Get the free Customer identification verification

Show details

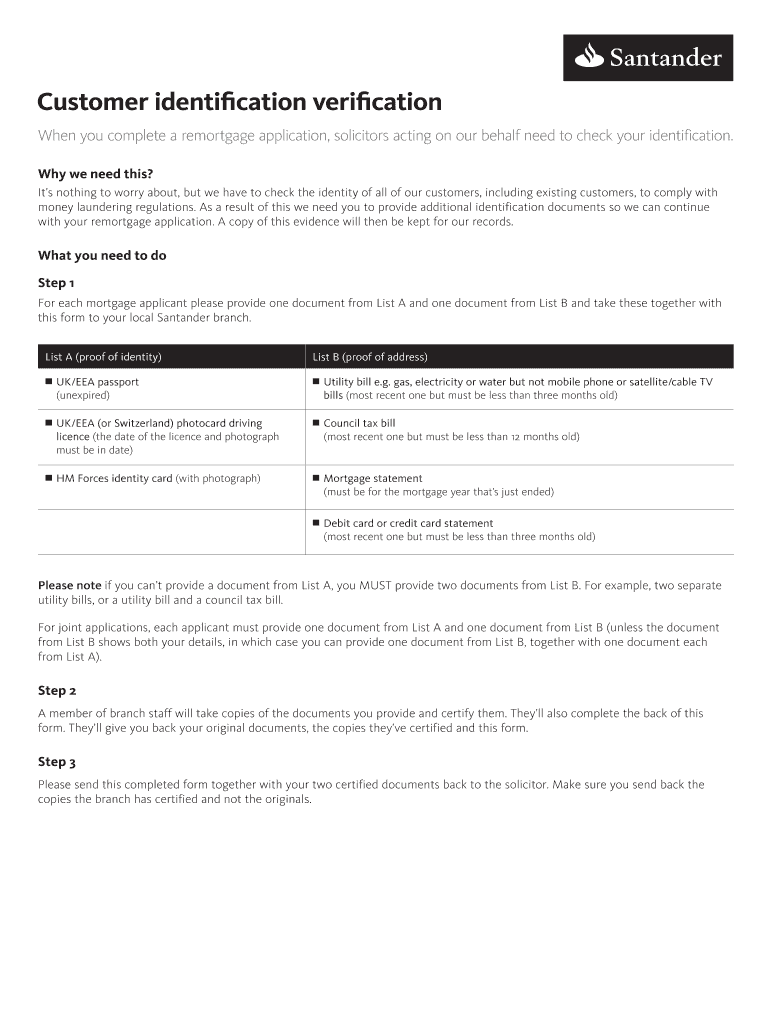

Customer identification verification

When you complete a remortgage application, solicitors acting on our behalf need to check your identification.

Why we need this?

Its nothing to worry about, but

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer identification verification

Edit your customer identification verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer identification verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing customer identification verification online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit customer identification verification. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer identification verification

How to fill out customer identification verification

01

Step 1: Begin by collecting the necessary identification documents from the customer. This may include government-issued identification, proof of address, and any additional required documents.

02

Step 2: Verify the authenticity and validity of the identification documents provided by the customer. This can be done by cross-checking the provided information with trusted sources or using verification services.

03

Step 3: Use the collected information to fill out the customer identification verification form. Ensure all the required fields are accurately filled, including personal details, identification document details, and any additional information.

04

Step 4: Double-check the filled form for any errors or missing information. Accuracy is crucial for successful verification.

05

Step 5: Submit the completed customer identification verification form along with the collected identification documents to the relevant authority or department responsible for verification.

06

Step 6: Wait for the verification process to be completed. This may involve thorough background checks and verification of the provided information.

07

Step 7: Once the verification is successfully completed, notify the customer about the approval and inform them about any further steps or actions required.

08

Step 8: Maintain a record of the customer identification verification process for future reference and compliance purposes.

Who needs customer identification verification?

01

Financial institutions such as banks and credit unions require customer identification verification to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

02

Insurance companies often need customer identification verification to prevent fraud and ensure the accuracy of policyholder information.

03

Government agencies and departments utilize customer identification verification for various purposes, including issuing official documents, granting licenses, and conducting background checks.

04

Online service providers, especially those dealing with sensitive information or financial transactions, employ customer identification verification to establish trust, protect against identity theft, and prevent fraudulent activities.

05

Legal and professional service providers, including lawyers, accountants, and notaries, may require customer identification verification to comply with legal and ethical obligations.

06

Healthcare organizations may implement customer identification verification to safeguard patient data, prevent medical identity theft, and ensure accurate medical records.

07

Real estate agents and brokers often perform customer identification verification to comply with anti-money laundering laws and verify the identity of property buyers and sellers.

08

Retailers and merchants may choose to implement customer identification verification for certain transactions, such as high-value purchases or age-restricted products, to mitigate fraud risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify customer identification verification without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your customer identification verification into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute customer identification verification online?

Easy online customer identification verification completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete customer identification verification on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your customer identification verification by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is customer identification verification?

Customer identification verification is the process of confirming the identity of a customer using various documents and information.

Who is required to file customer identification verification?

Financial institutions and other entities that engage in certain financial transactions are required to file customer identification verification.

How to fill out customer identification verification?

To fill out customer identification verification, the entity should collect relevant information from the customer and verify their identity using approved methods.

What is the purpose of customer identification verification?

The purpose of customer identification verification is to prevent money laundering, terrorist financing, and other illegal activities.

What information must be reported on customer identification verification?

Customer identification verification typically includes the customer's name, address, date of birth, and official identification number.

Fill out your customer identification verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Identification Verification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.