CA CDTFA-146-RES (Formerly BOE-146-RES) 2017 free printable template

Show details

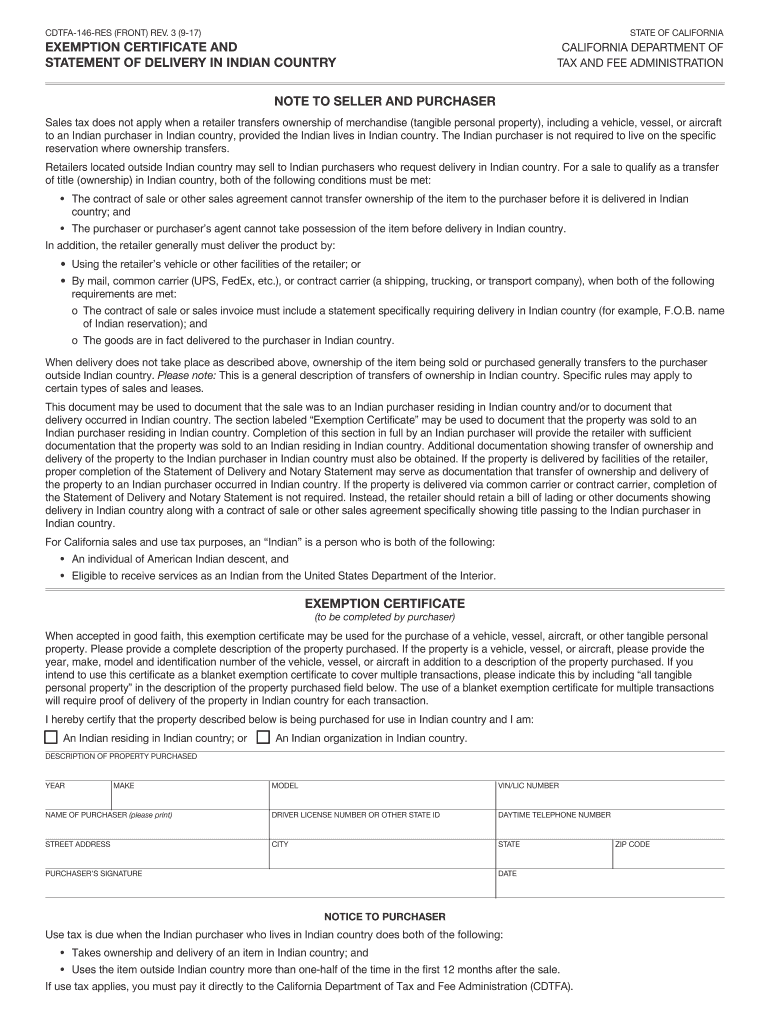

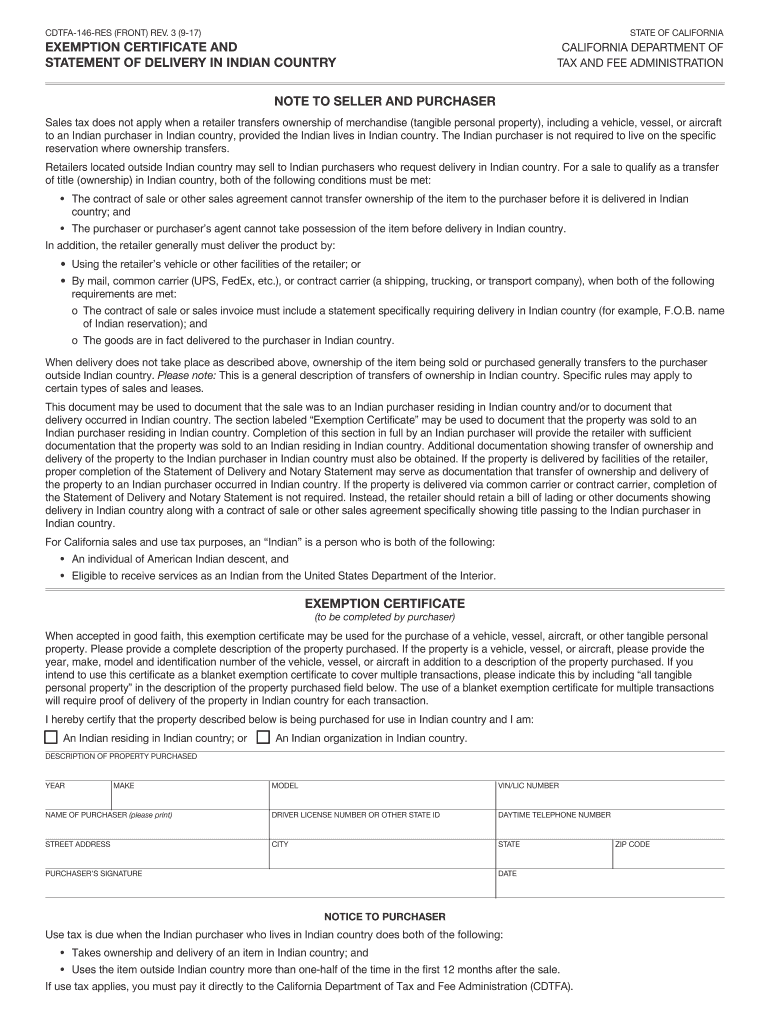

CDTFA146RES (FRONT) REV. 3 (917)STATE OF CALIFORNIAEXEMPTION CERTIFICATE AND

STATEMENT OF DELIVERY IN INDIAN COUNTRYCALIFORNIA DEPARTMENT OF

TAX AND FEE ADMINISTRATIONNOTE TO SELLER AND PURCHASER

Sales

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-146-RES Formerly BOE-146-RES

Edit your CA CDTFA-146-RES Formerly BOE-146-RES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-146-RES Formerly BOE-146-RES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-146-RES Formerly BOE-146-RES online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CDTFA-146-RES Formerly BOE-146-RES. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-146-RES (Formerly BOE-146-RES) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-146-RES Formerly BOE-146-RES

How to fill out CA CDTFA-146-RES (Formerly BOE-146-RES)

01

Obtain the CA CDTFA-146-RES form from the California Department of Tax and Fee Administration (CDTFA) website or office.

02

Fill in your name and contact information at the top of the form.

03

Indicate your account number or other identification details as required.

04

Provide a detailed description of the property that you are requesting exemption for.

05

Check the applicable boxes that relate to your situation and the type of exemption you're applying for.

06

Include any supporting documentation to validate your claim for the exemption.

07

Review all the information to ensure accuracy before signing the form.

08

Submit the completed form to the CDTFA through the appropriate channels, either online or by mail.

Who needs CA CDTFA-146-RES (Formerly BOE-146-RES)?

01

Individuals or businesses that own property in California and are seeking a property tax exemption.

02

Non-profit organizations that qualify for exemptions under California tax codes.

03

Property owners who are eligible for certain exemptions like the Disabled Veterans' Exemption or Senior Citizens' Exemption.

Fill

form

: Try Risk Free

People Also Ask about

What is a New York State tax exempt form?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

What is NY ST 120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.

What is the Virginia sales tax exemption?

Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for resale,” where you buy something with the intent of selling it to someone else.

What is the tax exemption form for NY?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

What is an exemption document?

An exemption or resale certificate is a form or document issued by a business to ensure sales tax is not applied to their invoice when they intend to resell their purchase. Sales tax is not used on these purchases because the applicable sales tax will be used on the final sale of the exchanged tangible property.

How many exemptions should I claim Virginia?

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA CDTFA-146-RES Formerly BOE-146-RES directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign CA CDTFA-146-RES Formerly BOE-146-RES and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find CA CDTFA-146-RES Formerly BOE-146-RES?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific CA CDTFA-146-RES Formerly BOE-146-RES and other forms. Find the template you need and change it using powerful tools.

How do I fill out CA CDTFA-146-RES Formerly BOE-146-RES on an Android device?

Use the pdfFiller Android app to finish your CA CDTFA-146-RES Formerly BOE-146-RES and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is CA CDTFA-146-RES (Formerly BOE-146-RES)?

CA CDTFA-146-RES is a form used by the California Department of Tax and Fee Administration (CDTFA) for reporting specific sales and use tax information related to the sale or purchase of tangible personal property.

Who is required to file CA CDTFA-146-RES (Formerly BOE-146-RES)?

Any seller or buyer who has engaged in transactions involving tangible personal property that requires reporting for sales and use taxes is required to file CA CDTFA-146-RES.

How to fill out CA CDTFA-146-RES (Formerly BOE-146-RES)?

To fill out CA CDTFA-146-RES, provide accurate details such as business information, transaction dates, description of the property, sales price, tax amounts, and any necessary supporting documentation as specified in the form instructions.

What is the purpose of CA CDTFA-146-RES (Formerly BOE-146-RES)?

The purpose of CA CDTFA-146-RES is to collect information about sales and use taxes to ensure compliance with California tax laws and regulations.

What information must be reported on CA CDTFA-146-RES (Formerly BOE-146-RES)?

The information that must be reported includes the seller's and buyer's details, transaction dates, description of the goods, amounts, taxes collected, and any deductions or exemptions being claimed.

Fill out your CA CDTFA-146-RES Formerly BOE-146-RES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-146-RES Formerly BOE-146-RES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.