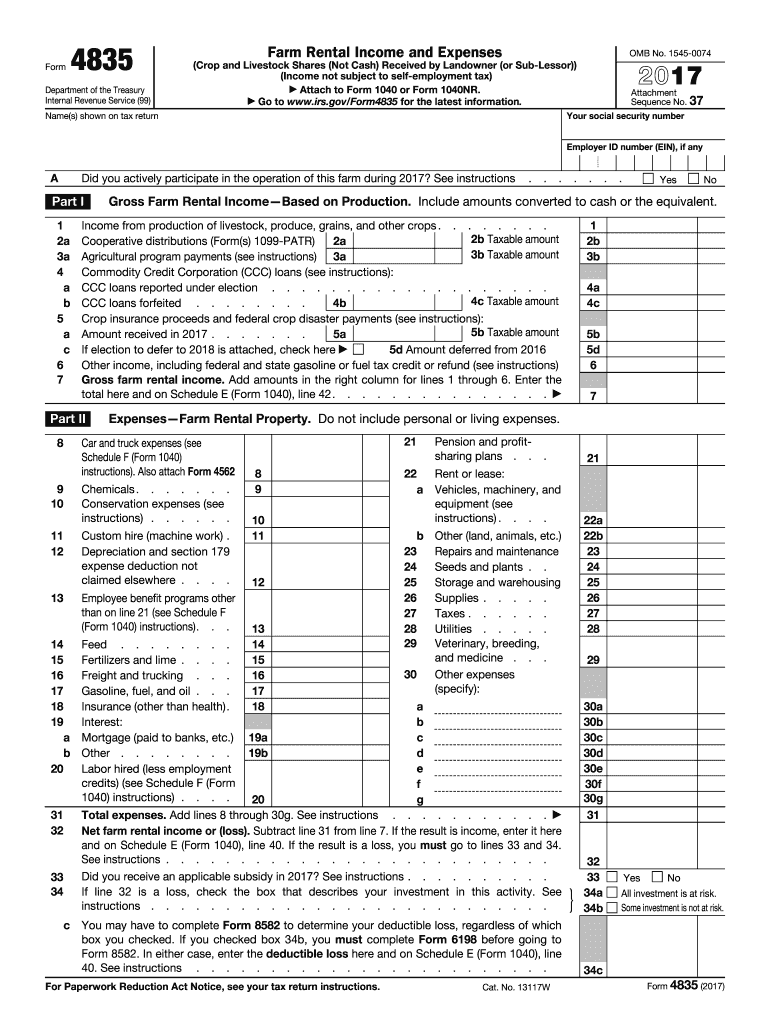

What is form 4835?

Landowners and sub-lessors file IRS form 4835 Farm Rental Income and Expenses to report farm rental income based on livestock and crops produced by the tenant (if they don’t participate in the management of the farm).

Who should file form 4835 2017?

If you are a landowner or a sub-lessor who “materially participates” in the operation of the farm, you are considered a self-employed business person. Such individuals typically report income on Schedule F, Profit or Loss From Farming, and don’t have to file 4835.

On the other hand, if you rent out your land to farmers but do not participate in the labor or management, the IRS considers you a qualified landowner to submit the 4835 form.

Landowners and sub-lessors who received cash rent for farmland based on a flat charge do not file 4835. Instead, they report their income on Schedule E (form 1040), Part I. Those with estate or trust income and expenses from renting crop and livestock shares will also need to file 1040.

What information do you need when you file form 4835?

To fill out tax form 4835 correctly, provide your name as it appears on your tax return, your social security number, and the employer ID number (EIN), if any. Part I of the form requires information about the gross farm rental income. Part II is dedicated to expenses associated with the farm rental property.

How do I fill out form 4835 in 2018?

You can fill out your Farm Rental Income and Expenses report in a few minutes with the help of pdfFiller. Fill out the template, print it, and mail it to the IRS, or pdfFiller can ship it for you. Here is how:

- Click Get Form above to view the template.

- Complete the form in the interface and click Done.

- Select this and accompanying files and click Send via USPS in the right side menu.

- Fill in mailing addresses.

- Select the terms of delivery.

- Click Send.

pdfFiller will promptly deliver a printed copy of the forms to the post office.

Find more detailed form 4835 instructions inside the document.

Is form 4835 accompanied by other forms?

Sned form 4835 with form 1040, 1040-SR, or 1040-NR.

When is the 4835 form due?

Send the forms to IRS by January 18, 2018.

Where do I send 4835?

Attach the document to form 1040, 1040-SR, or 1040-NR (whichever applies to you) and send them to the address relevant for your state as instructed.