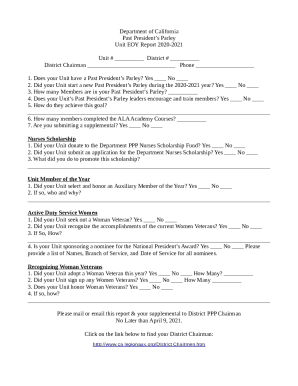

Get the free Instructions for Schedule D (565) Instructions for Form FTB 3885P

Show details

Instructions for Schedule D (565) Capital Gain or Loss General Information In general, California law conforms to the Internal Revenue Code (IRC) as of January 2005. However, there are continuing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your instructions for schedule d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for schedule d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing instructions for schedule d online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit instructions for schedule d. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out instructions for schedule d

How to fill out instructions for schedule d

01

Start by gathering all the necessary information, such as your investment income and capital gains or losses.

02

Use the correct form for Schedule D, which can be found on the IRS website.

03

Fill in your personal information, including your name, social security number, and filing status.

04

Report each investment transaction separately, including the date of sale or purchase, the cost basis, and the sales price.

05

Calculate your capital gain or loss for each transaction by subtracting the cost basis from the sales price.

06

If you have multiple transactions, list them all on Part I of Schedule D.

07

Total your gains and losses and transfer the amounts to the appropriate lines on your tax return.

08

If you have any adjustments or special circumstances, follow the instructions provided by the IRS.

09

Review your completed Schedule D for accuracy before submitting it with your tax return.

10

Keep a copy of your Schedule D for your records in case of an audit or future reference.

Who needs instructions for schedule d?

01

Individuals who have sold or disposed of capital assets, such as stocks, bonds, or real estate.

02

Taxpayers who have capital gains or losses from investment activities.

03

Traders or investors who buy and sell securities frequently.

04

Business owners who have sold business assets.

05

Anyone who has received a Form 1099-B or a statement showing proceeds from the sale of securities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my instructions for schedule d directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your instructions for schedule d as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I edit instructions for schedule d on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign instructions for schedule d right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit instructions for schedule d on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute instructions for schedule d from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your instructions for schedule d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.