Get the free Gifts-in-kind are gifts of property that are voluntarily transferred by an individua...

Show details

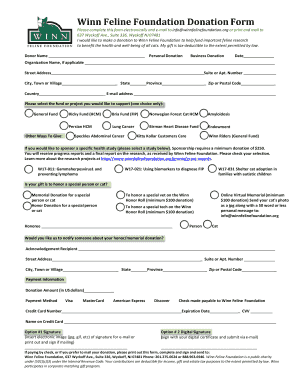

GiftInKind Donation Form

Giftsinkind are gifts of property that are voluntarily transferred by an individual or corporate donor

to Girl Scouts of New Mexico Trails Council, Service Unit, or Troop

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gifts-in-kind are gifts of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts-in-kind are gifts of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifts-in-kind are gifts of online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit gifts-in-kind are gifts of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

How to fill out gifts-in-kind are gifts of

How to fill out gifts-in-kind are gifts of

01

To fill out gifts-in-kind are gifts of, you need to follow these steps:

02

Start by gathering all the necessary information about the gift.

03

Identify the type of gift it is and its estimated value.

04

Determine the purpose or intended use of the gift.

05

Ensure that the gift meets the criteria for being classified as a gift-in-kind.

06

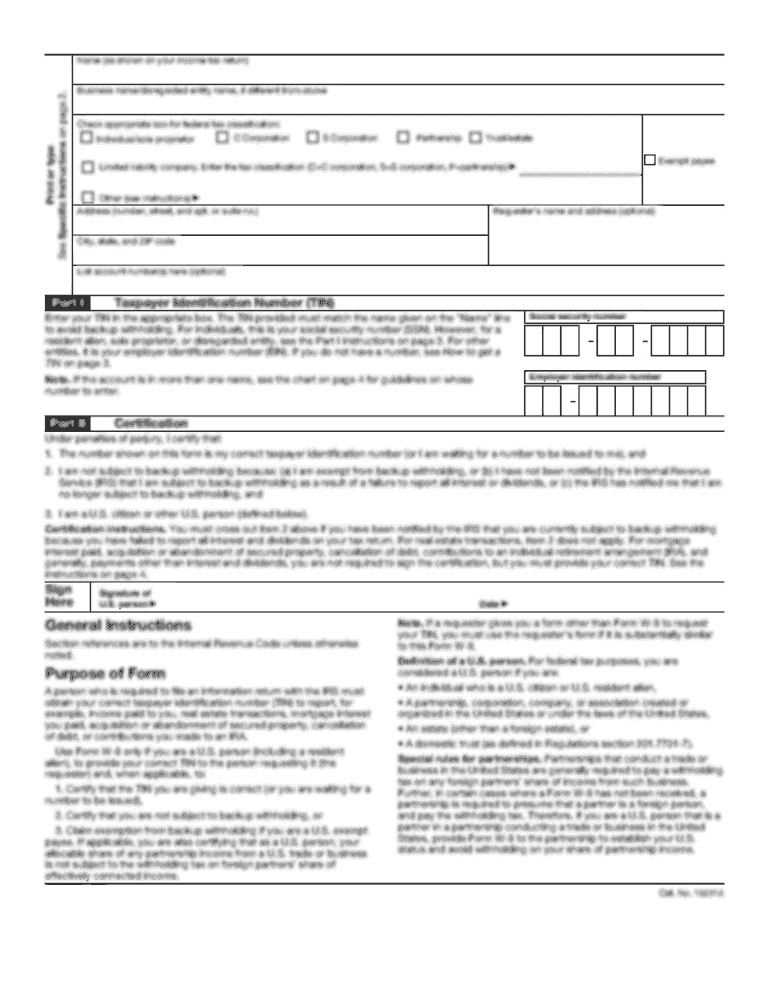

Fill out the appropriate forms or documentation provided by the organization or institution receiving the gift.

07

Provide detailed descriptions and any supporting documentation for the gift, such as photographs or appraisals.

08

Submit the completed forms and documents to the designated contact or department responsible for gifts-in-kind.

09

Keep a copy of the completed forms and any related correspondence for your records.

10

Follow up with the organization or institution to confirm receipt of the gift and any additional steps required for acknowledgment or recognition.

11

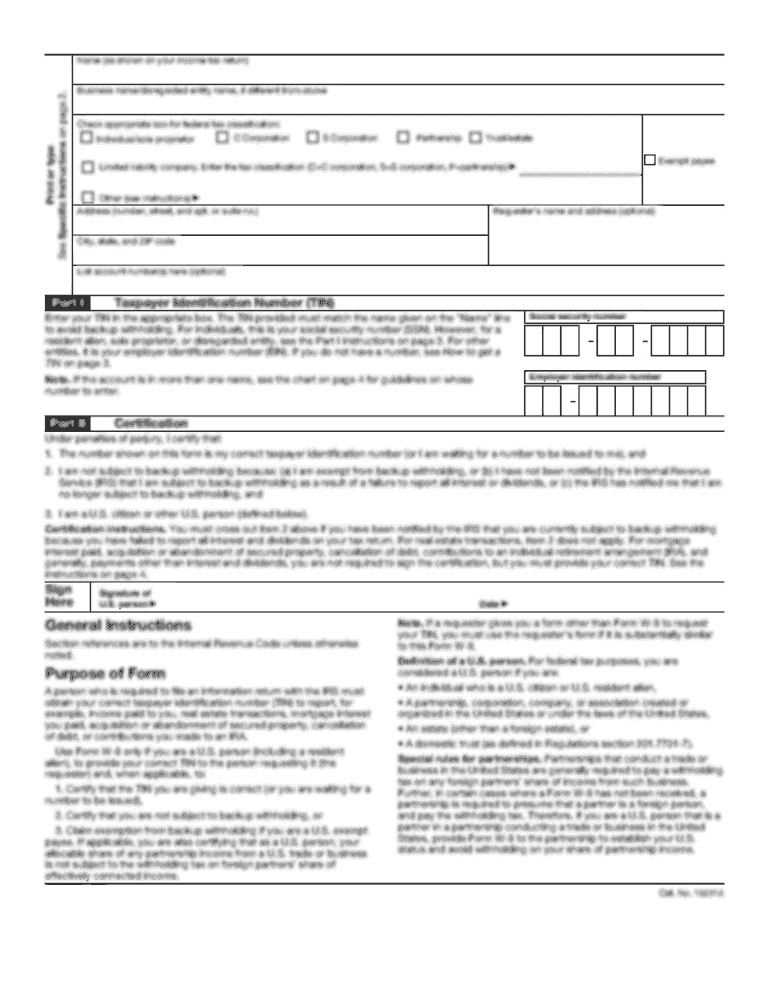

Consider consulting a tax professional or advisor to understand any potential tax implications or benefits of your gift-in-kind.

Who needs gifts-in-kind are gifts of?

01

Gifts-in-kind are gifts of various items or assets that can be utilized by individuals, organizations, or institutions in need.

02

Non-profit organizations often rely on gifts-in-kind to support their programs and services.

03

Educational institutions may use gifts-in-kind to enhance their classrooms, libraries, or research facilities.

04

Charitable organizations and shelters can benefit from gifts-in-kind by providing essential items to those facing hardship or homelessness.

05

Community centers or recreational facilities may accept gifts-in-kind to improve their amenities and activities.

06

Disaster relief efforts often require gifts-in-kind to assist affected communities.

07

Medical facilities may receive gifts-in-kind that contribute to patient care or research advancements.

08

Local, national, or international aid organizations may have specific needs for gifts-in-kind to support their missions.

09

By donating gifts-in-kind, you can make a positive impact and provide valuable resources to those in need.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gifts-in-kind are gifts of in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your gifts-in-kind are gifts of and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in gifts-in-kind are gifts of without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing gifts-in-kind are gifts of and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out the gifts-in-kind are gifts of form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign gifts-in-kind are gifts of and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your gifts-in-kind are gifts of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.