Get the free CONTINGENT bPROMISSORY NOTEb - ABC Bail Bonds

Show details

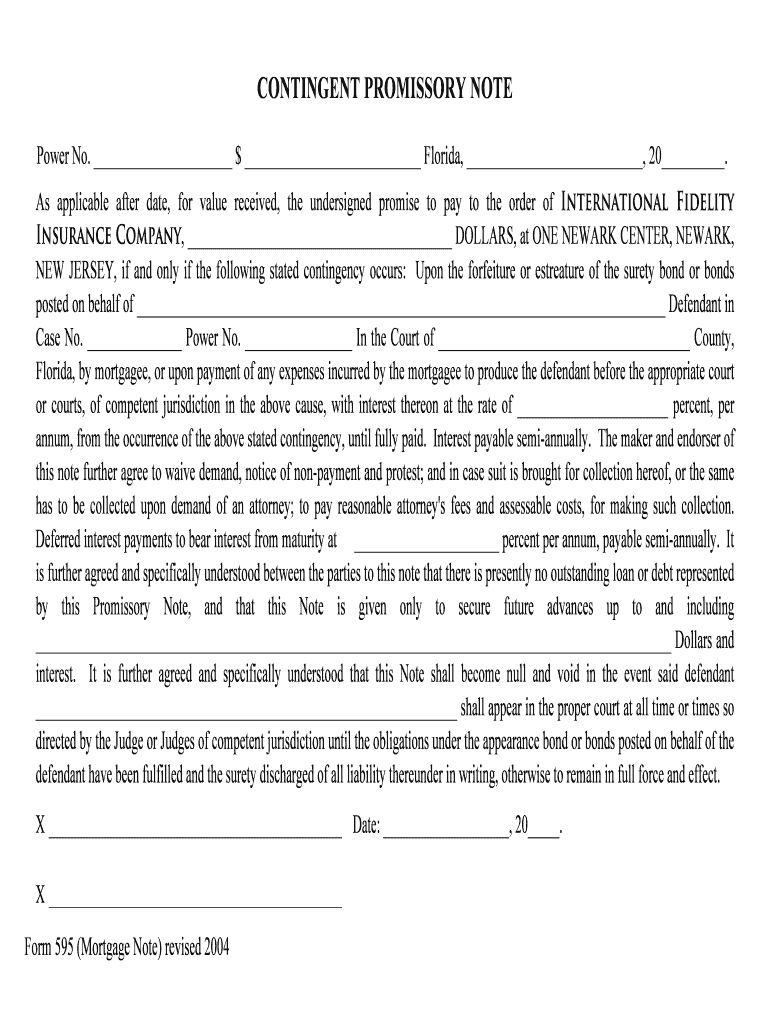

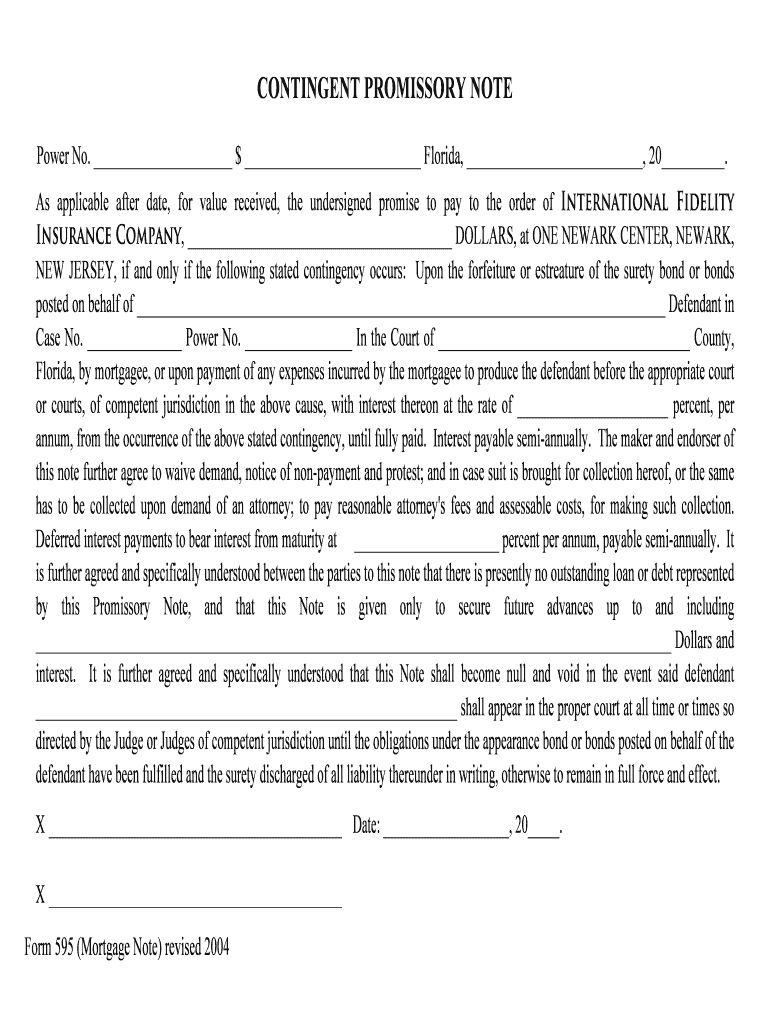

CONTINGENT PROMISSORY NOTE Power No. $ Florida, 20. As applicable after date, for value received, the undersigned promise to pay to the order of International Fidelity Insurance Company, DOLLARS,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contingent bpromissory noteb

Edit your contingent bpromissory noteb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contingent bpromissory noteb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing contingent bpromissory noteb online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit contingent bpromissory noteb. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contingent bpromissory noteb

How to fill out a contingent promissory note:

01

Start by entering the date at the top of the document. This is the date on which the promissory note is being filled out.

02

Next, write the names and contact information of both the borrower and the lender. Make sure to include their full names, addresses, and phone numbers.

03

Specify the principal amount of the loan. This is the amount of money that the borrower is obligated to repay to the lender.

04

Determine the interest rate for the loan. This is the percentage of the principal amount that the borrower will pay as interest over the loan's term. Clearly state whether the interest is compounded or simple.

05

Define the payment terms. This includes the frequency of payments (e.g., monthly, quarterly), the due dates for each payment, and the method of payment (e.g., check, bank transfer).

06

Outline any late fees or penalties for missed or late payments. Specify the amount or percentage of the late fee and the period after which the fee will be imposed.

07

Include any additional terms or conditions that both parties agree upon, such as collateral or security arrangements, prepayment options, and default provisions.

08

At the end of the document, provide spaces for the borrower and lender to sign and date the promissory note. Make sure both parties understand and agree to the terms mentioned in the note.

Who needs a contingent promissory note:

01

Homebuyers who are required to provide a promissory note as part of a mortgage agreement.

02

Startups or businesses seeking funding through loans from individuals or institutions.

03

Individuals or organizations lending money to family or friends, to ensure the loan terms are documented and legally enforceable.

04

Investors or lenders involved in real estate transactions where financing is involved.

05

Parents or guardians lending money to their children or dependents for educational or personal purposes.

Overall, a contingent promissory note is essential for anyone involved in a lending or borrowing arrangement. It provides a legal framework and clarity regarding the terms of the loan, ensuring both parties are protected and aware of their obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete contingent bpromissory noteb online?

pdfFiller has made it simple to fill out and eSign contingent bpromissory noteb. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit contingent bpromissory noteb online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your contingent bpromissory noteb to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the contingent bpromissory noteb in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your contingent bpromissory noteb right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is contingent bpromissory noteb?

Contingent promissory note is a type of promissory note that becomes payable only upon the occurrence of a specific event or condition.

Who is required to file contingent bpromissory noteb?

Typically, the borrower and the lender are required to file contingent promissory note.

How to fill out contingent bpromissory noteb?

Contingent promissory note can be filled out by including the terms of the loan, the interest rate, the repayment schedule, and the conditions that trigger repayment.

What is the purpose of contingent bpromissory noteb?

The purpose of contingent promissory note is to provide a legally binding agreement for a loan that is contingent on a specific event.

What information must be reported on contingent bpromissory noteb?

Information such as loan amount, interest rate, repayment terms, conditions triggering repayment, and signatures of the parties involved must be reported on contingent promissory note.

Fill out your contingent bpromissory noteb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contingent Bpromissory Noteb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.