Get the free 1094-C & 1095-C PROCESSING

Show details

PAYROLL AFFORDABLE CARE ACT 1094C & 1095C PROCESSING Computer Arts, Inc. Help Desk Support (208) 9550151 local (800) 3659335 support gocai.com Don't forget to check our website for additional Payroll

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1094-c amp 1095-c processing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1094-c amp 1095-c processing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1094-c amp 1095-c processing online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1094-c amp 1095-c processing. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out 1094-c amp 1095-c processing

How to fill out 1094-c amp 1095-c processing

01

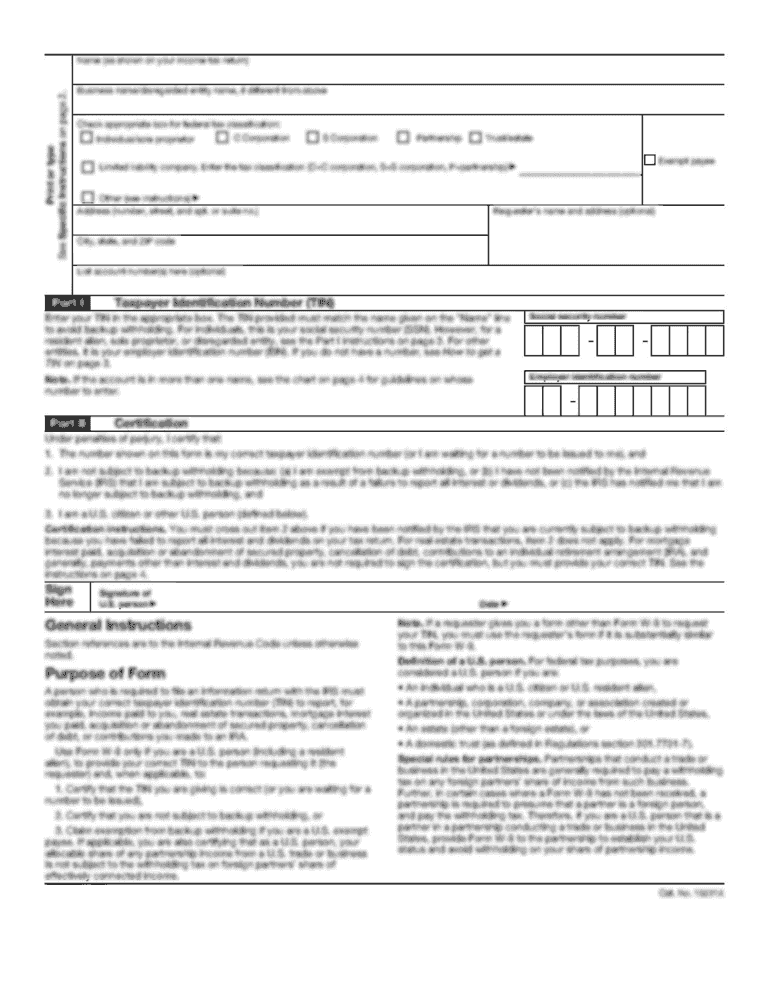

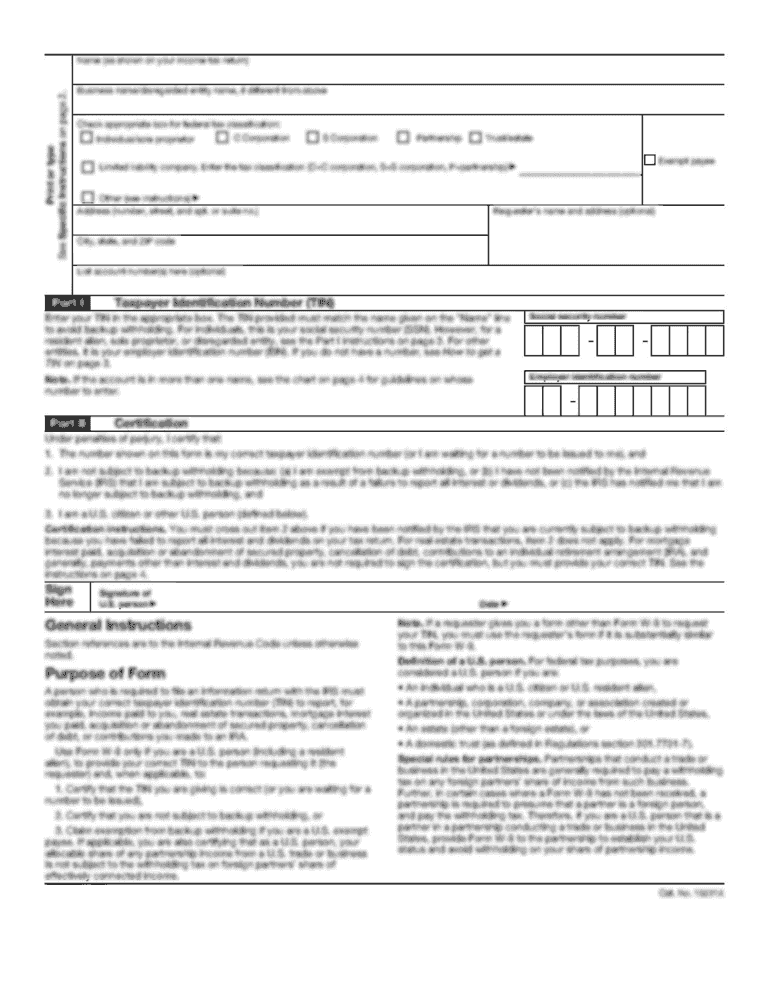

Step 1: Gather all necessary information. This includes employee and employer identification details, as well as information on any applicable offers of health coverage.

02

Step 2: Understand the different sections of Form 1094-C and Form 1095-C. Familiarize yourself with the purpose and requirements of each section.

03

Step 3: Fill out Form 1094-C. Provide accurate information regarding the employer's identification, address, contact details, and offer of health coverage.

04

Step 4: Fill out Form 1095-C for each employee. Include the employee's personal information, employment details, and any offers of health coverage provided by the employer.

05

Step 5: Review and double-check all the information filled out in both forms. Ensure accuracy and completeness before submission.

06

Step 6: Submit the completed Forms 1094-C and 1095-C to the IRS by the due date. Keep copies for your records.

07

Step 7: Maintain proper recordkeeping. Retain copies of the filed forms and any supporting documentation for the required period of time.

Who needs 1094-c amp 1095-c processing?

01

Employers who are applicable large employers (ALEs), which are generally those with 50 or more full-time employees or equivalents, need to complete 1094-C and 1095-C processing.

02

ALEs are required to report the health insurance coverage information for themselves and provide a detailed report for each full-time employee.

03

Filing Form 1094-C and 1095-C is necessary for compliance with the Affordable Care Act (ACA) requirements and to provide the IRS and employees with required information about health coverage.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1094-c amp 1095-c processing in Gmail?

1094-c amp 1095-c processing and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify 1094-c amp 1095-c processing without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your 1094-c amp 1095-c processing into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for signing my 1094-c amp 1095-c processing in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 1094-c amp 1095-c processing directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your 1094-c amp 1095-c processing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.