Get the free Consumer Loan Policy & Lending Product Guidelines - Community ...

Show details

LTV exceptions above 100 are generally not considered. c Private Mortgage Insurance PMI PMI is required for all mortgages above 80. 00 Base. 60 Base 9. 50 Visa Platinum Credit Cards 710-749 Prime 5. 24 Prime 7. 74 Credit Cards Closed End Home Equity Loan 5 YEAR 10 YEAR 1st lien APOR 110 bps 2nd lien APOR 310 bps st 1 lien APOR 120 bps N/A APOR Average Prime Offer Rate Home Equity Line of Credit 80 Prime minus. Refer to the Member Business Loans Policy. 26 SBA Programs Refer to SBA guidelines...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer loan policy amp

Edit your consumer loan policy amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer loan policy amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer loan policy amp online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit consumer loan policy amp. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer loan policy amp

How to fill out consumer loan policy amp

01

Gather all the necessary documents such as identification proofs, income statements, and previous loan details.

02

Research different lending institutions and compare their interest rates, loan terms, and repayment options.

03

Choose the lending institution that suits your needs and visit their website or physical branch to obtain the consumer loan policy amp application form.

04

Ensure that you read all the terms and conditions mentioned in the consumer loan policy amp application form.

05

Fill out the application form accurately, providing all the required information such as personal details, employment information, and loan amount.

06

Attach the necessary documents along with the application form, making sure they are properly organized and legible.

07

Review the completed application form and attached documents to ensure everything is in order and there are no mistakes.

08

Submit the filled-out application form and attached documents to the lending institution either online or in person.

09

Wait for the lending institution to review your application and conduct a background check, credit assessment, and verification process.

10

Once your application is approved, carefully read through the consumer loan policy amp offered by the lending institution.

11

Sign the consumer loan policy amp agreement if you agree to the terms and conditions mentioned.

12

Receive the approved loan amount in your designated bank account as per the agreed-upon disbursement schedule.

13

Make regular loan repayments on time to avoid any penalties or negative impact on your credit score.

14

Keep a copy of the consumer loan policy amp agreement and all the associated documents for future reference and legal purposes.

Who needs consumer loan policy amp?

01

Individuals who require financial assistance for various purposes such as purchasing a house, car, or any other valuable assets.

02

Businesses or entrepreneurs who need capital for investment, expansion, or operational requirements.

03

People who want to consolidate their debts and manage their finances more effectively.

04

Students pursuing higher education and requiring funds for tuition fees, accommodation, or other educational expenses.

05

Individuals facing unforeseen emergencies or unexpected expenses that require immediate financial support.

06

Those who have a reliable repayment capacity and want to build or improve their credit history.

07

Any person in need of a sizable amount of money but prefers to repay it in installments rather than a lump sum.

08

Customers who have a good credit score and want to take advantage of lower interest rates and favorable loan terms.

09

Individuals who are willing to comply with all the terms and conditions mentioned in the consumer loan policy amp agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit consumer loan policy amp on an iOS device?

You certainly can. You can quickly edit, distribute, and sign consumer loan policy amp on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete consumer loan policy amp on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your consumer loan policy amp. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit consumer loan policy amp on an Android device?

You can make any changes to PDF files, like consumer loan policy amp, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

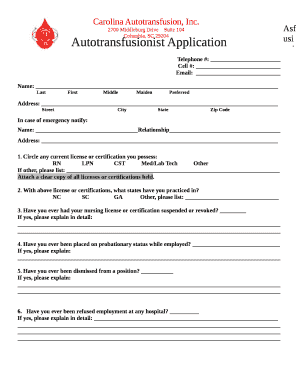

What is consumer loan policy amp?

Consumer loan policy amp is a set of guidelines and regulations implemented by financial institutions to manage the issuance and repayment of consumer loans.

Who is required to file consumer loan policy amp?

Financial institutions such as banks, credit unions, and online lenders are required to file consumer loan policy amp.

How to fill out consumer loan policy amp?

Consumer loan policy amp can be filled out by accessing the necessary forms provided by regulatory authorities and following the specific instructions outlined.

What is the purpose of consumer loan policy amp?

The purpose of consumer loan policy amp is to ensure responsible lending practices, protect consumers from predatory lending, and maintain the stability of the financial system.

What information must be reported on consumer loan policy amp?

Consumer loan policy amp typically requires information such as loan terms, interest rates, repayment schedules, fees, and borrower qualifications.

Fill out your consumer loan policy amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Loan Policy Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.