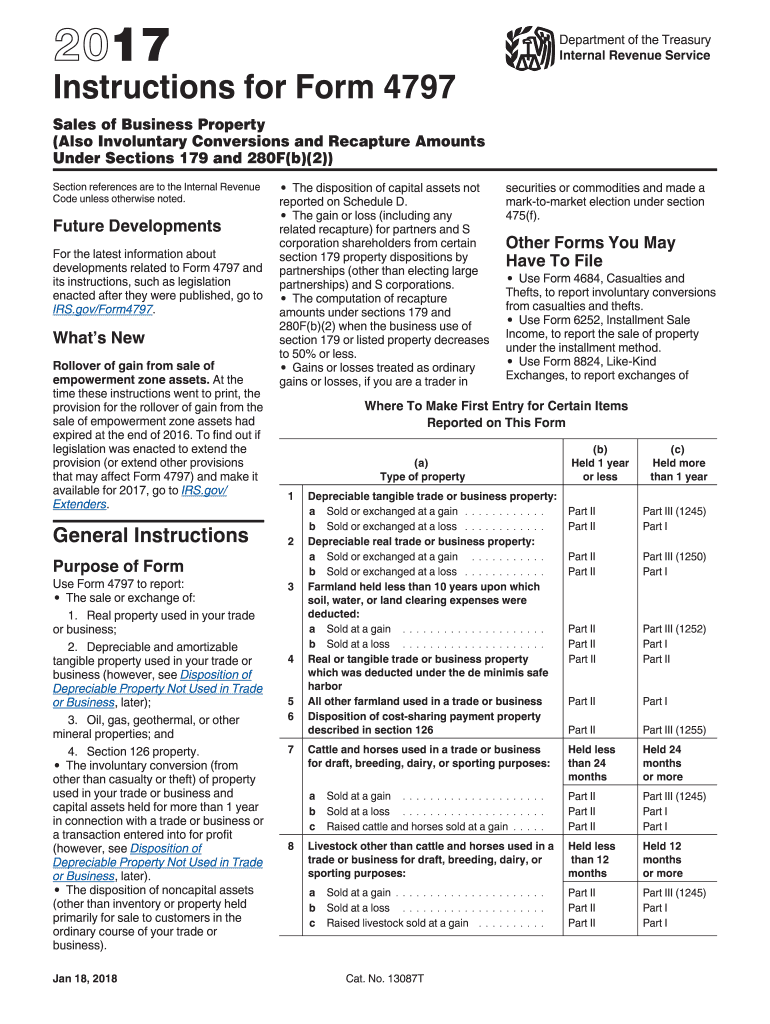

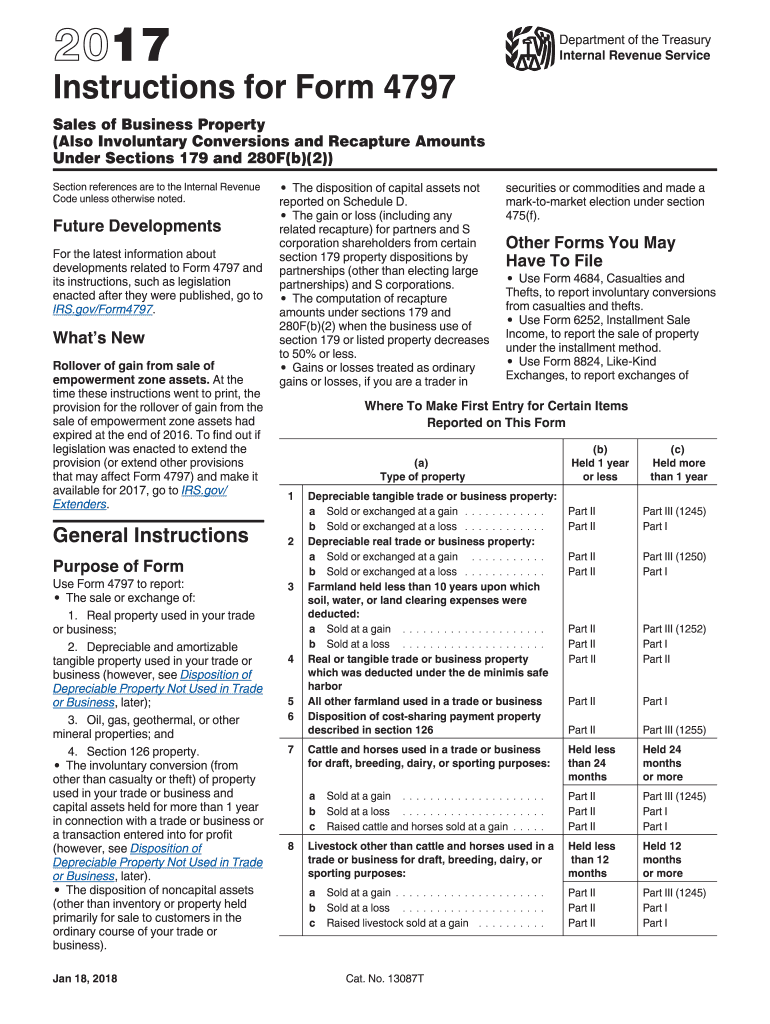

IRS Instruction 4797 2017 free printable template

Get, Create, Make and Sign

Editing fill out 4797 instructions online

IRS Instruction 4797 Form Versions

How to fill out fill out 4797 instructions

How to fill out fill out 4797 instructions

Who needs fill out 4797 instructions?

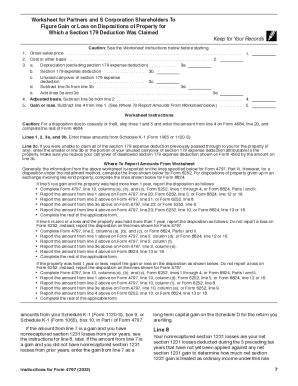

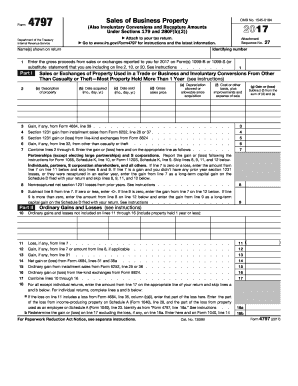

Instructions and Help about fill out 4797 instructions

Welcome to simple tax one two three sales of rental property form 47 97 Uncut captured 1250 gain and Schedule D tax worksheet create a basic tax return for a married couple file jointly for sales of rental property you need Schedule D and form 47 97 next click import buttons to enter w2 income for example enter $50,000 w2 income click Edit button to enter sales proceeds data enter property description sales proceeds the cost include original purchase price any improvements in all expenses during the sales transactions enter any depreciation deducted in the past enter sales date and purchase date rental property capital gain is 12:50 gain it will require using form 47 97 and Schedule D for the capital gain, and it also needs to use Uncut captured gain worksheet for the depreciation enter 1250 for the property type click Save when done now click View button to see the results the form 47 97 is generated since it is a capital gain enter details in part 3 the rental property is considered as 1250 gain the cost basis is adjusted by depreciation and the total capital gain is $70,000 this amount is then entered into...

Fill form : Try Risk Free

People Also Ask about fill out 4797 instructions

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your fill out 4797 instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.