Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

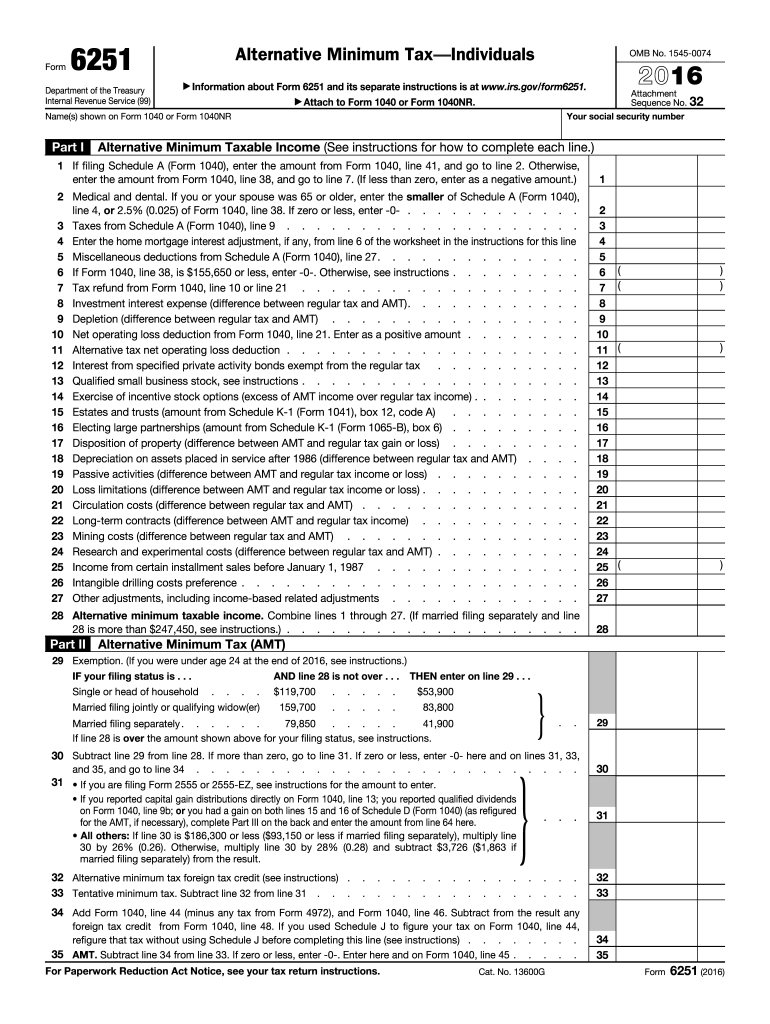

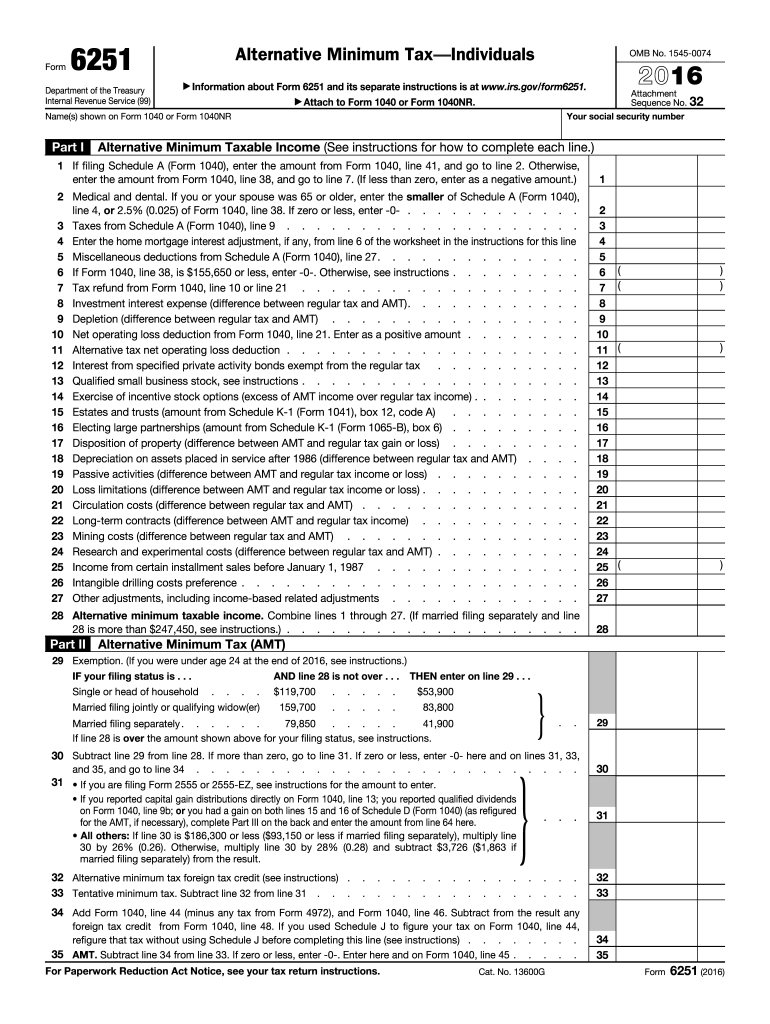

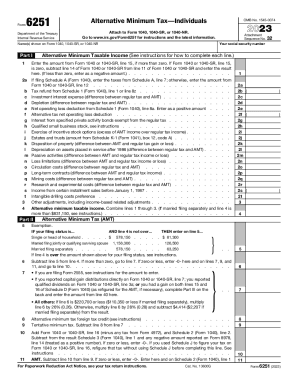

Form 6251 is a tax form used by taxpayers who may be subject to the alternative minimum tax (AMT). The AMT is a separate tax system designed to ensure that taxpayers who have certain deductions and credits do not avoid paying a minimum amount of tax. Form 6251 calculates the amount of AMT owed by an individual or a couple, and it helps determine if the taxpayer needs to pay the regular income tax or the AMT amount, whichever is higher.

Who is required to file form 6251?

Individuals who meet certain criteria are required to file Form 6251, also known as the Alternative Minimum Tax (AMT) form. Some of the criteria include:

1. If their income is above a certain threshold: The AMT is designed to ensure that taxpayers with high incomes and various deductions still pay some amount of taxes. If an individual's income exceeds the AMT exemption amount, they may be required to file Form 6251.

2. If they have certain types of income or deductions: Individuals who have specific types of income, such as tax-exempt interest from private activity bonds or certain incentive stock options, or certain deductions, like those related to state and local taxes, may need to file Form 6251.

It is important for taxpayers to review the instructions for Form 6251 or consult a tax professional to determine if they are required to file this form.

How to fill out form 6251?

Form 6251, also known as the Alternative Minimum Tax (AMT) form, is used to calculate if you owe any additional taxes under the alternative minimum tax system. Here are the steps to fill out Form 6251:

1. Gather your financial information: You will need your completed federal income tax return (Form 1040), as well as any supporting documentation related to your income, deductions, and credits.

2. Understand the alternative minimum tax: The purpose of AMT is to ensure that high-income individuals who have used various tax deductions and credits to reduce their regular tax liability still pay a minimum amount of tax. Make sure you understand the concept and rules of the AMT.

3. Complete Part I of Form 6251: This section focuses on determining your alternative minimum taxable income (AMTI). Start by taking your taxable income from your Form 1040 and making certain adjustments. These adjustments include adding back certain deductions and preferences, and may require referencing specific instructions provided by the IRS.

4. Complete Part II of Form 6251: In this section, you calculate the alternative minimum tax (AMT) by applying the appropriate AMT rates to your AMTI. The tax rates are lower than regular tax rates, but they apply to a broader base.

5. Determine exemptions and additional taxes: In Part III, you calculate any applicable exemptions and the alternative minimum tax credit. You may be eligible for certain exemptions, which would reduce your AMT liability. The credit can be claimed if you paid excessive AMT in previous years.

6. Compare regular tax and AMT liability: Complete Part IV to compare your regular tax liability with your AMT liability. This will help determine if you owe any additional tax under the alternative minimum tax system.

7. Complete the rest of the form: Answer the questions and complete any other necessary sections of Form 6251, such as providing personal information, calculating the tentative minimum tax, and determining the final alternative minimum tax.

8. Attach Form 6251 to your tax return: When you have completed Form 6251, attach it to your federal income tax return (Form 1040) and file it with the IRS.

It is recommended to consult a tax professional or utilize tax software when dealing with Form 6251, as it can be complex and require a deep understanding of tax laws and regulations.

What is the purpose of form 6251?

Form 6251, also known as the Alternative Minimum Tax (AMT) form, is used by individuals and some corporations to calculate the amount of their AMT liability. The AMT is an alternative tax system that operates parallel to the regular income tax system in the United States. It was designed to ensure that high-income taxpayers, who may have otherwise qualified for various deductions and exemptions, pay at least a minimum amount of tax.

The purpose of Form 6251 is to determine whether an individual or corporation is subject to the AMT and calculate the AMT liability. To complete this form, taxpayers need to calculate their taxable income using different rules and adjustments compared to the regular tax system. The AMT adjusts for certain deductions, exemptions, and tax preferences that are not allowed under the regular tax system.

If a taxpayer's AMT liability calculated on Form 6251 is higher than their regular tax liability, they are required to pay the higher AMT amount. However, if the regular tax liability is higher, they do not owe any additional AMT.

It is important to note that Form 6251 is only applicable to taxpayers who meet certain criteria, such as having high income, significant tax-exempt interest, large amounts of itemized deductions, or exercising incentive stock options. Taxpayers who are not subject to the AMT do not need to file Form 6251.

What information must be reported on form 6251?

Form 6251, also known as the Alternative Minimum Tax (AMT) form, is used to determine if an individual or corporation owes alternative minimum tax. The following information must be reported on Form 6251:

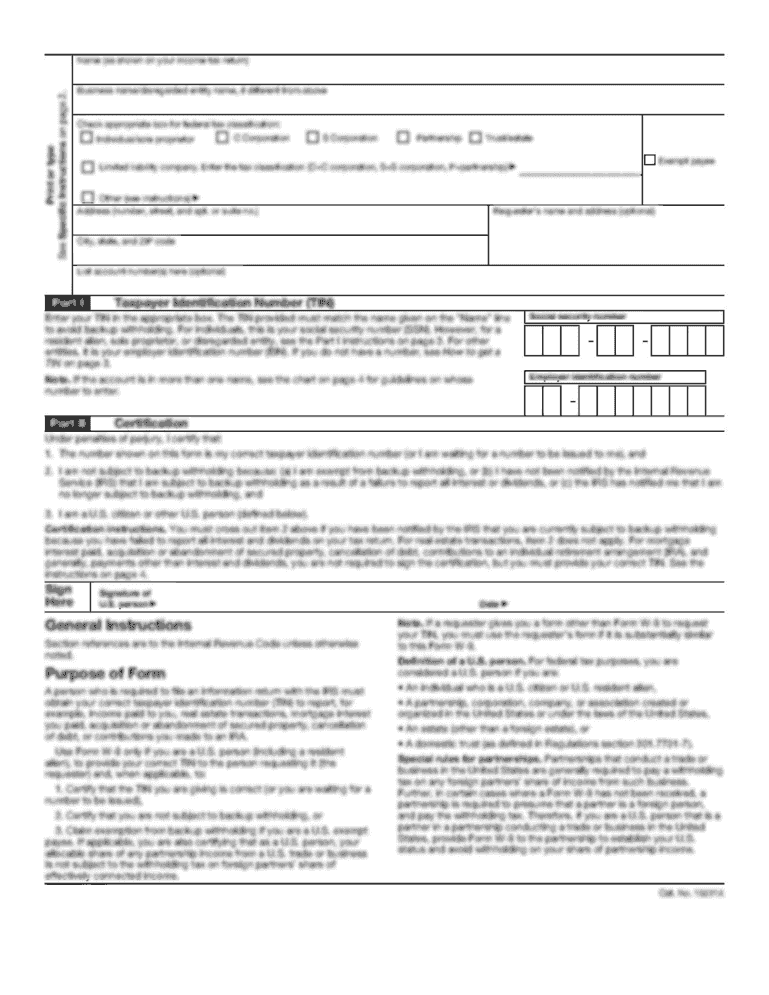

1. Personal Information: Full name, Social Security Number (or Employer Identification Number for corporations), address, and filing status.

2. Income: Report all sources of income, including wages, salaries, self-employment income, rental income, capital gains, and dividends.

3. Adjustments: Certain deductions, exemptions, or exclusions that are not allowed or limited under the regular tax rules may be added back or adjusted on Form 6251. This includes items such as state and local taxes, certain itemized deductions, and tax-exempt interest.

4. Alternative Minimum Taxable Income (AMTI) Calculation: Calculate your AMTI by subtracting the AMT deductions and exemptions from your adjusted gross income.

5. Tax Computation: Use the AMT tax rates and exemption amounts to calculate the alternative minimum tax due.

6. AMT Credits: Report any available alternative minimum tax credits, such as the foreign tax credit, prior year minimum tax credit, and the credit for child and dependent care expenses.

Finally, sign and date the form before submitting it to the IRS along with your tax return. It is important to note that this answer focuses on individual taxpayers, but corporations also use Form 6251 with specific additional sections tailored to their needs.

When is the deadline to file form 6251 in 2023?

The deadline to file Form 6251 for the tax year 2023 would be April 15, 2024.

What is the penalty for the late filing of form 6251?

The penalty for late filing of form 6251, also known as the Alternative Minimum Tax (AMT) form, depends on various factors, including the amount of tax owed and the reason for the late filing. As of 2021, the penalty for late filing of tax returns is generally 5% of the tax owed for each month or part of a month the return is late, up to a maximum of 25% of the tax owed. However, if the return is more than 60 days late, the minimum penalty is either $435 or 100% of the unpaid tax, whichever is smaller. It is important to note that penalties can vary, and there may be specific circumstances or exceptions that could affect the penalties imposed. It is advisable to consult the Internal Revenue Service (IRS) or a tax professional for accurate and up-to-date information regarding penalties for late filing of form 6251.

How can I manage my form 6251 2016 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your form 6251 2016 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make changes in form 6251 2016?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form 6251 2016 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete form 6251 2016 on an Android device?

Use the pdfFiller Android app to finish your form 6251 2016 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.