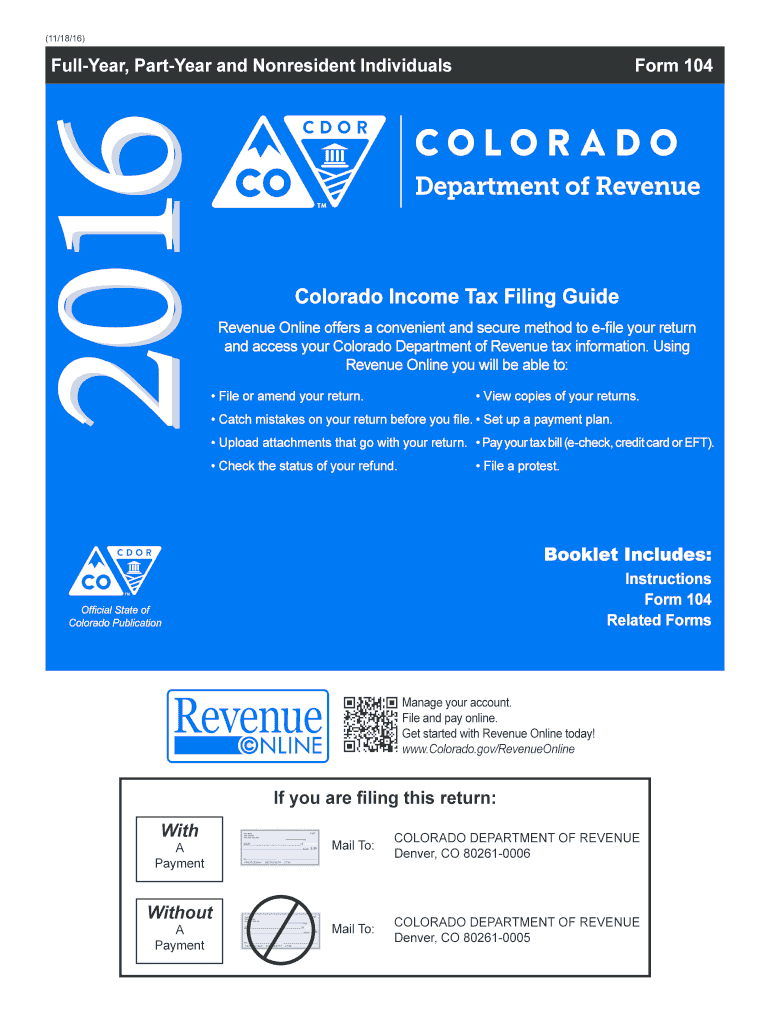

CO Income Tax Filing Guide 2016 free printable template

Instructions and Help about CO Income Tax Filing Guide

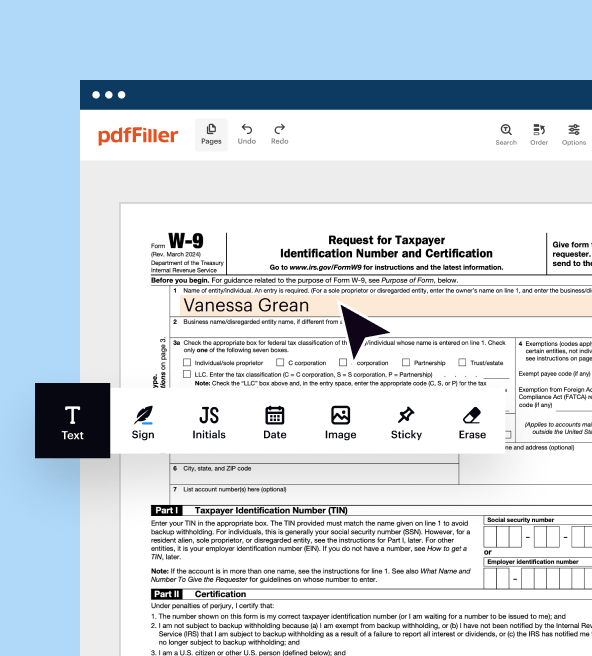

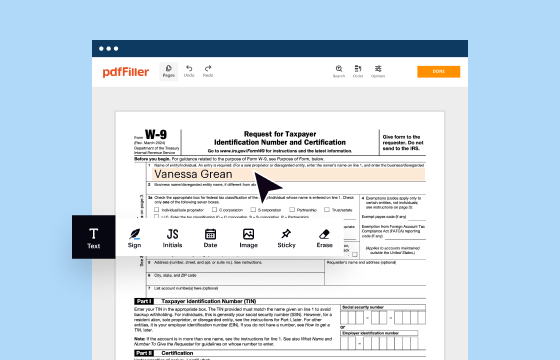

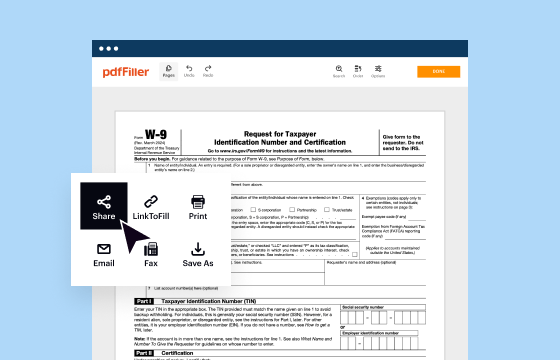

How to edit CO Income Tax Filing Guide

How to fill out CO Income Tax Filing Guide

About CO Income Tax Filing Guide 2016 previous version

What is CO Income Tax Filing Guide?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

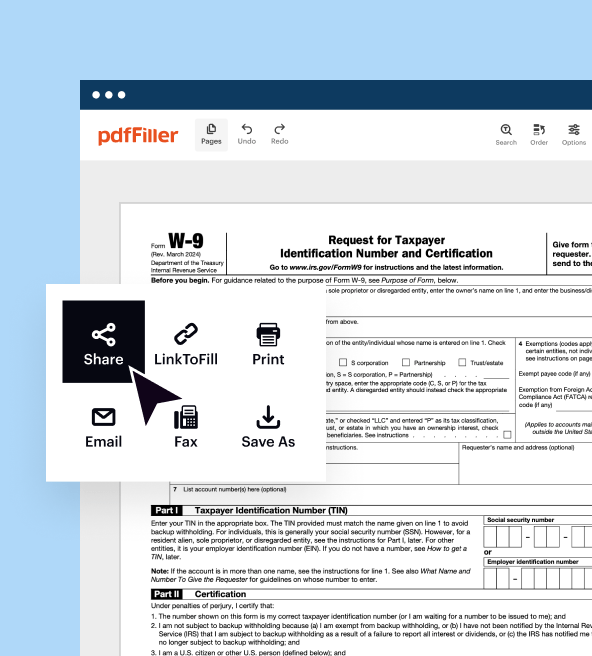

Where do I send the form?

FAQ about CO Income Tax Filing Guide

How can I correct mistakes on my colorado tax form 2016?

To correct any errors on your colorado tax form 2016, you will need to file an amended return using Form DR 0004. Be sure to clearly indicate that it is an amended form and provide a detailed explanation of the changes. Additionally, confirm that you are submitting it within the allowed timeframe for amendments to avoid potential penalties.

What should I do if I haven't received confirmation of my colorado tax form 2016 filing?

If you have not received confirmation after e-filing your colorado tax form 2016, you can verify the status through the Colorado Department of Revenue's online portal. It will display whether your form has been received and is being processed. Keep an eye out for any common e-file rejection codes which might require you to take further action on your filing.

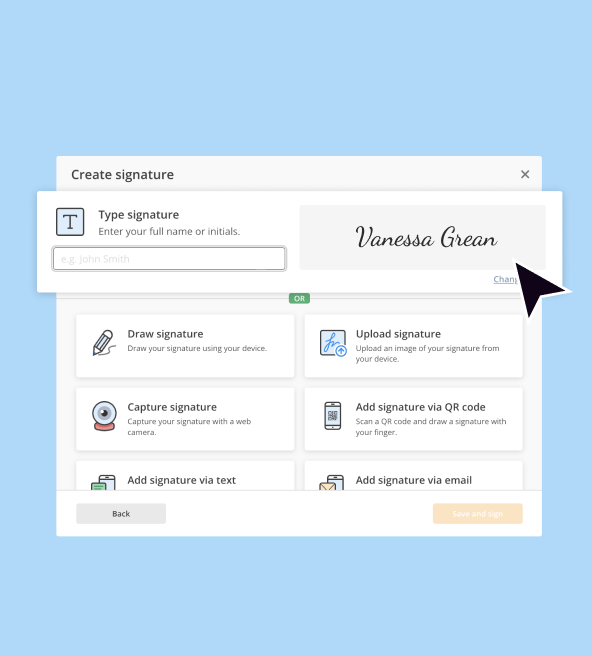

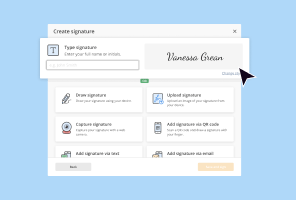

Are e-signatures acceptable when submitting a colorado tax form 2016?

Yes, e-signatures are acceptable for the colorado tax form 2016 when filed electronically. However, be sure to ensure that your e-signature meets the requirements set by the Colorado Department of Revenue. Retain all records of your submission for your personal files to maintain privacy and data security.

What should I do if I receive an audit notice after filing my colorado tax form 2016?

If you receive an audit notice regarding your colorado tax form 2016, carefully read the notice to understand what documentation is required and the specific areas under review. Prepare to gather all relevant documents, and consider consulting with a tax professional who can assist you with the audit process and help ensure you respond appropriately.