Get the free E X 1 3 D/ E X 1 7 D

Show details

MODEL E × 1 3 D/ E × 1 7 D E × 2 1 D/ E × 2 7 D ISSUE EMDEU1622 2ZZ9990063 WARNING The engine exhaust from this product contains chemicals known to the State of California to cause cancer, birth

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your e x 1 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e x 1 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit e x 1 3 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit e x 1 3. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

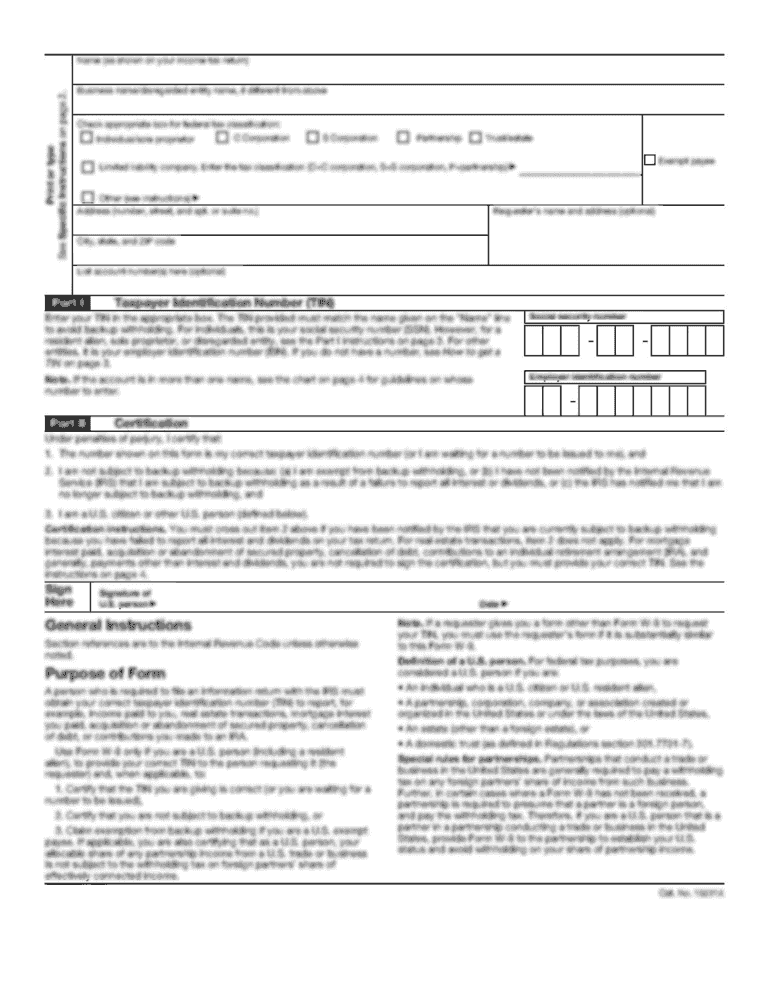

How to fill out e x 1 3

How to fill out e x 1 3

01

Start by obtaining the necessary form for completing e x 1 3.

02

Read through the instructions and make sure you understand them.

03

Gather all the required information and documents, such as identification details and financial records.

04

Begin filling out the form by entering your personal information, such as name, address, and contact details.

05

Follow the instructions provided and fill in each section of the form accurately.

06

Double-check your entries to ensure they are correct and legible.

07

If you encounter any difficulties or have questions, consult the provided guidelines or seek assistance from a professional.

08

Once you have completed all the required sections, review the entire form again to ensure nothing has been missed.

09

Sign and date the form where indicated.

10

Make copies of the completed form and any supporting documents for your records.

11

Submit the filled-out e x 1 3 form as instructed, either by mail, in person, or through an online submission platform.

12

Keep a copy of the submitted form and any related receipts or confirmations for future reference.

Who needs e x 1 3?

01

Anyone who is required by a specific institution or organization to submit e x 1 3 forms needs it.

02

Individuals who have earned income from self-employment, farming, or other sources that require reporting to the tax authorities also need to fill out e x 1 3 forms.

03

If you have received certain types of income, such as dividends or interest, that exceed a designated threshold, you may need to complete e x 1 3 forms.

04

People who are beneficiaries of a trust or estate might also need to fill out e x 1 3 forms.

05

It is advisable to consult with a tax professional or refer to the specific guidelines provided by the tax authorities to determine if you need to fill out e x 1 3 forms.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send e x 1 3 to be eSigned by others?

To distribute your e x 1 3, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the e x 1 3 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your e x 1 3 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out e x 1 3 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your e x 1 3 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your e x 1 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.