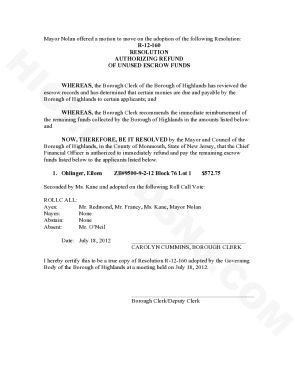

Get the free Custom Accounting & Tax

Show details

Custom Accounting Service Inc is a trusted Roseville accountant offering accounting services, bookkeeping, tax preparation, tax planning, QuickBookstraining, and incorporation for businesses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign custom accounting amp tax

Edit your custom accounting amp tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your custom accounting amp tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit custom accounting amp tax online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit custom accounting amp tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

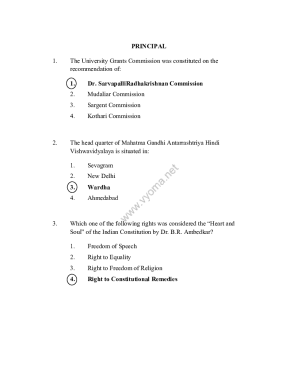

How to fill out custom accounting amp tax

How to fill out custom accounting amp tax

01

First, gather all the necessary financial documents such as income statements, balance sheets, and tax forms.

02

Next, analyze and categorize all the financial transactions according to the accounting principles.

03

Prepare the necessary accounting forms, including the general ledger, trial balance, and financial statements.

04

Ensure accurate bookkeeping by recording all financial transactions, including income, expenses, assets, and liabilities.

05

Perform regular reconciliations to ensure the accuracy of the financial records.

06

Evaluate the financial data and prepare tax returns, adhering to the applicable tax laws and regulations.

07

Submit the tax returns to the relevant tax authorities within the designated deadlines.

08

Keep updated with the latest changes in tax laws and regulations to ensure compliance.

09

Regularly review the financial records and reports to identify any discrepancies or errors and take corrective actions.

10

Maintain proper documentation of all financial transactions and records for future reference and audit purposes.

Who needs custom accounting amp tax?

01

Businesses of all sizes and types require custom accounting and tax services.

02

Entrepreneurs and self-employed individuals who need assistance with managing their financial records and tax obligations.

03

Startups and small businesses that lack the resources or expertise to handle complex accounting tasks and tax compliance.

04

Organizations operating in industries with intricate tax regulations and reporting requirements.

05

Individuals and businesses facing audits or investigations by tax authorities.

06

Companies expanding globally and dealing with international tax regulations and cross-border transactions.

07

Business owners who want to optimize tax planning and minimize tax liabilities.

08

Non-profit organizations that need accurate and transparent accounting records for compliance and reporting purposes.

09

Investors and stakeholders who require reliable financial information for decision-making and evaluation of business performance.

10

Individuals or businesses seeking professional advice to ensure adherence to tax laws and regulations and avoid penalties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find custom accounting amp tax?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the custom accounting amp tax. Open it immediately and start altering it with sophisticated capabilities.

How do I edit custom accounting amp tax online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your custom accounting amp tax to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the custom accounting amp tax electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your custom accounting amp tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Custom Accounting Amp Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.