Get the free IN TAXATION PROGRAM - dgfmssnschws7 cloudfront

Show details

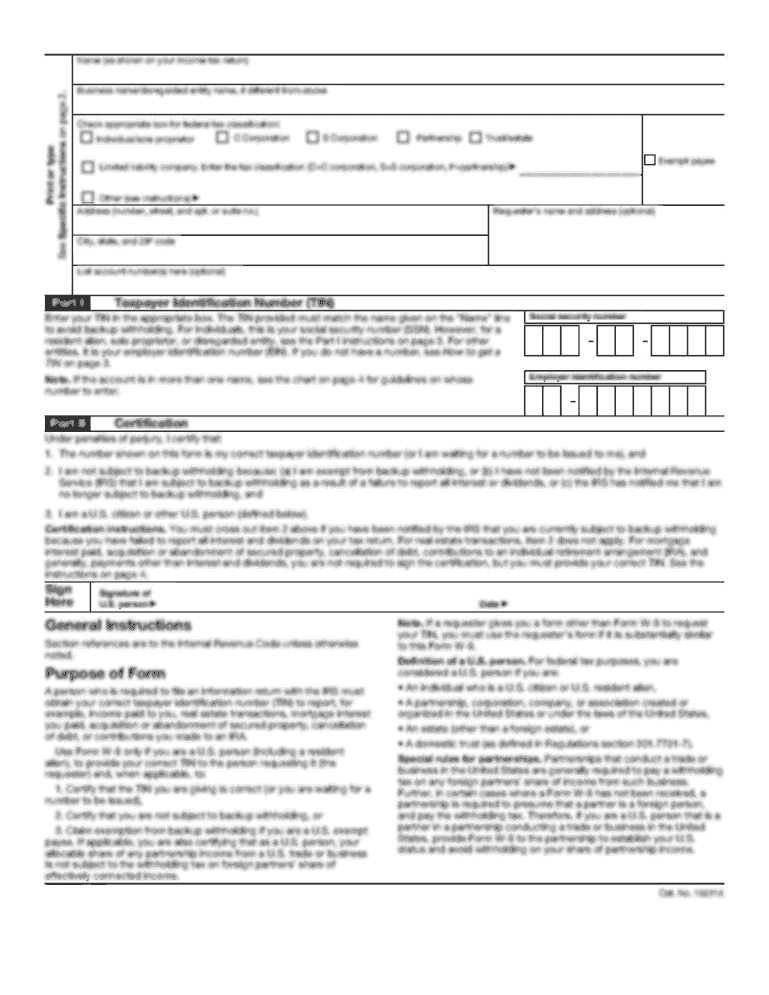

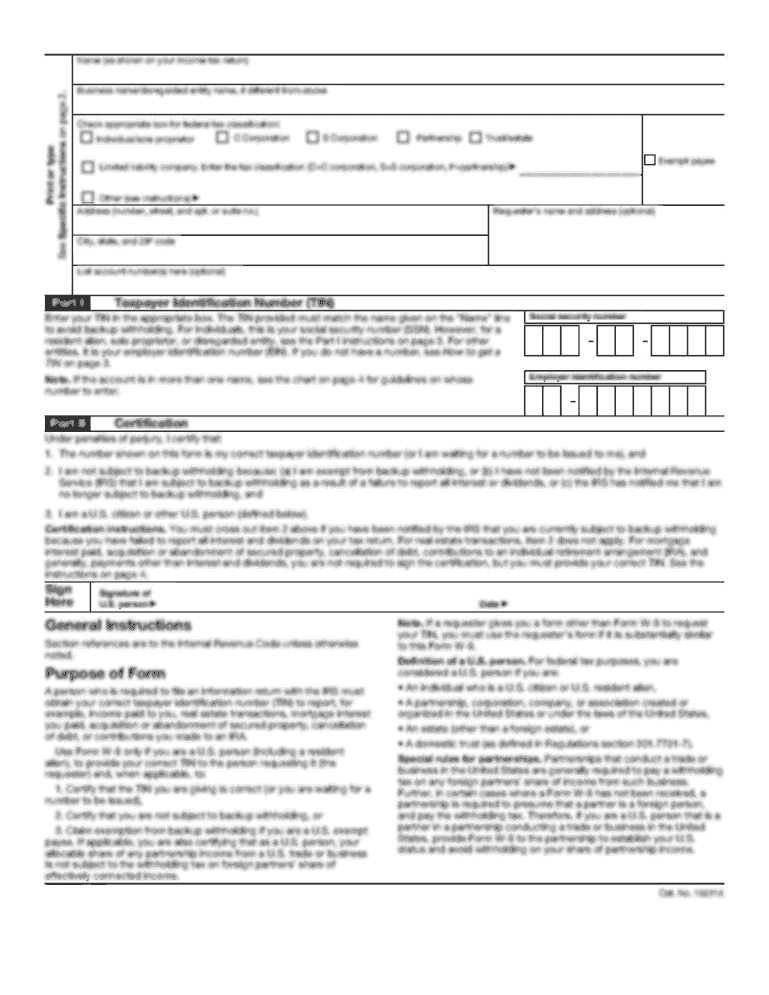

SPRING 2016 SUMMER 2016 FALL 2016 DIRECTIONS FOR COMPLETION OF CERTIFICATION OF FINANCES LL.M. IN TAXATION PROGRAM Please use the following estimated student budget to determine total costs for your year of studies. CERTIFICATION OF FINANCES LL.M. IN TAXATION PROGRAM Return this Completed Form to USF School of Law Graduate Tax Programs 101 Howard Street San Francisco CA 94105 Name USF ID Number Mailing Address Country of Birth Country of Citizenship Date of Birth Exchange Rate 1. I understand...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your in taxation program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in taxation program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in taxation program online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit in taxation program. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out in taxation program

How to fill out in taxation program

01

First, gather all necessary documents such as income statements, expenses receipts, and any relevant financial records.

02

Next, log in to the taxation program using the provided credentials or create a new account if necessary.

03

Select the option to file a new tax return and choose the appropriate tax year.

04

Enter your personal information, including name, address, and social security number.

05

Input all sources of income, including wages, self-employment earnings, and investment income.

06

Deduct eligible expenses, such as business expenses or mortgage interest payments.

07

Review the completed form for accuracy and make any necessary corrections.

08

Submit the tax return electronically or print a copy to mail to the appropriate tax authority.

09

Keep a record of the submitted tax return for future reference and follow up if needed.

Who needs in taxation program?

01

Individuals who earn income, whether from employment or self-employment, are required to file tax returns.

02

Small business owners and self-employed individuals need a taxation program to accurately calculate and report their income and expenses.

03

Investors who receive income from their investments, such as dividends or capital gains, may also need a taxation program.

04

Families or individuals who qualify for certain tax credits or deductions may find a taxation program beneficial in maximizing their refund or minimizing their tax liability.

05

Freelancers or contractors who receive 1099 forms from their clients need a taxation program to report this income correctly.

06

Even individuals with simple tax situations can benefit from using a taxation program for the convenience and accuracy it provides.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my in taxation program in Gmail?

in taxation program and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit in taxation program from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your in taxation program into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get in taxation program?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the in taxation program. Open it immediately and start altering it with sophisticated capabilities.

Fill out your in taxation program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.