Get the free Legal heirs entitled to vested interest in

Show details

104 htestatesHINDUSTAN TIMES, NEW DELHI, SATURDAY, JUNE 03, 2017Legal heirs entitled to vested interest in property of the deceased: Supreme Court ht law SUNIL TYAGIproperty absolutely only pointed

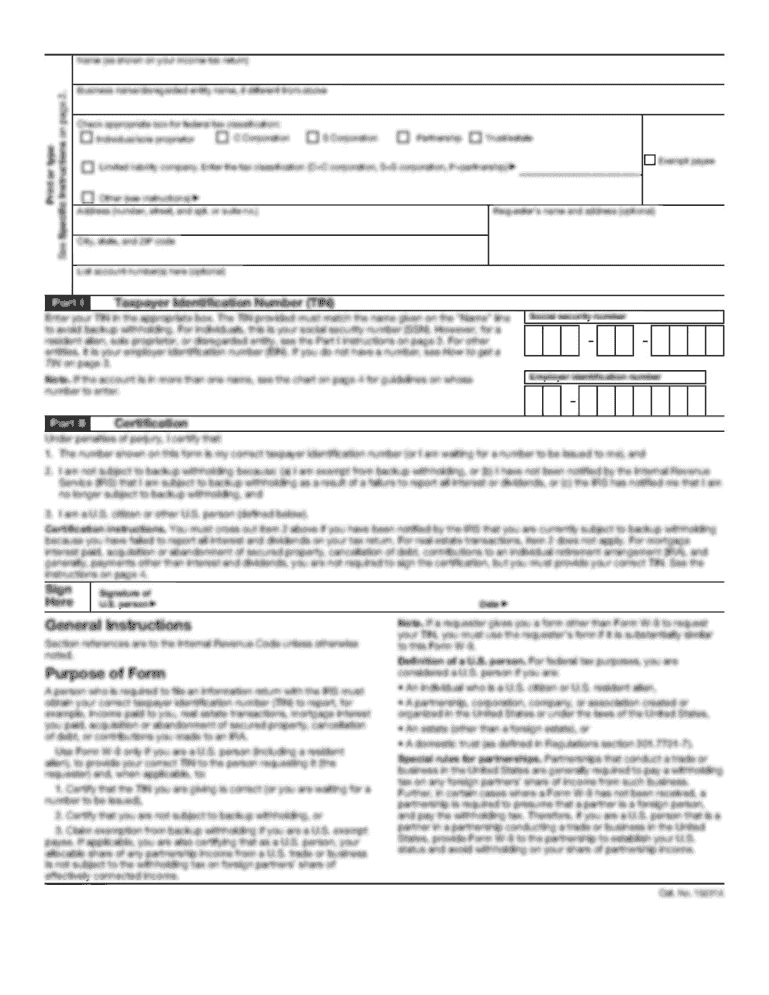

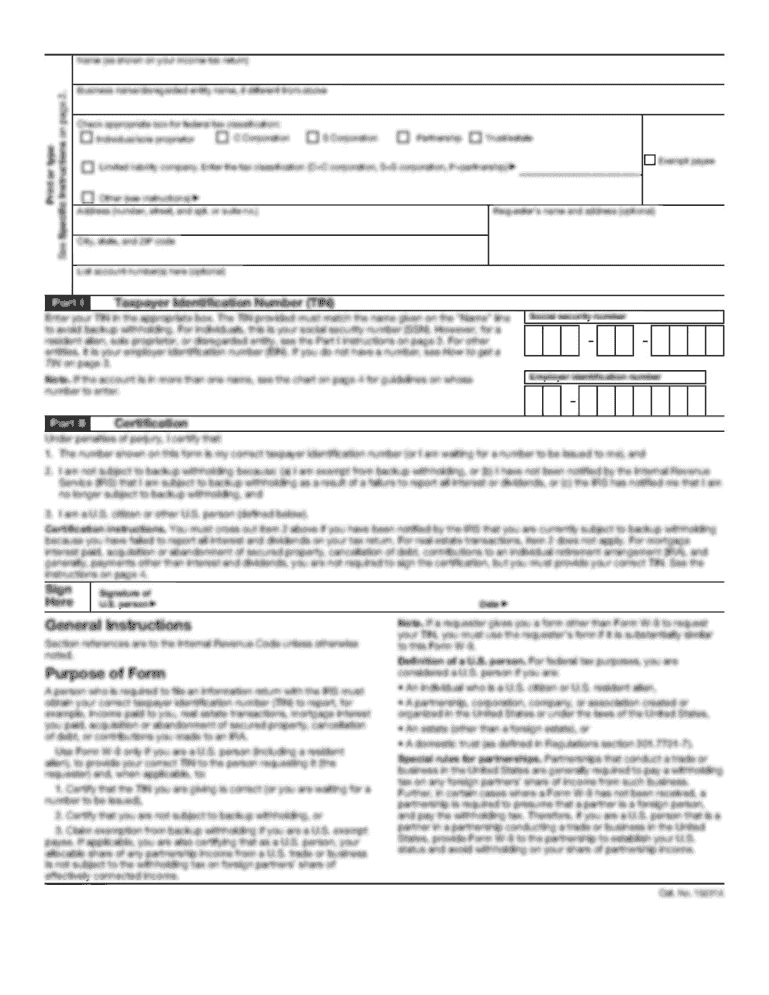

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your legal heirs entitled to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your legal heirs entitled to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit legal heirs entitled to online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit legal heirs entitled to. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out legal heirs entitled to

How to fill out legal heirs entitled to

01

To fill out legal heirs entitled to, follow these steps:

02

Determine the applicable legal provisions: Start by identifying the specific laws that govern the distribution of property or assets to legal heirs. This may include inheritance laws or laws specific to a particular jurisdiction.

03

Gather necessary documents: Collect all relevant documents that may include wills, death certificates, birth certificates, marriage certificates, or any other supporting documents that establish the relationship between the deceased and potential legal heirs.

04

Identify the legal heirs: Determine who qualifies as a legal heir based on the specific legal provisions and the supporting documents available. Legal heirs may include spouses, children, parents, siblings, or other close relatives depending on the applicable laws.

05

Prepare the necessary forms: Use the appropriate legal forms provided by the jurisdiction or legal authority responsible for handling the distribution of assets to legal heirs. These forms typically require personal and contact information of the legal heirs, details of the deceased, and information about the assets involved.

06

Provide supporting documents: Attach copies of the supporting documents mentioned earlier to the forms. These documents help establish the eligibility of the legal heirs and their rightful entitlement to the assets.

07

Submit the forms: File the completed forms and supporting documents with the relevant authority. This could be a probate court, an attorney, or any other designated authority responsible for overseeing the distribution of assets.

08

Follow up and provide additional information if required: Be prepared to respond to any queries or requests from the authority handling the distribution. They may require additional information or clarification to ensure the rightful distribution of assets to legal heirs.

09

Await the decision and distribution: Once the authority reviews the submissions and verifies the eligibility of the legal heirs, they will make a decision regarding the distribution of assets. If approved, the assets will be distributed according to the applicable legal provisions.

Who needs legal heirs entitled to?

01

Legal heirs entitled to may be needed in various situations, including:

02

Estate settlements: When a person passes away, their assets need to be distributed among the rightful heirs. Legal heirs entitled to help determine who should receive what portion of the deceased person's estate.

03

Probate proceedings: Legal heirs entitled to are required during probate proceedings to establish the rightful beneficiaries of a deceased person's estate.

04

Inheritance disputes: When there is a disagreement or dispute over the distribution of a deceased person's assets, legal heirs entitled to play a crucial role in determining the rightful beneficiaries and resolving the dispute.

05

Property transfers: Legal heirs entitled to are necessary when transferring property or assets from a deceased person to their rightful heirs.

06

Family disputes: Legal heirs entitled to may be required to settle family disputes related to the division of assets or inheritance.

07

Insurance claims: In cases where the deceased has insurance policies, legal heirs entitled to help establish the beneficiaries who are entitled to claim the insurance proceeds.

08

Financial planning: Legal heirs entitled to are important for individuals and families when creating a will or planning the distribution of their assets after death to ensure their wishes are carried out correctly.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the legal heirs entitled to electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your legal heirs entitled to in seconds.

Can I create an eSignature for the legal heirs entitled to in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your legal heirs entitled to right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit legal heirs entitled to straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing legal heirs entitled to.

Fill out your legal heirs entitled to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.