Get the free Corporate Tax Foundation - corptaxfoundation

Show details

3219 E. Camelback Rd. #379 Phoenix, AZ 85018 602.512.0355 Scholarship Application Instructions and Checklist Corporate Tax Foundation is pleased to offer scholarships for students to attend selected

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your corporate tax foundation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate tax foundation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate tax foundation online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate tax foundation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

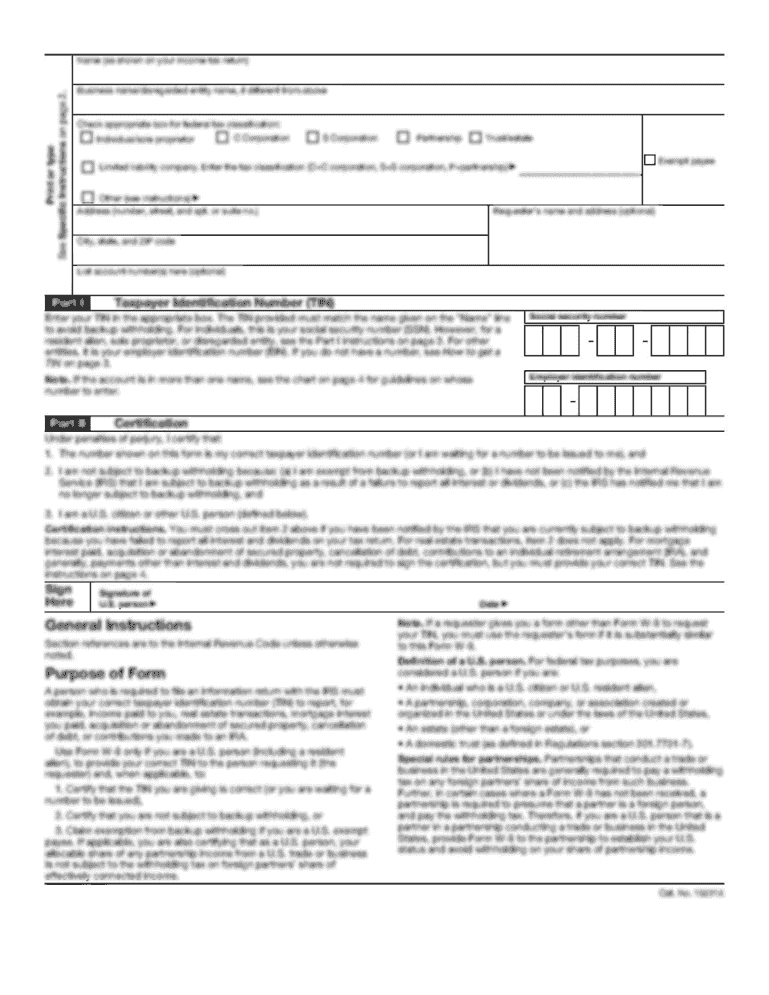

How to fill out corporate tax foundation

How to fill out corporate tax foundation

01

Gather all the necessary financial documents and records related to your corporation's income and expenses.

02

Determine the applicable tax forms you need to fill out for your corporation's tax return.

03

Fill out the required identification information such as your corporation's name, address, and employer identification number.

04

Provide accurate details of your corporation's income sources and expenses, including any deductions or credits you may be eligible for.

05

Calculate your corporation's taxable income using the appropriate tax rates and rules.

06

Complete the necessary schedules or additional forms as required by the tax authority.

07

Review the completed tax form for any errors or omissions.

08

File the corporate tax return electronically or by mail, along with any required payment or refund request.

09

Keep a copy of the filed tax return and all supporting documents for future reference and audit purposes.

Who needs corporate tax foundation?

01

Corporations registered as legal entities in a specific jurisdiction are generally required to file a corporate tax return.

02

Businesses with a separate legal structure from their owners, such as C-Corporations or S-Corporations, typically need to fill out corporate tax forms.

03

Companies that generate income from their operations or investments are obligated to report their financial activities and pay taxes accordingly.

04

Entrepreneurs and business owners who want to comply with the tax laws and regulations of their country or state.

05

Any corporation that meets the minimum income threshold set by the tax authority for filing corporate tax returns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the corporate tax foundation in Gmail?

Create your eSignature using pdfFiller and then eSign your corporate tax foundation immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit corporate tax foundation on an iOS device?

Create, edit, and share corporate tax foundation from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete corporate tax foundation on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your corporate tax foundation. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your corporate tax foundation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.