CA CDTFA-501-WG (formerly BOE-501-WG) 2011 free printable template

Show details

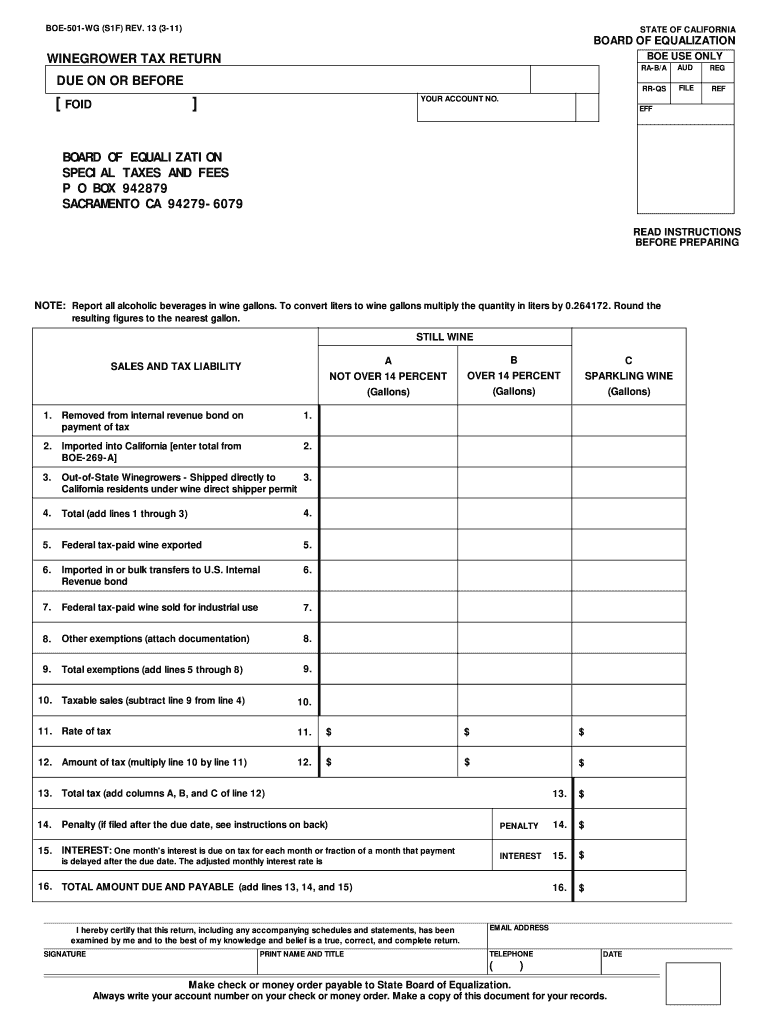

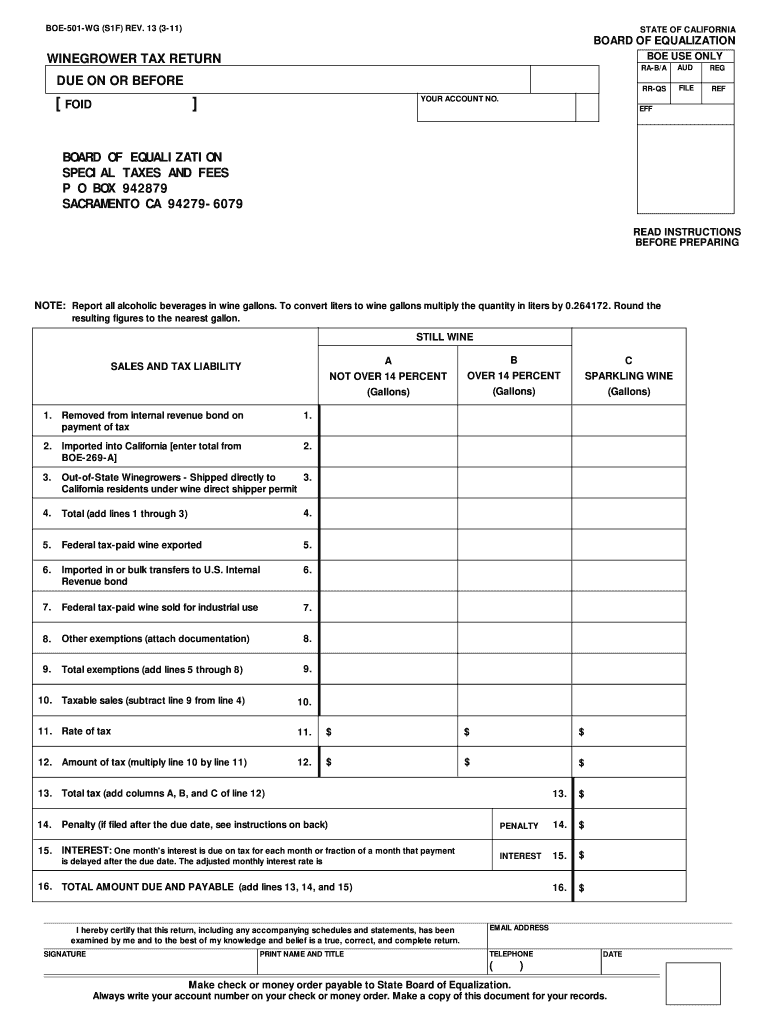

BOE501WG (S1F) REV. 13 (311) STATE OF CALIFORNIA BOARD OF EQUALIZATION BOE USE ONLY WINEGROWER TAX RETURN RAB/A FOOD AUD REG RRQ DUE ON OR BEFORE FILE REF YOUR ACCOUNT NO. EFF BOARD OF EQUALIZATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-501-WG formerly BOE-501-WG

Edit your CA CDTFA-501-WG formerly BOE-501-WG form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-501-WG formerly BOE-501-WG form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-501-WG formerly BOE-501-WG online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA CDTFA-501-WG formerly BOE-501-WG. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-501-WG (formerly BOE-501-WG) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-501-WG formerly BOE-501-WG

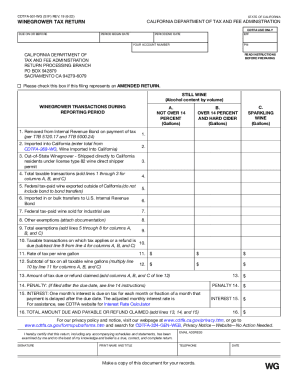

How to fill out CA CDTFA-501-WG (formerly BOE-501-WG)

01

Obtain the CA CDTFA-501-WG form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Provide your business name and contact information in the designated fields.

03

Enter your CDTFA account number, if applicable.

04

Specify the type of business activity you are reporting.

05

List all the transactions and amounts that are subject to the use tax.

06

Calculate the total use tax owed by adding the amounts together.

07

Provide any additional required information, such as your signature and date.

08

Review the completed form for accuracy before submission.

09

Submit the form to the CDTFA via mail or online, depending on your preference.

Who needs CA CDTFA-501-WG (formerly BOE-501-WG)?

01

Businesses that make purchases or use property subject to use tax in California.

02

Individuals or entities that are required to report and pay use tax for goods or services received within California.

Fill

form

: Try Risk Free

People Also Ask about

What is current California sales tax?

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

Are wine tasting fees taxable in California?

Wine Tasting and Self-Consumption If you charge a fee for wine tasting, you are considered a retailer of wine and sales tax applies to the wine tasting charges. If you also sell food during wine tastings, such as cheese, crackers, and smoked salmon, tax also applies to these sales.

What is the sales tax on wine in California?

California Wine Tax - $0.20 / gallon ✔ California's general sales tax of 6% also applies to the purchase of wine. In California, wine vendors are responsible for paying a state excise tax of $0.20 per gallon, plus Federal excise taxes, for all wine sold.

Who is subject to CA environmental fee?

Banks and insurance companies must pay the Environmental Fee for wholly owned corporations not engaged in banking or insurance (California Constitution, Article XIII, sections 27 and 28; and R&TC section 23182).

How much is the CA environmental fee?

Effective January 1, 2022 (22-23 fiscal year) the Environmental Fee rates are: fewer than 100 employees: $0. 100 to 249 employees: $1,261. 250 to 499 employees: $2,706.

What is California alcohol tax?

California ranks among the lowest states in taxing distilled spirits (whiskey, vodka, tequila, etc.), wine and beer. For instance, our distilled spirits tax rate, $3.30 a gallon, stands in sharp contrast to other states, including Washington at $32.52 and Oregon at $21.98.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CA CDTFA-501-WG formerly BOE-501-WG?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific CA CDTFA-501-WG formerly BOE-501-WG and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my CA CDTFA-501-WG formerly BOE-501-WG in Gmail?

Create your eSignature using pdfFiller and then eSign your CA CDTFA-501-WG formerly BOE-501-WG immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out CA CDTFA-501-WG formerly BOE-501-WG on an Android device?

Complete your CA CDTFA-501-WG formerly BOE-501-WG and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CA CDTFA-501-WG (formerly BOE-501-WG)?

CA CDTFA-501-WG, formerly known as BOE-501-WG, is a form used by the California Department of Tax and Fee Administration (CDTFA) for reporting certain types of tax-related information. It is specifically used to report information related to a seller's use tax liability.

Who is required to file CA CDTFA-501-WG (formerly BOE-501-WG)?

Individuals and businesses that are required to report and pay use tax on items purchased for use in California but were not taxed at the time of purchase must file CA CDTFA-501-WG.

How to fill out CA CDTFA-501-WG (formerly BOE-501-WG)?

To fill out CA CDTFA-501-WG, you need to provide your account information, report the total amount of purchases subject to use tax, calculate the use tax due, and provide any necessary details about the transactions or items purchased. Follow the instructions on the form carefully.

What is the purpose of CA CDTFA-501-WG (formerly BOE-501-WG)?

The purpose of CA CDTFA-501-WG is to facilitate the reporting and payment of use tax liabilities by businesses and consumers who have purchased items outside of California that are used in the state, ensuring compliance with state tax laws.

What information must be reported on CA CDTFA-501-WG (formerly BOE-501-WG)?

The information that must be reported on CA CDTFA-501-WG includes the seller's name, address, and seller's permit number, the buyer's information, a description of the purchased items, the total purchase amount, and the calculated use tax amount due.

Fill out your CA CDTFA-501-WG formerly BOE-501-WG online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-501-WG Formerly BOE-501-WG is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.