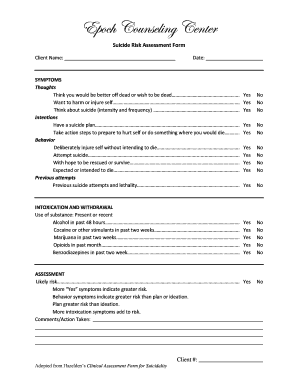

DE RTT-COO (Formerly 5401(8)CO) 2017 free printable template

Show details

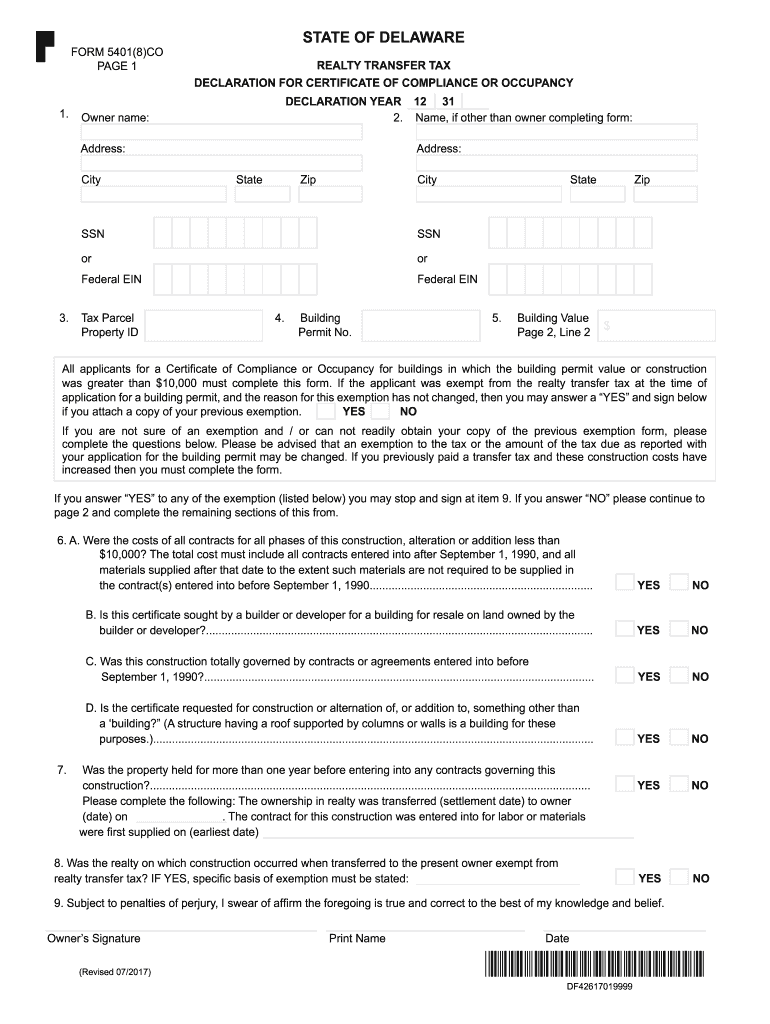

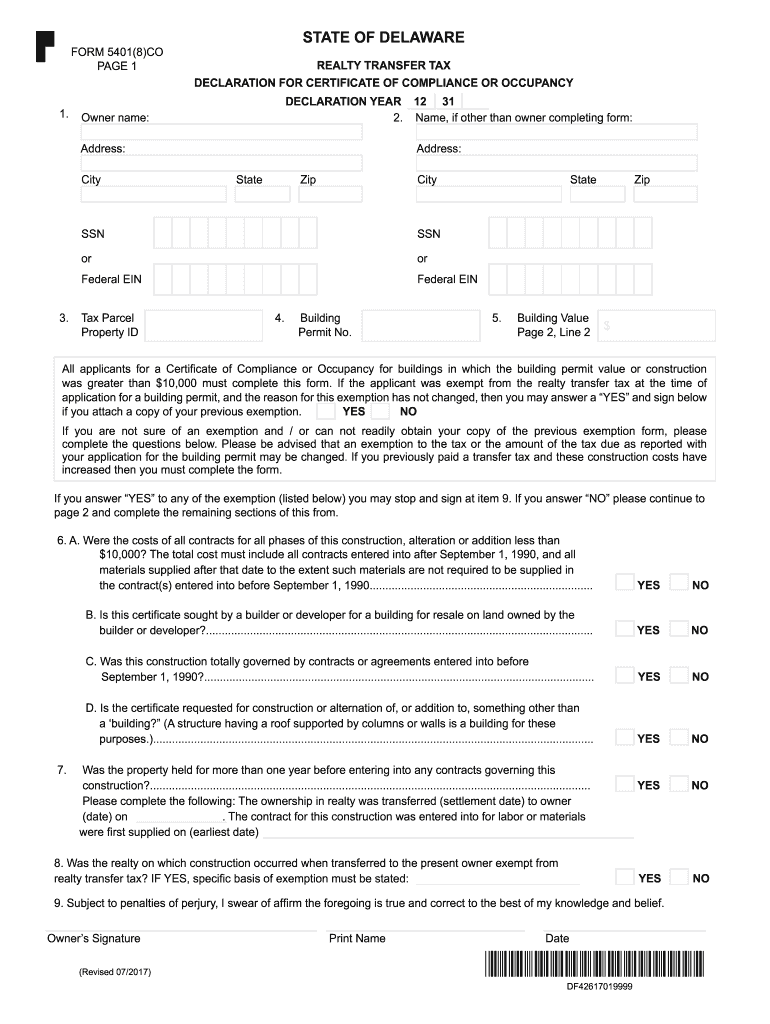

FORM 5401(8)CO

PAGE 11.3. Reinstate OF DELAWARE

REALTY TRANSFER TAX

DECLARATION FOR CERTIFICATE OF COMPLIANCE OR OCCUPANCYDECLARATION YEAR 12 31

2. Name, if other than owner completing form:Owner

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE RTT-COO Formerly 54018CO

Edit your DE RTT-COO Formerly 54018CO form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE RTT-COO Formerly 54018CO form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DE RTT-COO Formerly 54018CO online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit DE RTT-COO Formerly 54018CO. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE RTT-COO (Formerly 5401(8)CO) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE RTT-COO Formerly 54018CO

How to fill out DE RTT-COO (Formerly 5401(8)CO)

01

Begin by gathering all necessary documents related to your property, including any deeds or title documents.

02

Download the DE RTT-COO form from the official website or obtain a physical copy from your local government office.

03

Fill in your personal information in the designated fields, such as your name, address, and contact information.

04

Provide details about the property for which you are requesting the Certificate of Occupancy, including its location and any relevant identification numbers.

05

Complete all sections required by the form, ensuring all information is accurate and up to date.

06

Review your application for any errors or missing information.

07

Attach any necessary supporting documents as specified in the instructions.

08

Sign and date the form where required.

09

Submit the completed form along with any fees to your local authority, as per the instructions provided.

Who needs DE RTT-COO (Formerly 5401(8)CO)?

01

Individuals or businesses that are seeking a Certificate of Occupancy for a property.

02

Owners of newly constructed buildings or structures that need to comply with local regulations.

03

Real estate agents or brokers handling transactions that require proof of occupancy certification.

04

Developers who are completing housing projects that require compliance verification.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from transfer tax in Delaware?

First-time buyers in Delaware typically qualify for state-level exemptions. For example, Delaware first-time buyers automatically qualify for a state transfer tax exemption on a purchase price up to $400,000. First-time buyers purchasing property worth more than $400,000 will pay 1.25% of the amount above $400,000.

How much are real estate transfer fees in Delaware?

How much are transfer taxes in Delaware - and who pays? Transfer taxes in Delaware are 4% of the purchase price of the property, with 2.5% going to the state and 1.5% going to the county. Common practice is for the buyer and seller to split the transfer tax costs evenly, with both the buyer and seller paying 2%.

Who pays transfer tax for real estate in Delaware?

If the property is located in an area that does not impose a local transfer tax, the state realty transfer tax rate is now 3%. Realty transfer taxes are typically shared equally by the buyer and the seller.

Does Delaware have real estate transfer tax?

What is the Delaware transfer tax rate? Delaware has one of the most expensive transfer tax rates in the country. The state levies a 4% tax rate on any property sold, which is evenly split between the buyer and the seller.

How do I avoid transfer tax in Delaware?

You are exempt from paying transfer taxes on the first $400,000 of your home if this is your first time buying property. The maximum value of this reduction is $2,000. First-time homebuyers who are purchasing property for more than $400,000 will pay a 1.25% tax rate on the amount above $400,000.

What is Delaware Form 5403?

The Transferor/Seller must sign Form 5403, print their full name and title, if any. This form and the estimated income tax, if any, reported due and payable on this form must be remitted with the deed to the Recorder's Office before the Recorder shall record a deed conveying title in Delaware real estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my DE RTT-COO Formerly 54018CO directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your DE RTT-COO Formerly 54018CO along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit DE RTT-COO Formerly 54018CO on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing DE RTT-COO Formerly 54018CO, you can start right away.

Can I edit DE RTT-COO Formerly 54018CO on an iOS device?

You certainly can. You can quickly edit, distribute, and sign DE RTT-COO Formerly 54018CO on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is DE RTT-COO (Formerly 5401(8)CO)?

DE RTT-COO (Formerly 5401(8)CO) is a form used for reporting and documenting certain transactions in the context of regulatory compliance, typically related to taxation or reporting duties in a specific jurisdiction.

Who is required to file DE RTT-COO (Formerly 5401(8)CO)?

Individuals or entities that engage in specified activities or transactions that fall under the regulatory framework governing the DE RTT-COO are required to file this form.

How to fill out DE RTT-COO (Formerly 5401(8)CO)?

To fill out the DE RTT-COO, you need to provide accurate and complete information regarding the specified transaction or activity, following the guidelines set by the regulatory authority, including details such as dates, amounts, and involved parties.

What is the purpose of DE RTT-COO (Formerly 5401(8)CO)?

The purpose of DE RTT-COO is to ensure transparency and compliance with regulatory requirements by documenting certain transactions, allowing for proper oversight and management by relevant authorities.

What information must be reported on DE RTT-COO (Formerly 5401(8)CO)?

The DE RTT-COO requires reporting information such as the nature of the transaction, parties involved, transaction dates, amounts, and any other relevant details as stipulated by the regulatory guidelines.

Fill out your DE RTT-COO Formerly 54018CO online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE RTT-COO Formerly 54018co is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.