Get the free Consumer Debt Elimination Schemes and Scams

Show details

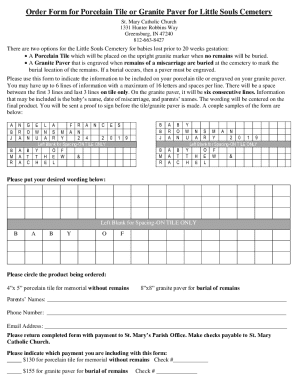

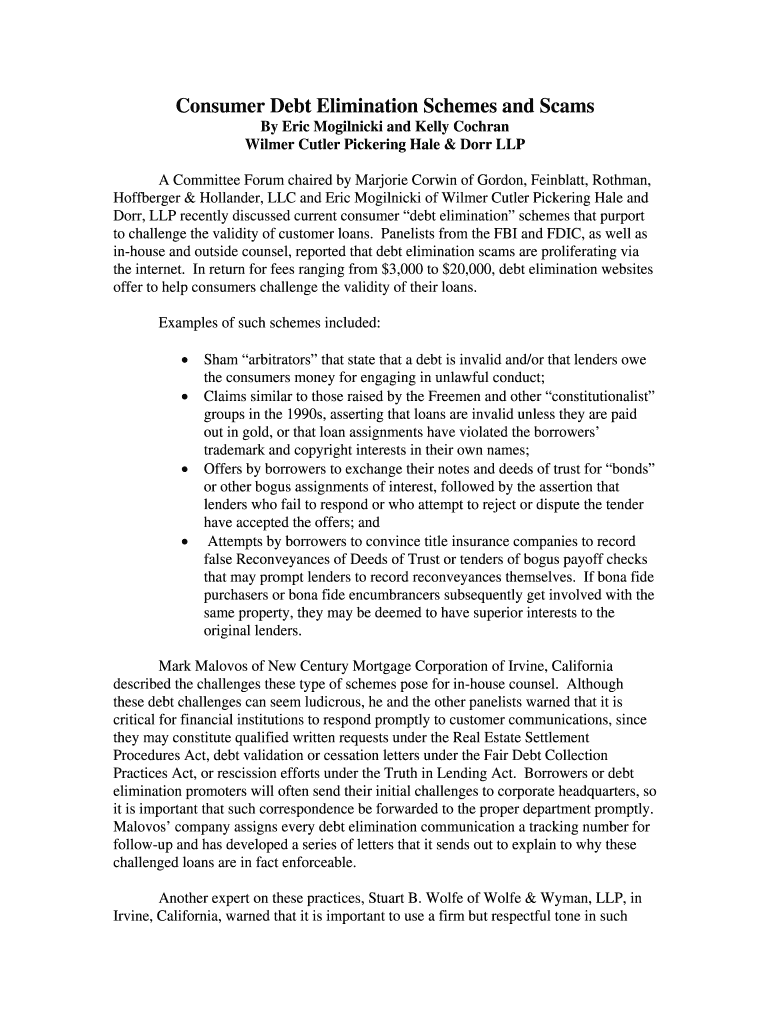

Consumer Debt Elimination Schemes and Scams By Eric Mogilnicki and Kelly Cochran Wilmer Cutler Pickering Hale Dorr LLP A Committee Forum chaired by Marjorie Corwin of Gordon Feinblatt Rothman Hoffberger Hollander LLC and Eric Mogilnicki of Wilmer Cutler Pickering Hale and Dorr LLP recently discussed current consumer debt elimination schemes that purport to challenge the validity of customer loans. Another expert on these practices Stuart B. Wolfe of Wolfe Wyman LLP in Irvine California warned...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer debt elimination schemes

Edit your consumer debt elimination schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer debt elimination schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer debt elimination schemes online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer debt elimination schemes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer debt elimination schemes

How to fill out consumer debt elimination schemes

01

Gather information about your consumer debts, including the amount owed, interest rates, and minimum monthly payments.

02

Create a budget to determine how much money you can allocate towards debt repayment each month.

03

Prioritize your debts by either focusing on the one with the highest interest rate, or the one with the smallest balance (debt snowball method).

04

Consider negotiating with creditors to lower interest rates or settle for a reduced amount.

05

Explore debt consolidation options, such as applying for a low-interest balance transfer credit card or a personal loan.

06

Stick to your budget and make consistent monthly payments towards your debts.

07

Avoid incurring additional debt while working towards debt elimination.

08

Celebrate your progress and stay motivated by tracking your debt repayment journey.

09

Consider seeking professional help from credit counseling agencies or debt settlement companies if you need assistance in managing your debts.

10

Stay committed to the process and remain disciplined, as consumer debt elimination may take time and effort.

Who needs consumer debt elimination schemes?

01

Individuals who are burdened with substantial consumer debts and struggling to make monthly payments.

02

People who want to regain financial control and improve their credit score.

03

Those who are motivated to eliminate their debts and are willing to commit to a debt repayment plan.

04

Individuals who want to avoid bankruptcy or legal actions due to overwhelming debts.

05

People who are ready to make lifestyle changes and adopt better financial habits.

06

Those who want to reduce the overall amount of interest paid and become debt-free.

07

Individuals who want to achieve long-term financial stability and freedom.

08

People who are willing to educate themselves about debt management and take proactive steps to address their financial situation.

09

Those who want to relieve the stress and anxiety associated with excessive consumer debt.

10

Individuals who are ready to seek professional guidance and explore different debt elimination strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my consumer debt elimination schemes directly from Gmail?

consumer debt elimination schemes and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get consumer debt elimination schemes?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific consumer debt elimination schemes and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my consumer debt elimination schemes in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your consumer debt elimination schemes and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is consumer debt elimination schemes?

Consumer debt elimination schemes are financial programs or strategies designed to help individuals eliminate or reduce their debt burden.

Who is required to file consumer debt elimination schemes?

Individuals who are seeking to eliminate or reduce their consumer debt are required to file consumer debt elimination schemes.

How to fill out consumer debt elimination schemes?

Consumer debt elimination schemes can be filled out by providing detailed information about the individual's debts, income, expenses, and any proposed repayment plans or strategies.

What is the purpose of consumer debt elimination schemes?

The purpose of consumer debt elimination schemes is to help individuals create a plan to pay off their debts and achieve financial freedom.

What information must be reported on consumer debt elimination schemes?

Consumer debt elimination schemes must include information about the individual's debts, income, expenses, and any proposed repayment plans or strategies.

Fill out your consumer debt elimination schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Debt Elimination Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.