Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

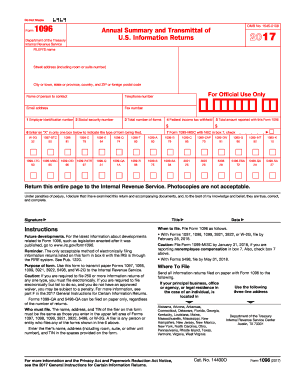

The 1098 form is a tax form used in the United States for reporting various types of income from different sources. There are several types of 1098 forms, but the most common one is the 1098 Mortgage Interest Statement. This form is issued by financial institutions to individuals who have paid mortgage interest on their primary residence or second home. The form provides the amount of mortgage interest paid during the tax year, which may be deductible for individual taxpayers.

Who is required to file 1098 form?

The 1098 form is typically filed by financial institutions or lenders, such as banks, mortgage lenders, or credit unions. They use this form to report mortgage interest, student loan interest, or tuition payments made by individuals. The form is then provided to the individuals for their tax filing purposes.

How to fill out 1098 form?

To successfully complete a Form 1098, follow these steps:

1. Get the necessary information: Gather all the relevant data on each borrower, including their name, address, and taxpayer identification number.

2. Identify the type of debt: Determine the nature of the loan for which you are reporting. For example, if it is a mortgage debt or student loan interest, select the appropriate box for reporting purposes.

3. Fill in the Payer Information: Enter your name, address, and taxpayer identification number (TIN) in the appropriate fields.

4. Fill in the Borrower Information: Enter the borrower's name, address, and taxpayer identification number (TIN) into the designated sections. If there are multiple borrowers, you must provide such information for each individual.

5. Provide property information: If the reported debt is for a mortgage, furnish the details of the property securing the loan (address, zip code, etc.) in the respective fields.

6. Report interest paid: In Box 1, disclose the amount of interest received or paid on the debt during the tax year. Ensure accurate calculations by referring to your records or mortgage statements.

7. Report any points paid: If points were paid on the mortgage during the tax year, specify the amount in Box 2.

8. Enter the type of mortgage: Indicate the type of mortgage using the boxes provided in Box 3.

9. Check for refund of interest: If a refund of overpaid interest received in a prior year was issued to the borrower during the current tax year, mark the appropriate box in Box 4 and include the refund amount.

10. Report mortgage insurance premiums: If the borrower paid mortgage insurance premiums, provide the amount in Box 5.

11. Fill in the outstanding mortgage balance: Indicate the outstanding balance of the mortgage principal at the end of the tax year in Box 6.

12. Check for cash received from a notional principal contract: If cash was received in the capacity of a notional principal contract during the year, check the applicable box in Box 7.

13. Sign and distribute the form: Sign and date the Form 1098, then provide copies to the borrower and the IRS no later than January 31st of the following year. Also, retain a copy for your records.

Note: Make sure to review the IRS instructions for any specific requirements or changes to Form 1098 for the tax year you are filing. It is also recommended to consult a tax professional or utilize tax software to ensure accuracy and compliance with current tax regulations.

What is the purpose of 1098 form?

The purpose of the 1098 form is to report certain types of payments or transactions made by individuals to the Internal Revenue Service (IRS). Specifically, the 1098 form is used to report mortgage interest, student loan interest, and tuition payments. The information provided on this form is used by the IRS for tax purposes, and recipients of the 1098 form may be able to deduct these payments or receive certain tax benefits based on the reported amounts.

What information must be reported on 1098 form?

The 1098 form is used to report certain types of deductible expenses, such as mortgage interest, student loan interest, and tuition payments. The specific information that must be reported on the 1098 form depends on the type of deductible expense being reported.

For a mortgage interest deduction, the form should include the following information:

- Payer's name, address, and taxpayer identification number

- Recipient's name, address, and taxpayer identification number

- Property address or a description of the property securing the mortgage

- Amount of mortgage interest received

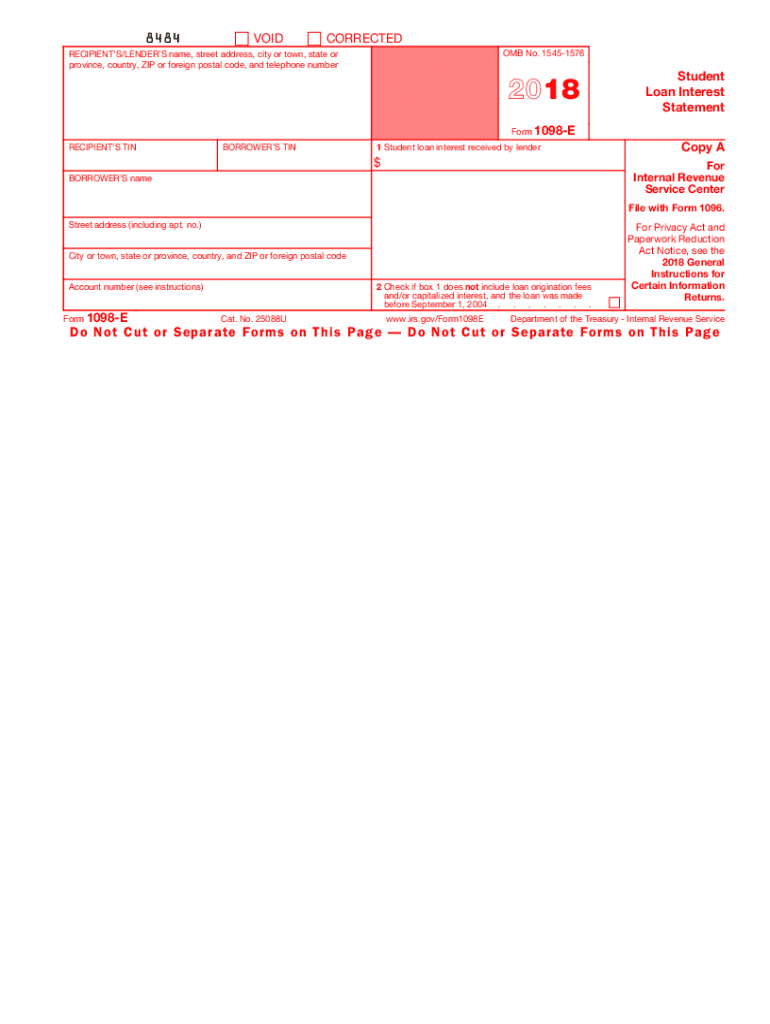

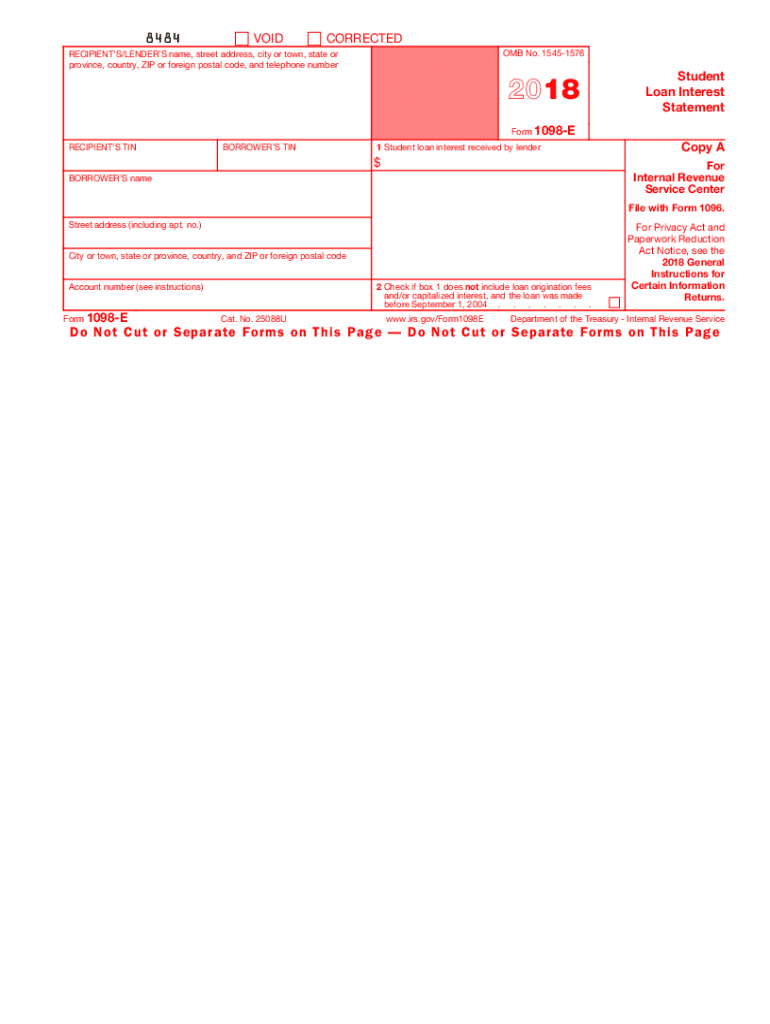

For a student loan interest deduction, the form should include:

- Payer's name, address, and taxpayer identification number

- Recipient's name, address, and taxpayer identification number

- Amount of student loan interest received

For a tuition payment deduction, the form should include:

- Payer's name, address, and taxpayer identification number

- Recipient's name, address, and taxpayer identification number

- Name, address, and taxpayer identification number of the educational institution

- Amount of tuition payments received

It is important to note that the reporting requirements for the 1098 form may vary based on the specific regulations and instructions provided by the Internal Revenue Service (IRS). It is recommended to refer to the IRS guidelines or consult a tax professional for accurate and up-to-date information.

When is the deadline to file 1098 form in 2023?

The deadline to file Form 1098 for the year 2023 is typically January 31, 2024. However, it is always recommended to check with the Internal Revenue Service (IRS) or consult a tax professional to confirm any changes or updates to tax deadlines.

What is the penalty for the late filing of 1098 form?

Failure to file Form 1098 or filing it late can result in penalties imposed by the Internal Revenue Service (IRS). The penalty amount can depend on the length of the delay and the size of the organization.

As of 2021, for small tax-exempt organizations with gross receipts of $1 million or less for the year, the penalty for late filing Form 1098 is $50 per day, with a maximum penalty of $27,500 per year.

For larger tax-exempt organizations with gross receipts of more than $1 million, the penalty for late filing Form 1098 is $270 per day, with a maximum penalty of $112,500 per year.

It's important to note that penalties can vary, and the IRS has the discretion to waive or reduce penalties in certain cases if reasonable cause is shown. It is recommended to consult the IRS guidelines or a tax professional for accurate and up-to-date information specific to your situation.

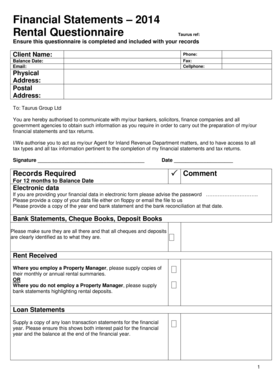

How can I modify 1098 form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your 1098 e form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send form 1098 for eSignature?

When you're ready to share your form 1098 e, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make changes in what income tax form should full time student use 2017?

With pdfFiller, the editing process is straightforward. Open your navient com my1098 e form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.