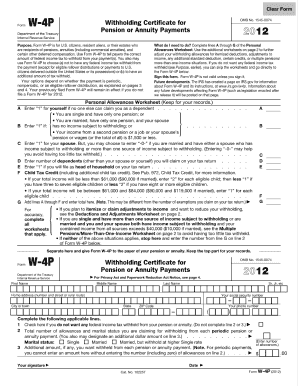

IL DoR IL-1120-ST 2016 free printable template

Show details

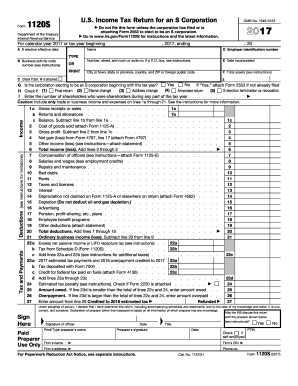

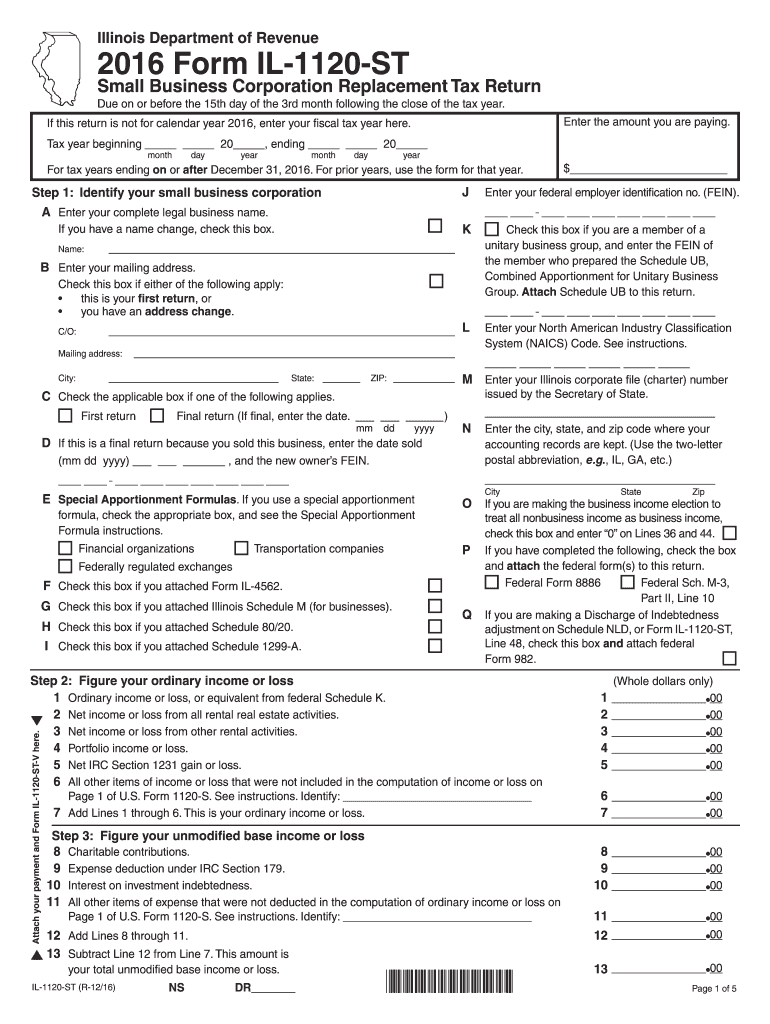

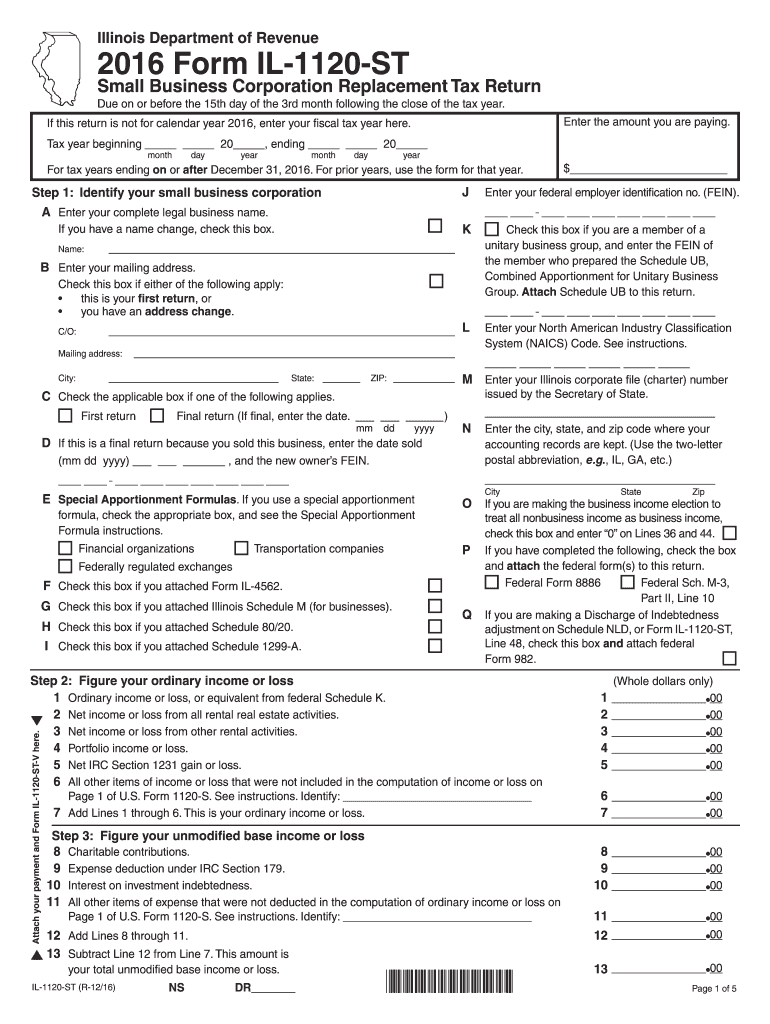

Year ending Month Year IL Attachment no. 1 Enter your name as shown on your Form IL-1065 or Form IL-1120-ST. 163080001 2016 Schedule B Partners or Shareholders Information Attach to your Form IL-1065 or Form IL-1120-ST. Attach your payment and Form IL-1120-ST-V here. Page 1 of U.S. Form 1120-S. See instructions. Identify 7 Add Lines 1 through 6. Enter the total here and on Form IL-1065 Line 59 or Form IL-1120-ST Line 58. See instructions. Attach all pages of Schedule B Section B behind this...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form il 1120 st form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form il 1120 st form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form il 1120 st online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit illinois form il 1120 st. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

IL DoR IL-1120-ST Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form il 1120 st

How to fill out form IL 1120 ST:

01

Gather all necessary information such as the company's name, address, and federal employer identification number (EIN).

02

Ensure that you have all the required supporting documents, including financial statements, schedules, and any other relevant attachments.

03

Start by providing the basic information of the company in Section A of the form, including the tax year and the type of return being filed.

04

Fill out Schedule I, Part 1, which includes information about the company's gross income, deductions, and credits.

05

Proceed to Schedule I, Part 2, where you will report any taxes and payments made by the company throughout the tax year.

06

Complete Schedule J, which requires you to disclose information about certain types of income and expenses.

07

Move on to Schedule K, where you will outline the company's income that is apportionable to Illinois and calculate the Illinois apportionment factor.

08

If applicable, fill out Schedule K-1, which is used to report income, deductions, and credits for each individual shareholder or partner.

09

Finally, review all the information provided, make sure everything is accurate and complete, and sign the form before submitting it to the appropriate tax authority.

Who needs form IL 1120 ST:

01

Corporations that are subject to the Illinois Income Tax Act and have income from multiple states or unitary activity may need to file form IL 1120 ST.

02

Companies that meet the filing requirements outlined by the Illinois Department of Revenue may also be required to submit form IL 1120 ST.

03

Non-corporate entities such as partnerships, S corporations, or limited liability companies (LLCs) may need to file form IL 1120 ST if they have income from unitary business activity or specific federal tax classifications.

Note: It is always recommended to consult with a tax professional or visit the official website of the Illinois Department of Revenue for the most up-to-date and accurate information regarding the filing requirements for form IL 1120 ST.

Fill form : Try Risk Free

People Also Ask about form il 1120 st

Who is subject to Il franchise tax?

Can I file form 1120 by myself?

Who must file an IL-1120 ST?

Do I have to file an Illinois corporate tax return?

What type of company files an 1120-s?

Who must file Illinois corporate income tax return?

Can you pay form 1120 online?

Who must file Form IL 1120?

Can I file my Illinois taxes online?

Who is required to file an 1120?

Can I file IL-1120 ST online?

What is a 1120 tax form used for?

What is a IL-1120-ST form?

Who must file an Illinois corporate tax return?

Who must file an S corp return?

Who must file an IL-1120-ST?

What is a IL-1120 ST form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out form il 1120 st?

To fill out Form IL-1120-ST, also known as the Illinois Small Business Corporation Replacement Tax Return, you can follow the steps below:

1. Provide general information:

- Enter the ending period of your tax year in the space provided.

- Provide the filer name, business name, address, federal employer identification number (FEIN), and Illinois Secretary of State file number.

- Indicate if your business has ceased operations during the tax year.

2. Complete Part 1 - Income:

- Provide details of your business income, including sales or services, rents, interest, dividends, gains, etc. Complete all applicable lines and attach supporting schedules if necessary.

- Report any required adjustments or modifications to your federal taxable income as per Illinois guidelines.

3. Complete Part 2 - Net Loss Deduction:

- If your business incurred a net loss during the tax year, complete this section to calculate the net loss deduction allowed for Illinois purposes.

4. Complete Part 3 - Deductions:

- Report deductions for expenses related to your business operations, such as salaries, wages, repairs, taxes, insurance, etc. Provide details on all applicable lines and attach supporting documentation if needed.

5. Complete Part 4 - Credits:

- Report any tax credits that apply to your business, such as Economic Development, Research and Development, or other available credits. Provide details as required.

6. Complete Part 5 - Nonbusiness Income:

- If your business had any nonbusiness income during the tax year, report it on this section. This may include gains from the sale of nonbusiness assets, rents, interest, royalties, etc.

7. Complete Part 6 - Tax Computation:

- Calculate your total Illinois business income tax using the tax rates provided in the instructions, based on the amount of net income reported.

8. Complete Part 7 - Replacement Tax and Payment:

- Calculate the replacement tax liability based on your business income or the alternative replacement tax base amount if applicable. Enter the total tax liability and any payments made during the tax year. Determine if you have an overpayment or balance due.

9. Complete Part 8 - Extension Payments and Payments Made:

- If you made any extension payments or estimated payments during the tax year, report those amounts in this section.

10. Complete Part 9 - Illinois Estimated Tax Payments:

- Report your estimated tax payments made throughout the tax year.

11. Complete Part 10 - Income Tax Paid to Other States:

- If you conducted business in other states or paid income taxes to other states, you may be eligible for a credit. Report this information in this section.

12. Complete Part 11 - Distributive Shares, Loss and Deductions:

- If the business is an S-Corporation, complete this section to report the distributive shares, losses, and deductions for each shareholder.

13. Complete Part 12 - Pass-Through Withholding Payments:

- If your business made any pass-through withholding payments, report those amounts in this section.

14. Complete Part 13 - Owner's Benefits Addback:

- Report any owner's benefits addback amounts as required.

15. Sign and date the form:

- Ensure the form is signed and dated by an authorized person.

Remember to thoroughly review the instructions for Form IL-1120-ST to understand specific reporting requirements, signatures, payment procedures, and any additional schedules or attachments that may be necessary based on your business activities.

What is form il 1120 st?

Form IL-1120-ST is the Illinois Department of Revenue's tax form for S Corporations that conduct business in the state of Illinois. S Corporations are entities that elect to pass corporate income, losses, deductions, and credits through their shareholders for federal tax purposes. This form is used to report the S Corporation's income, deductions, credits, and other information, and calculate the tax liability owed to the state of Illinois.

Who is required to file form il 1120 st?

In Illinois, corporations and S corporations are required to file Form IL-1120-ST, also known as the Illinois Small Business Corporation Replacement Tax Return. This form is used to report income, deductions, and tax liability for state purposes. It is important to note that other entities such as partnerships, limited liability companies (LLCs), and sole proprietorships are not required to file this form.

What is the purpose of form il 1120 st?

The Form IL-1120-ST, also known as the Illinois Small Business Corporation Replacement Tax Return, is used by certain small business corporations to report their income, deductions, and tax liability to the state of Illinois. This return is required for small business corporations that are subject to the Illinois Replacement Tax. The purpose of the form is to calculate and report the correct amount of tax owed by these corporations and to comply with the tax laws of the state.

What information must be reported on form il 1120 st?

Form IL-1120-ST, also known as the Illinois Small Business Corporation Replacement Tax Return, is used by small business corporations to report their income, deductions, credits, and calculate the Illinois Small Business Corporation Replacement Tax. The specific information that must be reported on this form includes:

1. Business information: This includes the business's legal name, address, federal employer identification number (EIN), date of incorporation, and the applicable tax year.

2. Income: Report all business income, including gross receipts, sales, rental income, interest, dividends, and any other income generated by the business during the tax year.

3. Deductions: List all allowable deductions, including expenses directly related to the business operation such as wages and salaries, rent, utilities, insurance, advertising, and other ordinary and necessary expenses.

4. Apportionment: If the business operates in multiple states, determine the Illinois apportionment ratio to accurately report the portion of income taxable in Illinois.

5. Credits: Report any tax credits that apply to the business, such as the Illinois Angel Investment Credit or the Infrastructure Maintenance Fee Credit.

6. Tax Calculation: Calculate the Illinois Small Business Corporation Replacement Tax based on the business's net income and apply the appropriate tax rate.

7. Income Tax Prepayment Credits: Report any income tax prepayment credits claimed on Form IL-1120-ST-T (Illinois Small Business Corporation Replacement Tax Payment Voucher).

8. Quarterly Installments: If the business is required to make estimated tax payments, provide information about the estimated payments made throughout the year.

9. Illinois Foreign Operating Corporation (FOC): If the business is a foreign operating corporation, complete Schedule FOC-A, FOC-B, and FOC-C to report additional information related to foreign operations.

10. Signature: The return must be signed by an authorized officer of the corporation, indicating that the information provided is true and accurate.

Additionally, any supporting schedules, attachments, or forms required to substantiate the reported information should be included with the IL-1120-ST.

What is the penalty for the late filing of form il 1120 st?

The penalty for the late filing of Form IL-1120-ST (Illinois Income and Replacement Tax Return for Small Businesses) is as follows:

- For returns filed within 30 days after the due date: A penalty equal to 2% of the tax due per month or fraction thereof, up to a maximum of 18%.

- For returns filed more than 30 days after the due date: A penalty equal to 10% of the tax due or $100, whichever is greater, plus 2% of the tax due per month or fraction thereof, up to a maximum of 18%.

It's important to note that penalties may vary depending on specific circumstances and the discretion of the Illinois Department of Revenue.

How do I edit form il 1120 st straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing illinois form il 1120 st.

How can I fill out 2014 il 1120 st on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your il 1120 st from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit st 1 il form on an Android device?

You can make any changes to PDF files, such as form il 1120 st, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your form il 1120 st online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Il 1120 St is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.