Get the free Copy 1D Employer's- State, Local or File Copy

Show details

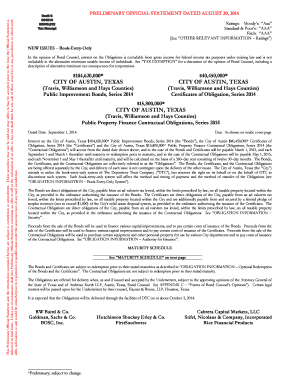

B Employer identification number (EIN) Copy 1/D Employer's- State, Local or File Copy OMB No. 1545-0008 22222 c Employer s name, address, and ZIP code 1 Wages, tips, other compensation 3 Social security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your copy 1d employers- state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your copy 1d employers- state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing copy 1d employers- state online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit copy 1d employers- state. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out copy 1d employers- state

How to fill out copy 1d employers- state:

01

Obtain the copy 1d employers- state form from your local state employment office or download it from their website.

02

Fill in your personal information such as your name, address, and contact details in the designated fields.

03

Provide details about your employer, including their name, address, and identification number.

04

Indicate the start and end dates of your employment with the employer mentioned.

05

Specify the type of work you performed for the employer and any job title you held.

06

State the reason for separation from the employer, whether it was voluntary or involuntary.

07

Provide any supporting documentation or evidence if required, such as a termination notice or resignation letter.

08

Review the completed form for accuracy and completeness before submitting it to the state employment office.

Who needs copy 1d employers- state:

01

Individuals who are applying for unemployment benefits and need to provide information about their previous employment.

02

Employers who receive requests from former employees to complete and sign copy 1d employers- state forms.

03

State employment offices that require this form to assess an individual's eligibility for unemployment benefits and verify their employment history.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is copy 1d employers- state?

Copy 1d employers- state is a section of the employer's tax form that reports state income tax withheld.

Who is required to file copy 1d employers- state?

Employers who have withheld state income tax from employee wages are required to file copy 1d employers- state.

How to fill out copy 1d employers- state?

Copy 1d employers- state must be filled out with the total amount of state income tax withheld from employees during the tax year.

What is the purpose of copy 1d employers- state?

The purpose of copy 1d employers- state is to report the total amount of state income tax withheld from employees to the state tax authorities.

What information must be reported on copy 1d employers- state?

Copy 1d employers- state must include the employer's name, address, federal employer identification number, and the total amount of state income tax withheld.

When is the deadline to file copy 1d employers- state in 2023?

The deadline to file copy 1d employers- state in 2023 is January 31, 2024.

What is the penalty for the late filing of copy 1d employers- state?

The penalty for late filing of copy 1d employers- state is $50 per form, up to a maximum of $536,000 per year.

How can I send copy 1d employers- state to be eSigned by others?

To distribute your copy 1d employers- state, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit copy 1d employers- state online?

With pdfFiller, the editing process is straightforward. Open your copy 1d employers- state in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit copy 1d employers- state on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign copy 1d employers- state. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your copy 1d employers- state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.