Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

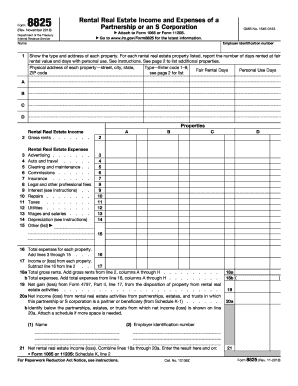

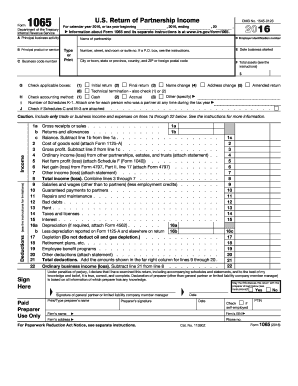

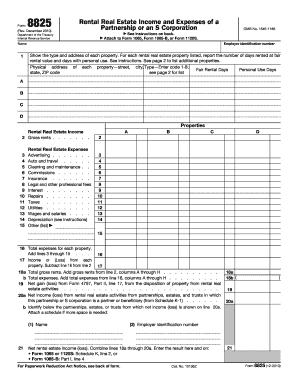

IRS Form 8825 is a tax form used by individuals, partnerships, corporations, or trusts that own or are beneficiaries of rental real estate. It is used to report income and expenses related to rental real estate properties, including commercial properties and residential rental properties. The form provides a breakdown of rental income, deductions, depreciation, and other expenses associated with the rental property.

Who is required to file irs form 8825?

Individuals or businesses who own or operate rental real estate, and receive income or incur expenses from these activities, are required to file IRS Form 8825. This form is specifically used to report income and expenses related to rental real estate activities.

How to fill out irs form 8825?

Filling out IRS Form 8825 is a relatively straightforward process, but it is recommended that you consult with a tax professional or review the instructions provided by the IRS for detailed guidance. Here is a general outline of the steps to fill out Form 8825:

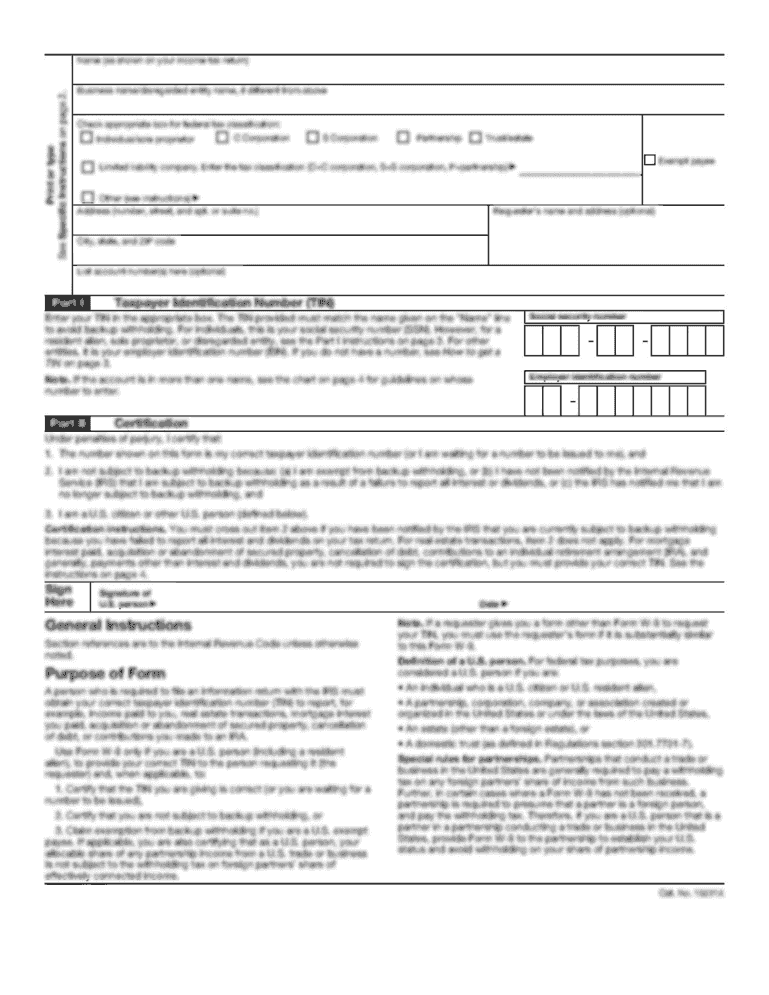

1. Provide your personal information, including your name, address, and taxpayer identification number (usually your Social Security number).

2. Enter the tax year for which the form is being filed.

3. Include the name, address, and employer identification number (EIN) of the partnership or S corporation you are reporting on.

4. Complete Part I: Income.

- List the rental real estate you are reporting on, including the address, number of units, and percentage of ownership.

- Provide the income received from the rental property, including rents and other sources of income.

5. Complete Part II: Administrative Information.

- Provide information about any rental real estate activities conducted through partnerships or S corporations, including the number of partners or shareholders and their names and addresses.

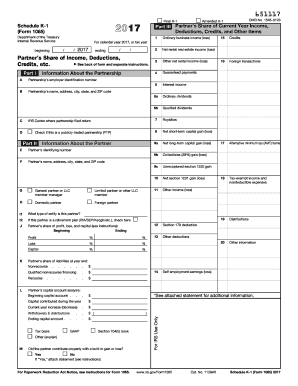

6. Complete Part III: Allocation of Rental Income, Deductions, Credits, etc.

- Allocate the income, deductions, and credits from the rental property among partners or shareholders.

- You may need to attach a statement or schedule to provide the detailed breakdown.

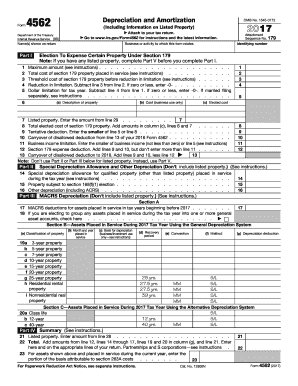

7. Complete Part IV: Depreciation of Rental Real Estate.

- Report the depreciation expenses for the rental property being claimed.

8. Complete Part V: Other Information.

- Provide any additional information that may be required or relevant to your specific situation.

9. Sign and date the form.

Remember to review your completed form for accuracy and attach any required schedules or statements before submitting it to the IRS. It is best to consult with a tax professional if you are unsure about how to fill out any part of the form or if your rental real estate situation is complex.

What is the purpose of irs form 8825?

The purpose of IRS Form 8825 is to report rental real estate income and expenses on a commercial property or a residential property with more than six units. This form is used by partnerships, S corporations, trusts, and estates that own rental real estate properties and need to report these activities to the Internal Revenue Service (IRS).

What information must be reported on irs form 8825?

IRS Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation, is used to report rental activity of partnerships or S corporations to the Internal Revenue Service (IRS). The form requires the following information to be reported:

1. Identification of the partnership or S corporation: This includes the name, address, and taxpayer identification number (TIN) of the entity filing the form.

2. Rental income: Total rental income received from all rental properties is reported, including gross rental receipts, advanced rent payments, and any other rental income received.

3. Rental expenses: All deductible rental expenses, such as mortgage interest, property taxes, insurance, repairs, maintenance, advertising, property management fees, and other relevant expenses, should be listed on the form.

4. Depreciation: The cost and depreciation of the rental property must be reported, as well as any depreciation deductions taken during the tax year.

5. Allocation of income and deductions: If there are multiple rental properties owned by the partnership or S corporation, the income and deductions related to each property must be allocated and reported separately.

6. Income and deductions from partnerships or S corporations: If the partnership or S corporation received income or deductions from another partnership or S corporation, those amounts should be reported on this form.

7. Summary of income, deductions, and net rental income: A summary of all the income, deductions, and net rental income derived from the rental real estate activity should be provided.

It is worth noting that this form is typically prepared by partnerships or S corporations that own rental real estate properties. Individual taxpayers who own rental properties report their income and expenses on Schedule E (Form 1040). Additionally, specific instructions and guidelines provided by the IRS should be referred to while completing the form.

When is the deadline to file irs form 8825 in 2023?

The deadline to file IRS Form 8825 in 2023 is typically April 17th. However, note that tax deadlines are subject to change, and it's always best to check for any updates or extensions from the IRS.

What is the penalty for the late filing of irs form 8825?

The penalty for the late filing of IRS Form 8825 can vary. Currently, the penalty for filing a partnership or S corporation return late is $205 for each month or part of a month the return is late multiplied by the number of partners or shareholders in the partnership or S corporation during any part of the tax year, up to a maximum of 12 months. However, the penalty can increase if the return is more than 60 days late. It's important to note that penalties and regulations can change over time, so it's advisable to consult the latest IRS guidelines or seek professional advice for accurate information.

How do I modify my irs form 8825 in Gmail?

irs form 8825 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send irs form 8825 for eSignature?

Once your irs form 8825 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit irs form 8825 online?

With pdfFiller, it's easy to make changes. Open your irs form 8825 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.