Get the free IRS Forms (PDF) - Magtax

Show details

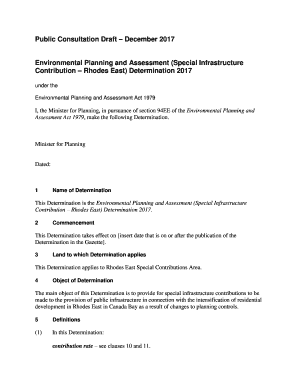

Forms 1099, 1098, 3921, 3922, 5498, and W-2G. Street address (including apt. No.) 3. City, state, and ZIP code. Account number (see instructions). Department ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs forms pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs forms pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs forms pdf - online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs forms pdf -. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out irs forms pdf

How to fill out IRS forms PDF:

01

Start by downloading the IRS forms from the official IRS website. Ensure that you have the correct form for your specific tax situation.

02

Open the downloaded PDF form using a PDF reader software such as Adobe Acrobat Reader.

03

Familiarize yourself with the instructions provided on the form. The instructions will guide you through the process of filling out the form correctly.

04

Begin by entering your personal information, such as your name, address, and Social Security number, in the designated fields. Make sure to double-check the accuracy of the information entered.

05

Proceed to the next sections of the form, where you will need to provide details regarding your income, deductions, credits, and any other relevant information.

06

Use the instructions provided on the form to determine which sections and fields are applicable to your tax situation. Skip any sections that are not applicable.

07

To ensure accuracy and avoid mistakes, take your time to review each section of the form after filling it out. Double-check all the information entered, ensuring that it matches your tax documents and records.

08

If you have any questions or need further assistance while filling out the form, refer to the IRS website, publications, or reach out to a tax professional for guidance.

09

Once you have completed filling out the form, save a copy of the PDF for your records.

10

Print the completed form, sign it where required, and mail it to the address specified in the instructions or submit it electronically if you are eligible to do so.

Who needs IRS forms PDF:

01

Individuals who are required to file federal income tax returns need IRS forms.

02

Business owners, including self-employed individuals, need IRS forms to report their business income, deductions, and credits.

03

Individuals who have received income from rental properties, investments, or other sources may need IRS forms to report and document their earnings.

04

Anyone who has received a Form 1099 or W-2 from an employer or other income provider will need IRS forms to accurately report their income and fulfill their tax obligations.

05

Tax professionals, including accountants and tax preparers, may also require IRS forms to assist their clients in completing their tax returns accurately.

06

Non-profit organizations and charities that qualify for tax-exempt status under the IRS regulations may need IRS forms to submit required information and documentation.

07

Estates, trusts, and other legal entities may require IRS forms to report income and fulfill their tax reporting obligations.

Remember, it is always recommended to consult with a tax professional or refer to the official IRS website for specific guidance related to your individual tax situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs forms pdf - directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your irs forms pdf - along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I modify irs forms pdf - without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your irs forms pdf - into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an eSignature for the irs forms pdf - in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your irs forms pdf - and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your irs forms pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.